As explained by Niccolò Machiavelli, human nature is inherently conservative and suspicious of new foreign paradigms compared to established and familiar paradigms. This is truest of all for monetary systems, especially the three century old Bank of England British Pound.

Predicting the Future – Probabilities and the Game of Unions

Part Two of the essay will attempt to predict the future by discussing scenarios of the three options for Wales as an Independent Nation and the probabilities of each, that will be of aid in ruling out less probable scenarios as well as ruling in more probable scenarios.

Option 1: Leaving the United Kingdom and joining the European Union and the Euro

This is the least probable option, because Wales (within the British Union) voted to leave the EU in 2016, and to rejoin Wales would have to gain independence from the UK first, which looks improbable to impossible at present. Additionally the Brexit vote was roughly 50% remain and 50% leave, so even in a future referendum the probability of joining the EU would be half, and would drive a clear divide and civil war (literary rather than literally) down the middle of the Welsh population.

Keep the Pound Campaign – despite the best efforts of newly converted europhile New Labour riding the wave of goodwill following the ’97 landslide to swindle swoon Britain into the Euro and a Continental Currency Union at the start of the new Millennium, the idea received little traction on the ground (source)

Even less probable than re-adopting the European Union, would be to adopt for the first time the Euro. As discussed in Part One, the Pound is a historical institution of Wales for over a Millennium, and especially since the establishment of the Bank of England (1694) the Pound is the lifeblood of British and Welsh trade and taxation, for financing the debts of the British Government. Despite the best of will for the effective propaganda from New Labour for adopting the Euro, money is the most essential element within society, that we produce into and consume with, selling a good or service to buy goods and services, and store our personal net worth for a future that is by nature uncertain. Adopting a new monetary and accounting system therefore is always riskier and dangerous to destroy personal and national debt wealth, than remaining with the familiar and trusted. Indeed the Pound Sterling standard of the Bank of England is now over three centuries old, with historical certainty in the psychology of Welsh and British populations, for living today and more importantly for producing and saving in a relatively stable currency for the future. Only for this reason, any campaign by a newly independent Welsh Government to persuade Wales to adopt the Euro would unleash a civil war and wealth destruction on a national scale, bringing the government to its knees, not to mention that Wales has no domestic financial infrastructure or banking network today, we are completely dependent on an English banking system and financial network with its headquarters in the City of London.

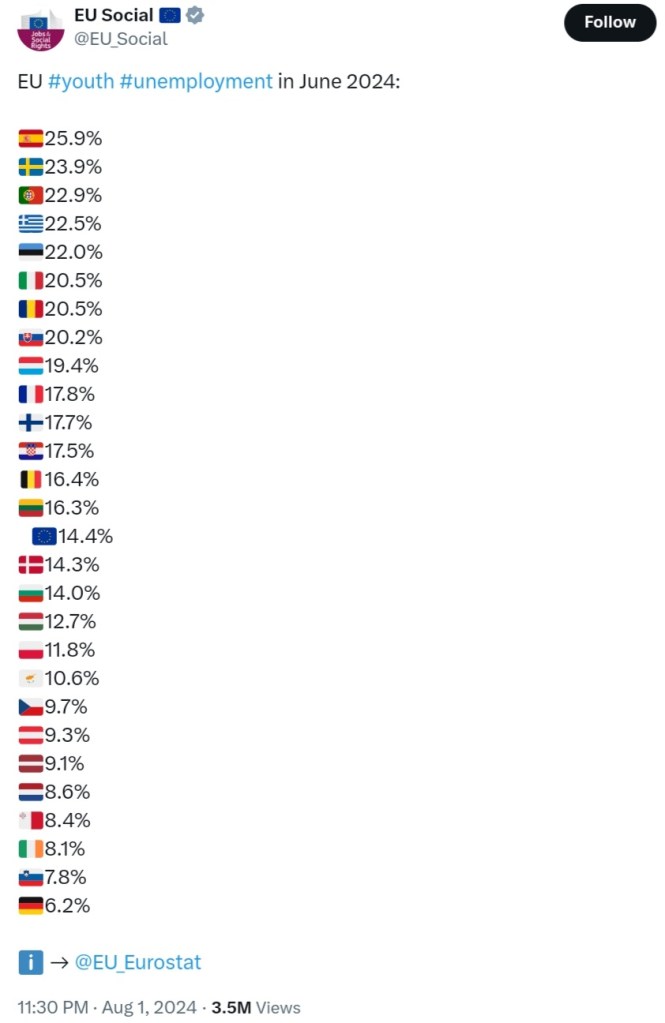

Unemployment and hopelessness among the youth is depressing the Southern countries, as their industries and jobs disappear towards the Northern countries in the monetary prison of the Euro. This would be Wales’ fate on the peripheries of Europe, which by comparison has a current youth unemployment rate of 13.1% according to Statista (source)

To expound upon the idea of Wales benefiting from membership of the Euro, the Cantillon Effect already discussed in Part One belongs to the Euro as well as the Pound. As bad as the inequalities the Pound produces between London as first receivers and the rest of the Union as last receivers, it is a far smaller Union compared to the European Continent and the twenty Nation States that are in the Euro today, with even more extreme inequalities between the North (including Frankfurt as the location of the European Central Bank and Brussels as the location of the Commission) and the EU producers, and the South on the whole being the consumer/debtor countries. The nature of the Euro as a Continental currency treats the economies of all twenty members as one, despite huge productivity disparities that in the old days could be remedied by twenty national currencies strengthening and weakening against each other, reflecting trade surpluses or deficits. In this system, having a weak currency depreciating against the strong currencies of the North, allowed Southern countries to maintain competitiveness by lowering the cost of exports (and domestic production) while increasing the cost of imports (and foreign products), but within the Euro this is impossible. It is inevitable therefore that unemployment in the Southern countries will increase as their industries disappear, largely to Germany and the Netherlands and the higher mechanised and productive economies of the North. By staying out of the Euro and keeping the Pound, the UK has been able to escape the worst of a destructive continental currency union.

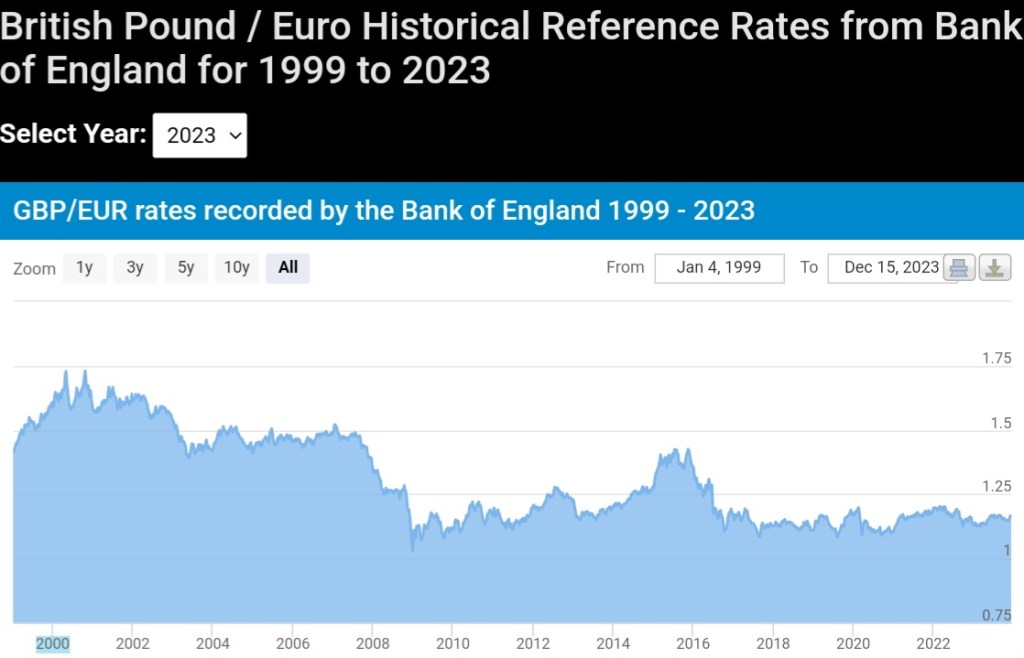

Despite the catastrophic trade deficits that Westminster Parliament chooses to run with the European Union, Britain has at least one mechanism to ease the pressure and compete more effectively, by devaluing the Pound against the Euro (source)

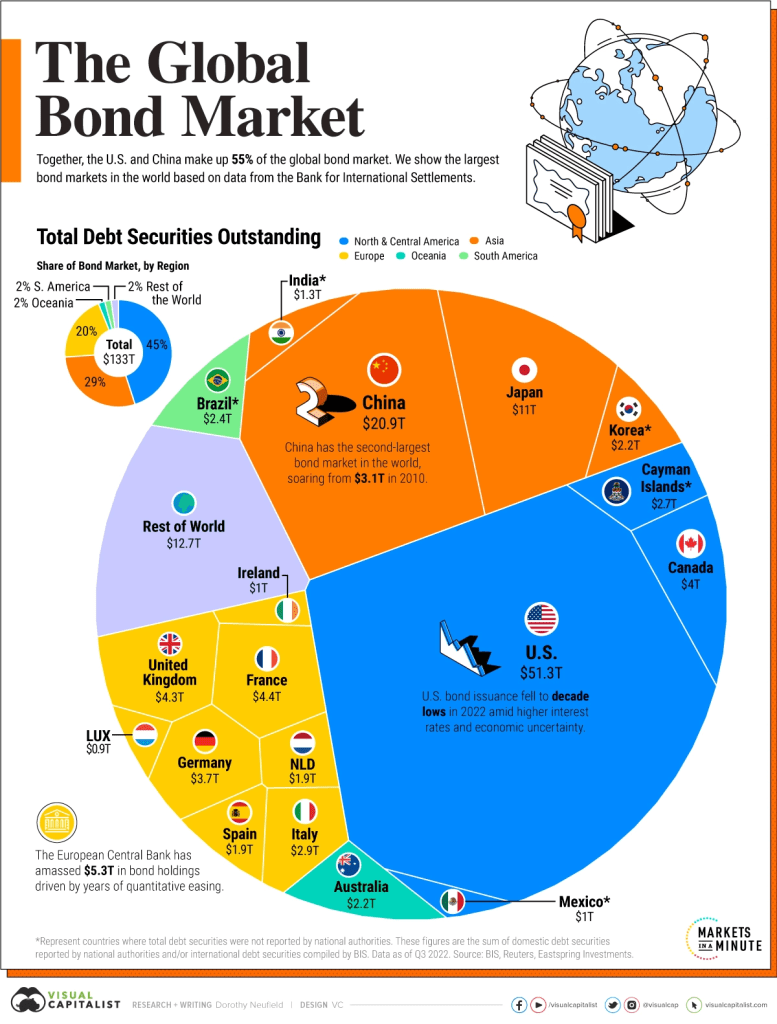

To tie off the discussion on the Game of Unions, the fact that the British Union and the Pound is 317 years old while the European Union has only been around since 1992 and the Maastricht Treaty, and the Euro has only existed since the 1st January 2002, makes Britain a far stronger Union than the Continent’s. Nowhere is this clearer than in the financial system, backed by Britain’s National debt market, the Treasuries and Gilts market, insofar as Britain’s fiscal union where debts are unified within a single Treasury. Europe on the other hand, has a Central Bank and Currency Union, but unlike Britain its debt markets are distributed between twenty disparate member state Treasuries, and for all the talk over the Age of the Euro about a Fiscal Union and the consolidation of debts via the issuance of EuroBonds, the European banking sector sits atop a collection of national bonds, mostly German Bunds, but also French OAT’s and Italian BTP’s. Because of the disparities between interest rates and credit ratings of these national bonds, in times of crisis the Euro Union wobbles because of the divided foundations and weakness of French and Italian economies, compared to the stregth of Germany. Indeed, the price Germany had to pay on French terms for Reunification following the collapse of the Soviet Union, was retiring the Deutsche Mark and adoption of the Euro and the Currency Union, however it is also Germany that has fought hardest against a Fiscal Union so that is doesn’t have to shoulder Continent wide European debts.

The European Central Bank keeps a Target 2 balance between its internal trading members, and the figures are eye watering. There is no possibility that Italy, Spain, Greece and France can repay their deficits to Germany, Luxembourg, the Netherlands and Ireland (source)

The Euro will end whenever Germany as the factory and most powerful country on the continent decides that enough is enough, there will be no Fiscal and Debt Union, and that it is time to bring the Euro experiment to an end. This will likely mean the Northern members breaking away to create a smaller Union with a stronger currency, leaving the Southern countries in an Union with a weaker currency, or Europe will once again revert to national currencies, correcting all the mistakes and imbalances created by a continental currency. The recent restrictions out of the German Constitutional Court on Government spending is an early example of the rebellion against increasing debt issue on deck the Titanic.

Probability of Option 1 for Welsh Independence: No Probability

Option 2: Leaving the United Kingdom and Creating a New Currency (Welsh Pound)

The Barnett Formula for redistribution of British taxes flowing into London’s Treasury, back out as public spending to the rest of the Union (source)

As the future of the EU depends upon Germany’s continuation as the most productive country running the largest trade surpluses, the United Kingdom is dependent upon England as the most productive running trade surpluses with the deficits of the rest of Britain, as the Barnett Formula suggests. Indeed as the author believes that it will be Germany that breaks up the EU, also believes that it will be England that breaks up the United Kingdom, for a few reasons.

The dissolution of the Union requires an Act of Parliament, so who is going to control the process with 543 constituencies out of 650?! (ffynhonell)

The most obvious reason is the power of England domination in Parliament compared to the rest of the Celtic nations, and to make this crystal clear Welsh incorporation into England in 1535 and 1542 were via Acts of Parliament, as was the Union of 1707 with Scotland and the 1800 Union of Ireland. Also in the case of the breakaway of the Irish Free State in 1922 in agreement with David Lloyd George, officially via the Act of Parliament. We also have a recent case to shed more light on the process of breaking up the Union, to study in some more detail.

The 2014 Scottish Independence Referendum gives an extremely interesting case study of an agreement if London Parliament would ever agree to separation, when David Cameron as Prime Minister agreed to the calls of the Scottish Parliament for a referendum. Via the Crown of Elizabeth II, it was decreed to transfer temporary powers to the Scottish Parliament to hold the referendum, with the question “Should Scotland be an Independent Country?”, with the British Government promising that a simple majority voting “Yes” would be enough for Scotland to become an independent country following a period of negotiation.

David Cameron, destroyer of Unions? – A far closer result than London’s Parliament had expected perhaps, but the Scots voted against Independence. Obviously Cameron and London Parliamentarians weren’t expecting Britain to vote in a Referendum to Leave the European Union either, less than two years later. Oops! (source)

Analysing the main reason over voting against Independence and for keeping the Union amongst the Scottish population, boiled down to keeping the Pound and the stability of Britain’s familiar monetary standard, over the uncertainty and chaos of splitting a three century old currency and customs union. This makes intuitive sense to anyone who owns a bank account and uses the Pound today, and opens up the discussion of what would happen if a future referendum were ever successful in Wales.

If the Currency Union came to an end under a hard money standard such as gold and silver as it was before the Bank of England standard from 1694, dissolution would be relatively straightforward, but in a Currency Union based upon a Central Bank and the value of money derives from paper or by today from electronic digits on a computer or mobile phone screen, this becomes a far more complex question. Today, Scotland has barely a domestic banking system and Wales has no domestic banking system, the UK’s monetary standard is completely dependent upon English banks, deriving their currency value from the Bank of England. Dissolving Britain’s monetary union would force the decentralisation of money, and for the modern world that runs on perpetually increasing debt and inflation to afford our socialist economy with public spending nearly half the size of the economy, then true independence would mean a Welsh Pound. In the modern world, an Independent Wales requires a Central Bank, the Bank of Wales and a Welsh Pound, which brings us to the monetary and banking infrastructure that enables our current reality.

As part of the 1707 Union Scotland kept its own Legal system and to a extent kept its banking system too, but Wales has been in the Union nearly two centuries earlier, and therefore completely dependent on the English Legal system and London banking network. Indeed, despite a colourful history to Welsh Banking such as Bank y Llong (1762 to 1806), the Black Ox (Llandovery) Bank (1799 to 1909), The Black Sheep (Aberystwyth and Tregaron) Bank (1810 to 1815), and the most successful in the North and South Wales Bank (1836 to 1908), the Bank Charter Act of 1844 handed the monopoly on creating banknotes to the Bank of England as already discussed in Part One, impinging upon credit creation in rural Wales and since the early Twentieth Century Wales has been completely dependent on English banking infrastructure (North and South Wales Bank is swallowed by Lloyds Bank in 1908, and the Black Ox Bank swallowed by Midland Bank in 1909). Wales today therefore lacks its own financial infrastructure, and creating one overnight ex nihilo is practically impossible. There will be further treatment on the monetary policy of an Independent Wales in Part Three of the essay.

The foundation of the Monetary Union is the Fiscal Union, and the foundation of the Fiscal Union is Treasuries, national bonds (debt) created by Treasuries. The market for British debt is over £3 TRILLION up to year end 2022 (source)

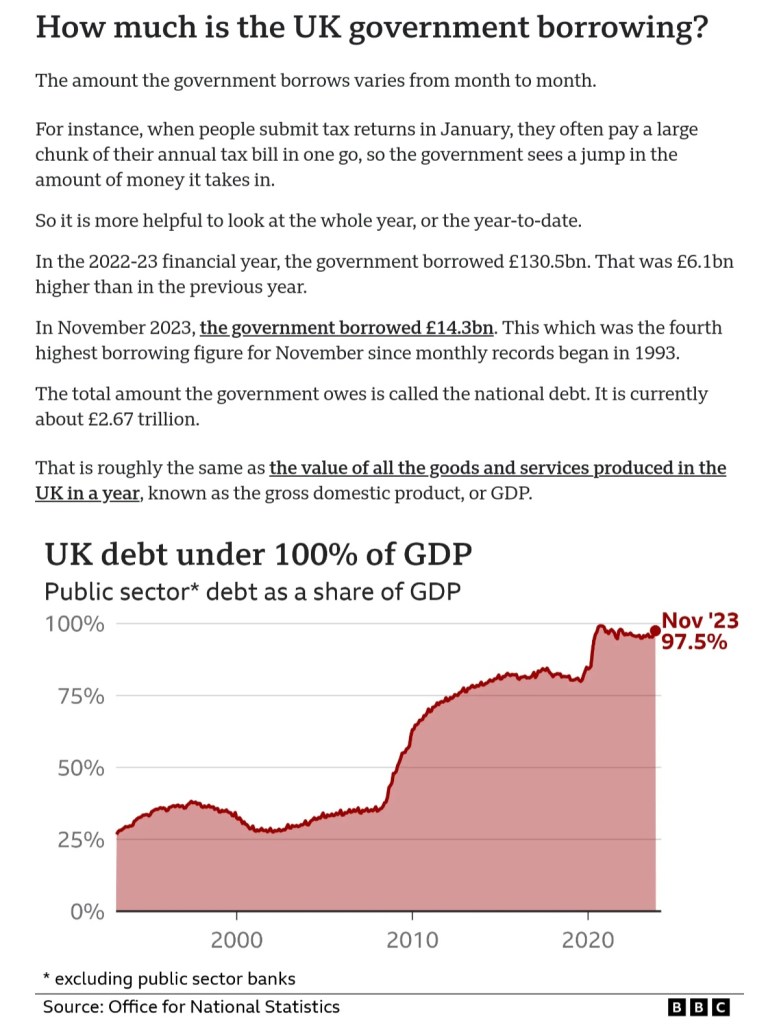

Even though the UK is a monetary union that enforces by Legal Tender the use of Pound Sterling for trade in order to pay the taxes (and the invisible inflation tax) to London’s Treasury, there is an even more important element to discuss which is the Fiscal Union and the chronic debts that underpin the monetary union. Despite all the taxes the Treasury collects by threatening UK taxpayers with imprisonment, which was a record of £787 Billion in the 2022/23 Financial Year, it is nowhere near enough to cover Westminster Parliament’s out of control public spending with the UK currently nearly £3 TRILLION in the red, with deficits increasing over time. There has been no treasure in the Treasury for a very long time, and the future of the Union is more debt, more taxes and more inflation to pay the interest costs to the lenders still stupid enough to invest in the national debt of the British Government.

Britain’s national debt is £2.67 Trillion or 97.5% of Gross Domestic Product according to ONS statistics (source)

Who then is still stupid enough to lend money to increase the spending and public liabilities of Britain? The answer is complex but to simplify they are investors of Britain’s financial (FIRE) sector, from banks to pension funds, investment funds, and insurance funds, effectively compelled by accounting laws and regulations to invest in Britain’s national debt. Additionally, the Bank of England can purchase UK Treasuries and take them out of circulation by a scam process called “Quantitative Easing“, guaranteeing a continuous demand for UK Treasury debt in the near term future, enabling Parliament to escalate the National Debt enslaving the population and the unborn to service the debts of our political elites.

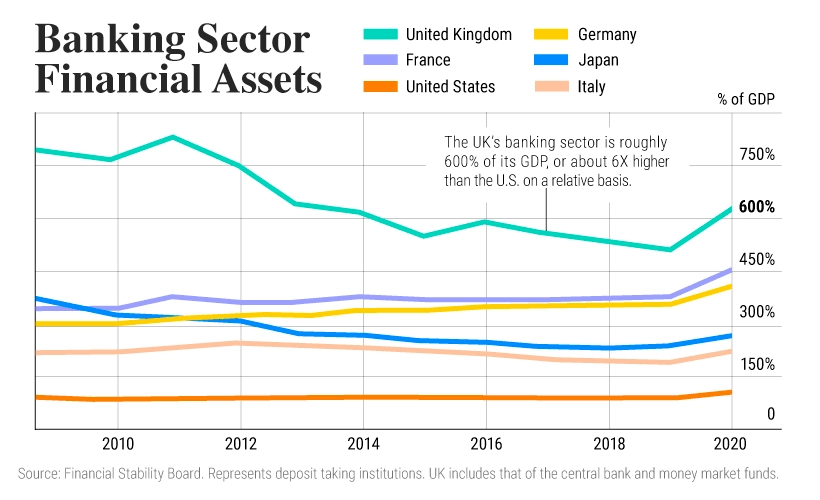

To answer the question of how Britain can run trade deficits of £100 BILLION a year with the European Union, is through our banking and FIRE sector and the household, corporate and national debt that perpetuates this financial serfdom. This also means that any financial and debt crises will hit the British Banks and economy far harder in the coming recession of 2025 and 2026 (source)

To close the discussion on the probability of Welsh Independence through the front door, via the breakup of the Pound and Britain’n monetary and fiscal union, people must understand that this would mean the end of Britain as a socialist country, where public spending is nearly half of GDP and public sector employment is a quarter to a third of the population. The only reason we are still able to operate like this is the long and trusted history of the British Debt Union, and an Union that can maintain its debt service costs at low enough interest rates to maintain our socialist experiment, especially in the Celtic countries, as the Barnett Formula attests. Dissolving the British fiscal union would mean starting from scratch, dividing the debts of the Union between four new independent Treasuries, severely effecting upon the ability to borrow and at far higher interest rates, to reflect the far higher risk and uncertainty of investing in newly independent nations, than the historic stability of London’s Treasury and three centuries of tradition in increasing paying its debts.

The breakup of the British debt union would bring to an end public sector spending that is nearly half of GDP today, the Welsh public sector would have to be gutted for us to afford leaving the Union (source)

The above should explain to Welsh readers, even the most passionate independence believers, the cratering in purchasing power of a new currency and the collapse of the NHS, the education sector, state pensions and everything else that would become unaffordable outside Britain’s indebted Union, it should become clearer that the voluntary dissolution of the Union to its home nations in reality will never happen, because of the damage and destruction it would wreak on our present social order and the lives of everyone who works and lives in the Pound Sterling matrix, including Wales.

Probability of Option 2 for Welsh Independence: Very Low Probability

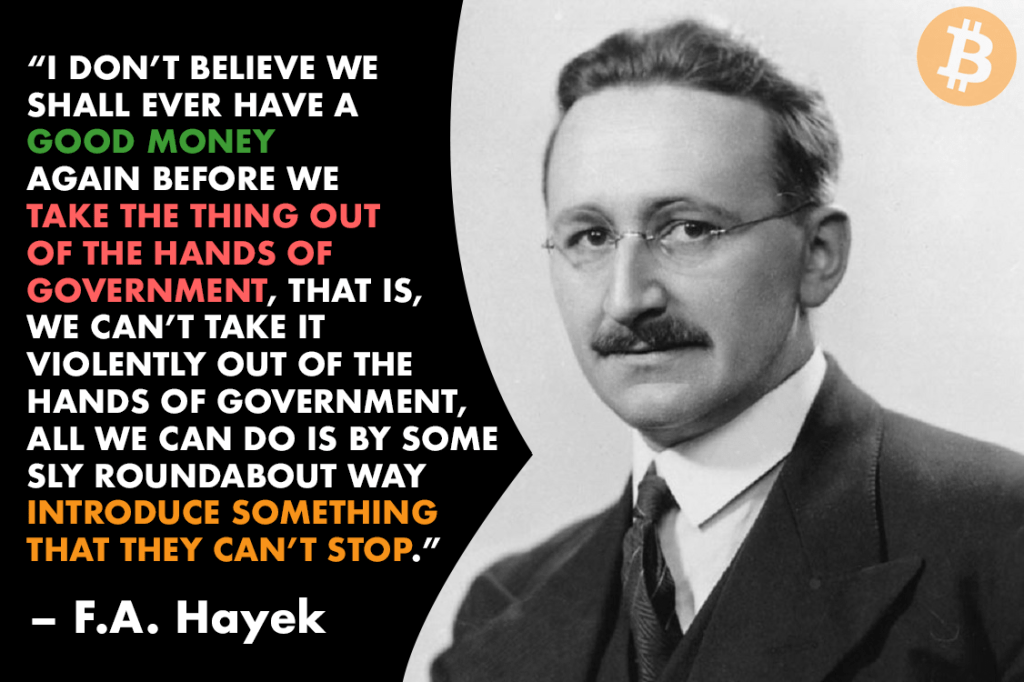

Option 3: Technological Change and Breaking the Pound and United Kingdom Via Adoption of External Money

It is worth listening to Hayek’s words in this short two minute video from 1984, on the denationalisation of money, via an alternative and superior accounting system. Hayek predicts the birth and rise of Bitcoin 25 years earlier (source)

This Option is already superior to the other two options, because it exists outside of any national law and is therefore already independent of the present order. This makes the monetary and accounting standard voluntary, allowing the population to adopt gradually and over an extended period of time, and avoids a disorderly dissolution of monetary and fiscal unions, which is critically important for the stability of the present order that would create economic destruction in an un-controlled demolition, as would be the case in the prior two options.

Another advantage of Bitcoin is that it is a worldwide standard that cuts out many of the regulations and barriers that are an intrinsic part of national fiat currencies, it works over borders enabling peer to peer trade, business to business, and even country to country, in the same way gold used to be a worldwide monetary standard for national and international trade settlement.

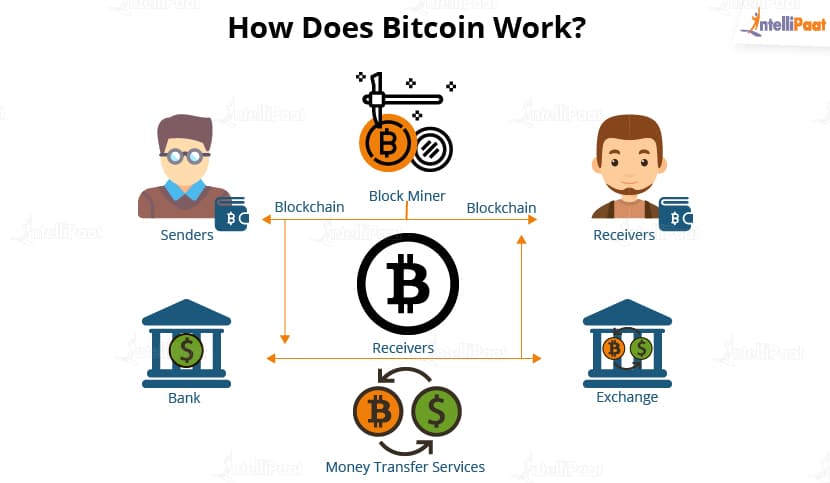

Bitcoin is an accounting standard native to the internet, and therefore dependent upon electricity and opeartes very similarly to online banking, but rather than trusting a bank you are trusting in the network that has had a permanent uptime for the last sixteen years, without limitations of banking hours or weekends, it can be sent or received 24 hours a day, 365 days a year.

The most important element of Bitcoin’s monetary policy is its currency issue schedule, based upon Proof of Work and the dense use of electricity reinforcing the network, and receiving new bitcoins as a reward, currently issued at 3.125 every ten minutes plus any transaction fees included in the same block. This makes Bitcoin mining possible in any part of the world, that has led to the distribution of the mining network and electricity supply over the world. The nature of bitcoin creation also allows individuals, businesses or governments to mine currency in their own countries, as will be discussed in more detail further on.

For these reasons, if independence comes to Wales this is the most likely Option, therefore it is worth exploring further.

Probability of Option 3 for Welsh Independence: Most Probable

Defining Money and Currency

Monetary shortages early in the Industrial Revolution forces a copper mining company on Anglesey to create tokens for local trade settlement, in an interesting article (source)

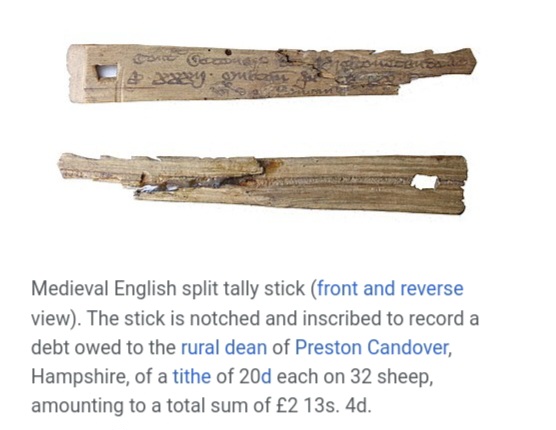

Before delving deeper into Bitcoin, it is important to spend a section on the vagaries of money and currency, and the way to think about them in the modern world. Even though the Welsh words “arian” and “prês” derive from silver and brass (copper) because these were the foundation of the Pound, Shilling and Pence (£sd) standard for over eight centuries, gold and silver coins are only half the story, indeed there are long tracts of the Middle Ages where local shortages of precious metal coins necessitates local economies and trade to adapt to monetary substitutes, via accounting ledgers or paper currencies produced from wood, leather or paper.

Rather than transacting in money, debits and credits can be settled via book-keeping and accounting, and the tally stick is an example. Once agreement is reached, the stick is split in half for each party to keep a contract copy, as an anti fraud measure (source)

Another example of a monetary substitute is paper currency (banknote), that explodes over the West at the end of the Medieval Period, and in the wake of the Protestant Reformation that establishes modern banking and double-entry book-keeping, giving control of credit creation to local banks that keep the precious metals in their vaults. This method also centralises credit creation, increasing fraud and fractional reserve banking.

Two pound banknote of the Black Sheep Bank – While small value transactions would be settled on the ground in shillings and pence, paper currencies were a convenient method of settling medium to large value transactions (for example two tower pounds (700 grams) of silver (two pounds) at today’s value of 75 pence per gram is worth £525! The custom of local paper banknotes came to an end with the Bank of England’s banknote issue monopoly in 1844 (source)

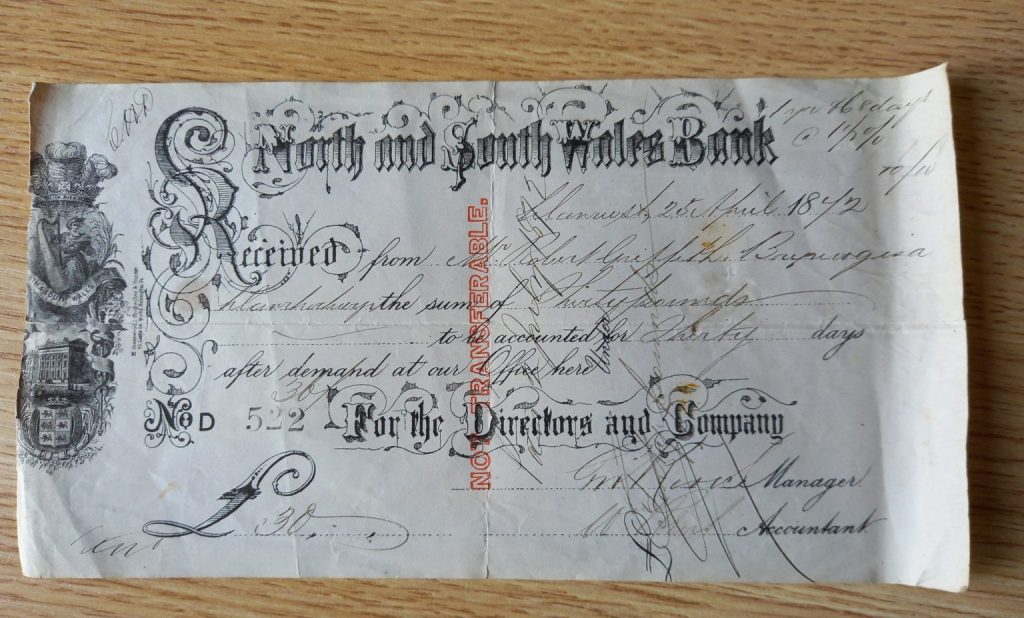

By the beginning of the Twentieth Century medium to large transactions were being settled in paper rather than metal, either via Bank of England banknotes for standard sums and increasingly through cheques for more specific and higher sums, the trend should be clear, trade settlement moves from physical money to promissory and abstract credit. The speed of trade settlement also increases with the invention of the Telegraph enabling Wire tranfers, that has only accelerated since the Second World War, with communication inventions such as Telex using the Telephone.

An example of a North and South Wales Bank cheque from 1872 for Thirty Pounds (nearly £8,000 priced in today’s silver) (source)

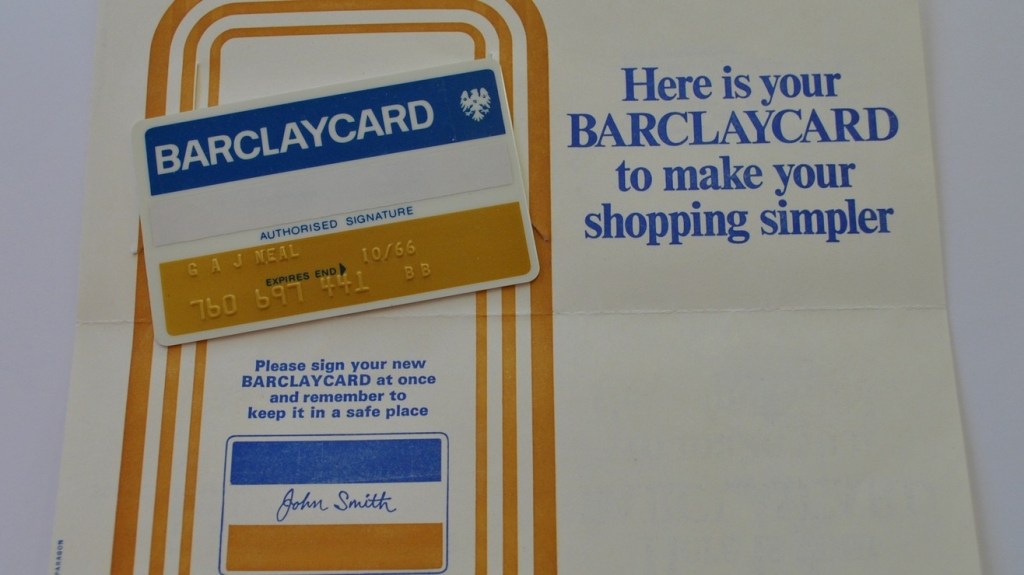

In the Sixties the payments revolution and credit cards start to hit Britain and 1966 sees the introduction of the Barclaycard, credit cards became far more popular in the UK and US than in Continental Europe for example.

Credit cards start competing with banknotes at the end of the Sixties, while Debit Cards are not introduced until 1987 with Barclays Connect (source)

The largest technological communications leap in the history of humanity and money/currency, begins with internet privatisation in 1994, beginning the Age of experimentation of computer money and digital currency. Indeed, within the internet’s first year and years ahead of the banks, David Chaum released DigiCash, a digital cash that communicated with correspondent banks to settle trade peer to peer, anonymously through blind cryptographic signatures, with the first payment completed in 1994. Unfotunately for Chaum, a lack of interest by the banks in his digital and anonymous e-cash, meant that DigiCash would go bankrupt in 1998.

The first e-cash of the internet – David Chaum’s DigiCash. Satoshi Nakamoto cites DigiCash in the 2008 Bitcoin Whitepaper (source)

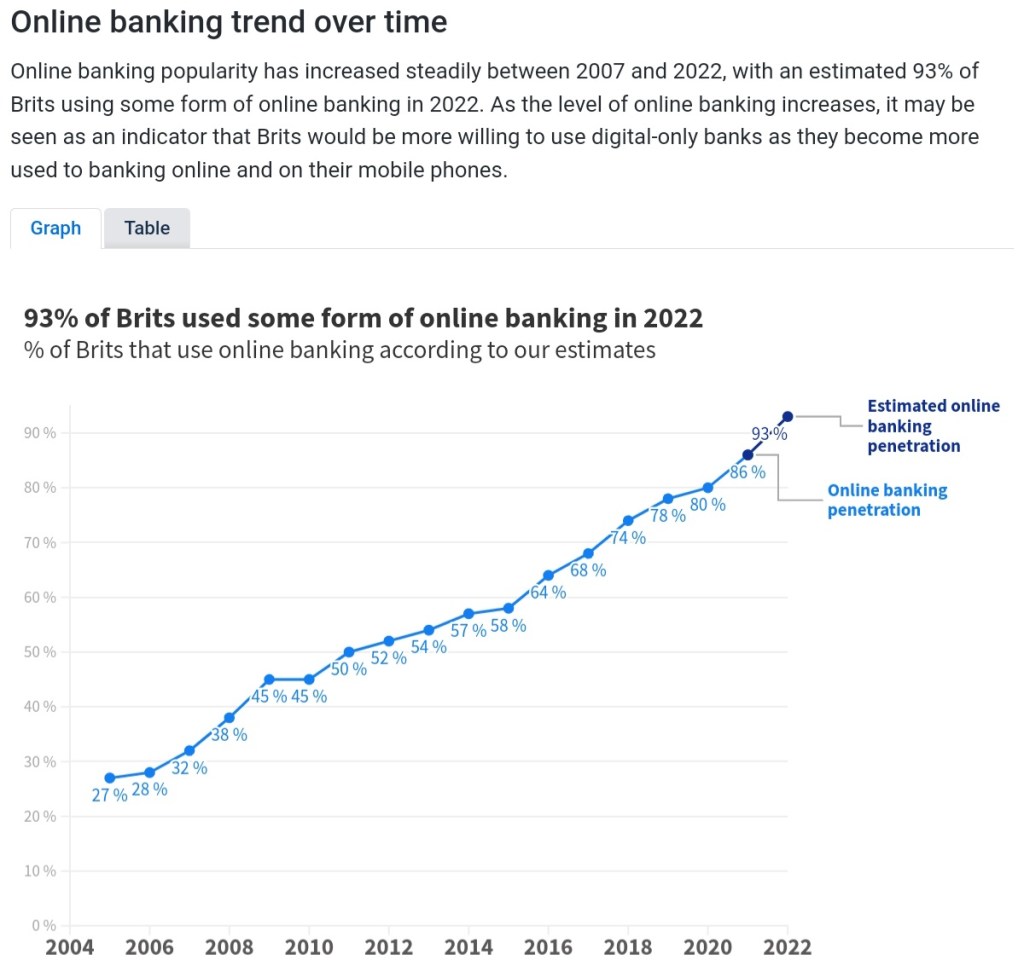

Since the turn of the Millennium banks over the world have continued building on the internet, and every modern and popular bank has developed their own version of online banking. It began on personal computers, and since the advent of the iPhone and the smartphone revolution since 2007, mobile banking has exploded the growth of digital money and is actively swallowing up the old cash economy and the demand for local bank branches, as the banking system has pledged their future to the internet and turning their backs on the old methods of credit creation and transfer.

An interesting read on modern banking trends. As the old generations die out, the new generations forget the monetary age before the internet (source)

The future should therefore be clear, the Banks operating under the licences and regulations of the British Government have turned their backs on the analogue monetary world of metal and paper, and bet the entire future on the internet and mobile phones, the British population and the rest of the world will adopt digital currency via the front door, which also makes it intuitive and familiarises the public with adopting Bitcoin, via the back door.

An example of a Bitcoin wallet on a mobile phone, bluewallet (source)

Tracing the Roots of Bitcoin

We begin discussing Bitcoin at its roots, and for what purpose was it created?

The Bitcoin Whitepaper, posted on bitcoin.org (source)

On the last day of October 2008 as the global financial system collapsed into the largest crisis of the new century, a link was e-mailed to a paper authored by Satoshi Nakamoto with the title, Bitcoin: A Peer-to-Peer Electronic Cash System, describing methods of a peer to peer financial network without a central counter-party. The Paper also lists other digital currency projects in the first fifteen years of the internet that inspired and contributed to the invention of Bitcoin, from David Chaum’s DigiCash 1994, Hashcash by Adam Back yn 1997, to Wei Dai’s B-money in 1998, Nick Szabo’s bitgold in 1998 and Hal Finney’s rpow in 2004. By combining elements of these earlier projects, the decentralised protocol design is presented to the world.

Bitcoin’s Genesis block on the 3rd of January 2009 refering to the financial crisis in Britain, and the banking bailout by Chancellor of the Exchequer Alistair Darling via the British taxpayer

The Bitcoin protocol is released quietly on the 3rd of January 2009, with Satoshi nurturing the project and mining to protect the network in its earliest days, while trying to spread awareness to other cryptographers. The following quote is also from the first weeks of the protocol:

“The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve. We have to trust them with our privacy, trust them not to let identity thieves drain our accounts. Their massive overhead costs make micropayments impossible.

Bitcoin’s solution is to use a peer-to-peer network to check for double-spending. In a nutshell, the network works like a distributed timestamp server, stamping the first transaction to spend a coin. It takes advantage of the nature of information being easy to spread but hard to stifle. For details on how it works, see the design paper at http://www.bitcoin.org/bitcoin.pdf” ~ Bitcoin open source implementation of P2P currency, 11th of February 2009 (source)

The purpose of Bitcoin therefore was to decentralise money and accounting over the world, by-passing the need for central trust in intermediaries, whether a banker, an accountant, a lawyer or regulator, and rather trust in Bitcoin’s distributed network increasing adoption and the value of the network. It is incredible that this project is not only still alive, but as it crosses sixteen years old on the 3rd January 2025 with its market capitalisation over One Trillion Dollars and an unit of its currency at £50,000 each, threatening and terrifying the inflation and taxation apparatus of the Legacy Regimes all over the world, Bitcoin is stronger than ever looking towards the future and monetary independence.

Who Was Satoshi?

There has been so much discussion and misinformation surrounding this question, it is worth commenting briefly. Firstly, the fact that this person is still anonymous, considering the open and permanent nature of the internet as his invention slowly takes over and changes the world, is quite incredible. There are many investigators and journalists who have tried to discover the identity of Satoshi, using his pseudonym, his online hours posting pattern, his references, and of course his language, writing style, grammar and spelling. Satoshi’s online correspondence lasts approximately two and a half years from August 2008 to his last recorded e-mail in April 2011, providing insights into the writing patterns of the author (Satoshi’s complete collected writings can be read here).

“Sorry to be a wet blanket, but, writing a description of Bitcoin for general audiences is bloody hard. There’s nothing to relate it to.” – Satoshi, 5th of July 2010. This sentence suggests a Briton, or native of the Commonwealth (source)

Despite not knowing with any certainty leaving us guessing in the dark, when taking the Front Page Headline of the Times of London newspaper in the genesis block, alongside his English writing style in words and spelling, does suggest that Satoshi is derived from the British Isles with the strongest probability of being an Englishman. Even so, it leaves the possibility that he was a Scot or a Welshman! In any case, his long term will was bent on disrupting and loosening the noose of London’s Parliament, the Bank of England and the Pound over the rest of Britain, and undermining the Union that enslaves us in this destructive monetary system.

Bitcoin’s Elemental Trinity – Users, Developers, Miners

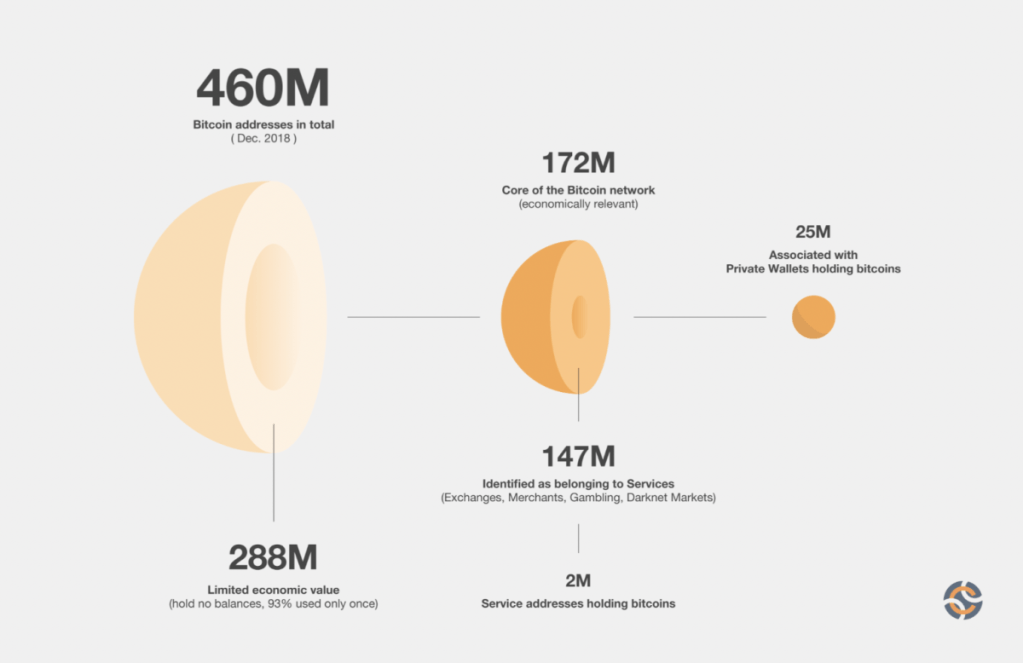

An interesting read on the approximations of Bitcoin and crypto users in general. Up to August 2023, there are estimates of 172 million Bitcoin users, and 25 million self custodying their bitcoins (source)

To expand further, Bitcoin can essentially be divided into three categories of network participants, in users, developers and miners.

Users – The most popular division are those that invest in Bitcoin as a store of value and payment network by either purchasing or accepting bitcoins or spending and selling bitcoins, for goods and services or national fiat currencies. This is by far the most common group and is a far easier method for the average person to adopt the network via its currency, rather than the more specialised developers or miners. Because of the nature of Bitcoin as a worldwide network operating on some level in all 195 countries of the world simultaneously, the technology is being adopted from the bottom up via the development of Bitcoin to Fiat currency exchanges that grows by the day. While Bitcoin began from scratch with zero users and zero value, it has today reached estimates of 25 million self custodial users, within a burgeoning ecosystem of 200 million users that have bought bitcoins on an exchange, and approximately 400 million crypto-currency users worldwide.

Developers – Having spent the first eighteen months nurturing Bitcoin through developing and mining, from Summer 2010 Satoshi Nakamoto’s contribution diminishes at exactly the time there was more demands on him to captain the inexperienced ship, by the end of 2010 he had disappeared completely leaving the project in the hands of a handful of early disciples. By disappearing Satoshi essentially left competing developers to fight it out for future direction, that has created Bitcoin’s bottom up and anarchic leaderless developer structure. There have been numerous Wars the most famous being the Blocksize Wars between 2015 and 2017, pitting big blockers and network centralisers against small blockers and network decentralisers. It was a ragtag band of small blockers that won the scaling War against big blockers, and since 2017 developers have surged from the hundreds into the thousands, which also means that the fighting and competing over Bitcoin development grows over time, making Bitcoin ever more resistant to change as should be expected, as its value grows over a Trillion Dollars. Even so, there have been a few upgrades that have achieved network consensus, such as SegWit in 2017 and Taproot in 2021, and it likely the future will see further consensus on improvements, to scale the network to more self custodial users.

Powerful and specialist computers consuming electricity to mine bitcoin (source)

Miners – Completing the trinity are the miners, who manufacture and deploy specialised machines and electricity to protect the Bitcoin network from attacks, and in return get rewarded in currency, bitcoin. In the beginning it was possible to mine on personal computers and laptops, and this is how Satoshi mined the first million coins (fifteeen years later have still not moved). As interest in and the value of Bitcoin increased, competition in mining led to increasingly dense use of electricity, and a shift in processing power from CPU (Central Processing Unit) to GPU (Graphics Processing Unit), and by 2012 had advanced to ASIC (Application Specific Integrated Circuit). Since the Age of the ASIC electrical costs have become increasingly important to mining Bitcoin, reflected in the centralisation of mining in low cost electricity countries, especially China between 2012 and 2021. In May 2021 the China Communist Party (CCP) officially banned Bitcoin mining within the country, and even though mining remains healthy in the shadows and dark energy markets within China, global hashrate has migrated and decentralised to the rest of the world and especially to the West in the last three years, which strengthens and distributes the mining community geographically.

The miners are an essential element of the Bitcoin network, which they have leveraged to try and gain hegemony over users and developers, indeed the big blockers in the BlockSize Wars of 2015-2017 were the miners in order to increase their fees from transactions, the users and developers had to assert their supremacy over the miners and force them to submit, in the process recognising the supremacy of users (and full node runners) over the network.

The most successful distributed consensus network we have ever seen, works like this! (source)

The Fourth Element – Bitcoin Exchanges

Bitcoin at its essence is a peer to peer ledger and network, but our present reality is trapped within a fiat currency world. The most convenient way of entering Bitcoin currently therefore, is through an Exchange for national fiat currencies (source)

Exchanges could be considered a sub-set of the users but they are also unique by financialising the Bitcoin network, by connecting to the banking system that currently imprisons the world’s debts wealth. Because Satoshi created Bitcoin with the miners as sole issuers of currency and first receivers, in the early days there was as such no exchange built to allow anyone other than a miner to own bitcoins. The first major exchange of note in those early years was Mt Gox in Japan and launched in July 2010, that allowed both miners to sell their bitcoins for fiat and for outside retail investors to sell their fiat to own bitcoins, and therefore it became the premier price discovery point of Bitcoin’s early value in fiat currencies. Other notable early exchanges were Bitstamp launched in November 2011, LocalBitcoins in June 2012, Coinbase in October 2012, and Bitfinex launched December 2012, but Mt Gox dwarfed them all as the most liquid exchange with an estimated 70% of global network share heading into its cataclysmic bankruptcy in February 2014, and its aftermath was the worry that the death of Gox would also kill Bitcoin.

In the wake of Mt Gox, Bitcoin exchange has decentralised to all of the world’s two hundred countries, and developing in different ways and means depending on national governmental regulations and banking restrictions, that will contribute to financialising and the success of Bitcoin in the long term, while in the short and medium term Bitcoin will be threatened by governments and banks that will attempt to control and co-opt, via the banking system and their leverage upon Bitcoin Exchanges.

Bitcoin Monetary Policy and Issue Schedule

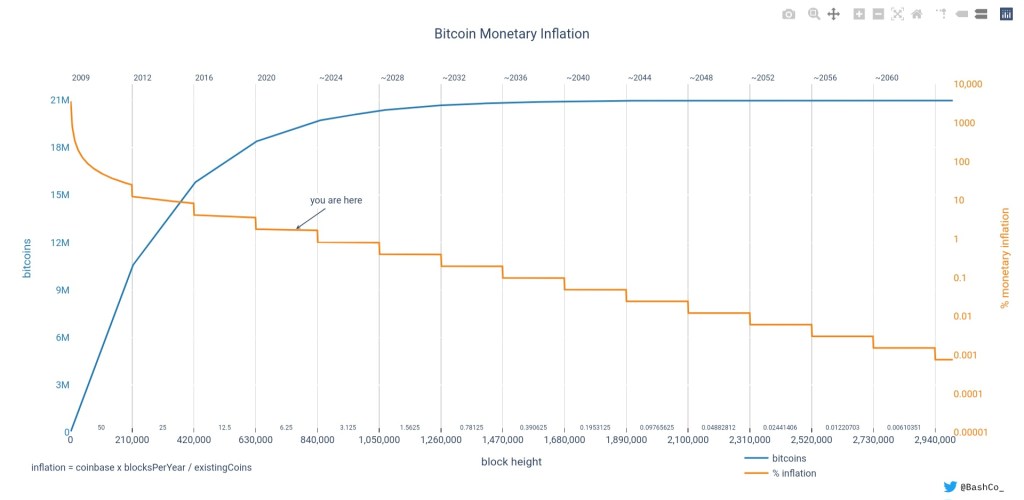

Chart of Bitcoin’s issue schedule, quantity (stock) in blue, and inflation rate (flow) in orange (source)

Bitcoin’s issue schedule has been pre-programmed with a maximum cap of Twenty One Million (21,000,000) units, that began on the 3rd of January 2009 issuing 50 bitcoins every ten minute block up to 28th November 2012, 210,000 blocks were mined, issuing 10,500,000 bitcoins (210,000 x 50), or half the maximum cap.

On the 28th November 2012, the block subsidy halved to 25 bitcoins every ten minute block (3600 per day) lasting until the 10th of July 2016, mining 5,250,000 bitcoins (210,000 x 25), for a cumulative total of 15,750,000 and/or 75% of total issue in the first eight years.

The issue once again halved following July 2016 down to 12.5 bitcoin every ten minutes (1800 per day) with the third halvening epoch lasting until the 11th of May 2020, to create another 2,625,000 bitcoin (210,000 x 12.5), for a cumulative total of 18,375,000 and/or 87.5% of the maximum…

The fourth halving epoch that dropped the subsidy to 6.25 bitcoin every ten minutes (900 per day) ended on the 19th of April 2024, when another 1,312,500 bitcoin (210,000 x 6.25) were mined for a cumulative total of 19,687,500 and 93.75% of maximum issue…

The fifth halving epoch between 2024 and 2028 will mine just over 600,000 at 450 per day for 96.975% of the maximum, with less than a million left to mine for the next over hundred years.

Digital scarcity and deflation are therefore intrinsic properties of the Bitcoin protocol with monetary flows halving every four years, fueling the increasing the user base that is today estimated at over 100 million people, and reflected in Bitcoin’s price in fiat currencies on exchanges globally.

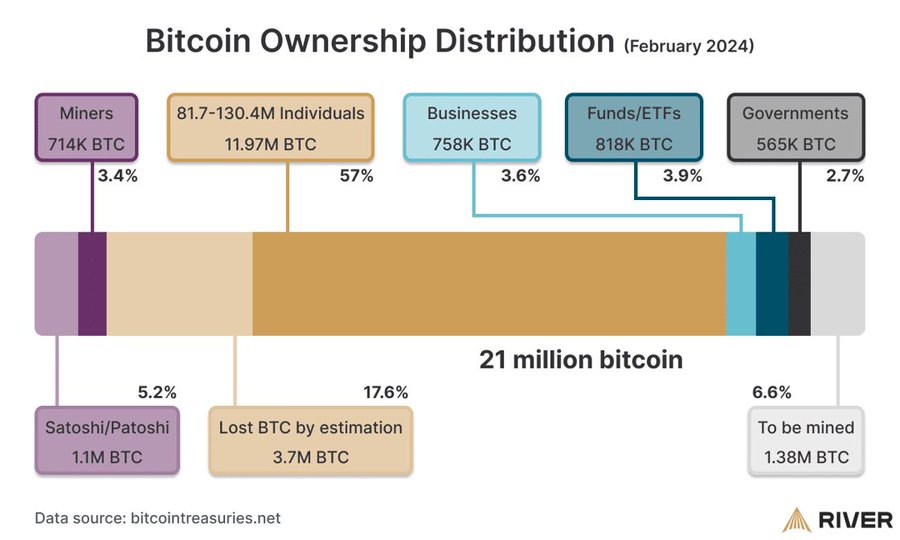

Bitcoin Ownership Distribution

A very useful graphic for Bitcoin’s ownership distribution up to February 2024 (source)

Bitcoin’s Price and the Boom and Bust Cycle

To demonstrate the deflationary properties of Bitcoin in fiat currencies, the table below records the price of bitcoin on the 3rd of January (and Bitcoin’s birthday) in Pound Sterling every year since 2009, taken from this chart…

| Date and Year | Bitcoin Price in Pounds | Green/Red Dot |

| 3rd January 2009 | £ 0.00 | N/A |

| 3rd January 2010 | £ 0.00 | N/A |

| 3rd January 2011 | £ 0.19 | N/A |

| 3rd January 2012 | £ 4.27 | 🟢 |

| 3rd January 2013 | £ 8.34 | 🟢 |

| 3rd January 2014 | £ 576.71 | 🟢 |

| 3rd January 2015 | £ 189.00 | 🔴 |

| 3rd January 2016 | £ 313.08 | 🟢 |

| 3rd January 2017 | £ 735.74 | 🟢 |

| 3rd January 2018 | £ 12,138.06 | 🟢 |

| 3rd January 2019 | £ 3,151.18 | 🔴 |

| 3rd January 2020 | £ 5,436.28 | 🟢 |

| 3rd January 2021 | £ 29,032.95 | 🟢 |

| 3rd January 2022 | £ 35,236.97 | 🟢 |

| 3rd January 2023 | £ 13,743.49 | 🔴 |

| 3rd January 2024 | £ 35,755.59 | 🟢 |

Three green years and one red year have repeated the last three halving cycles. If the historical pattern repeats, 2024 and 2025 will also be 🟢

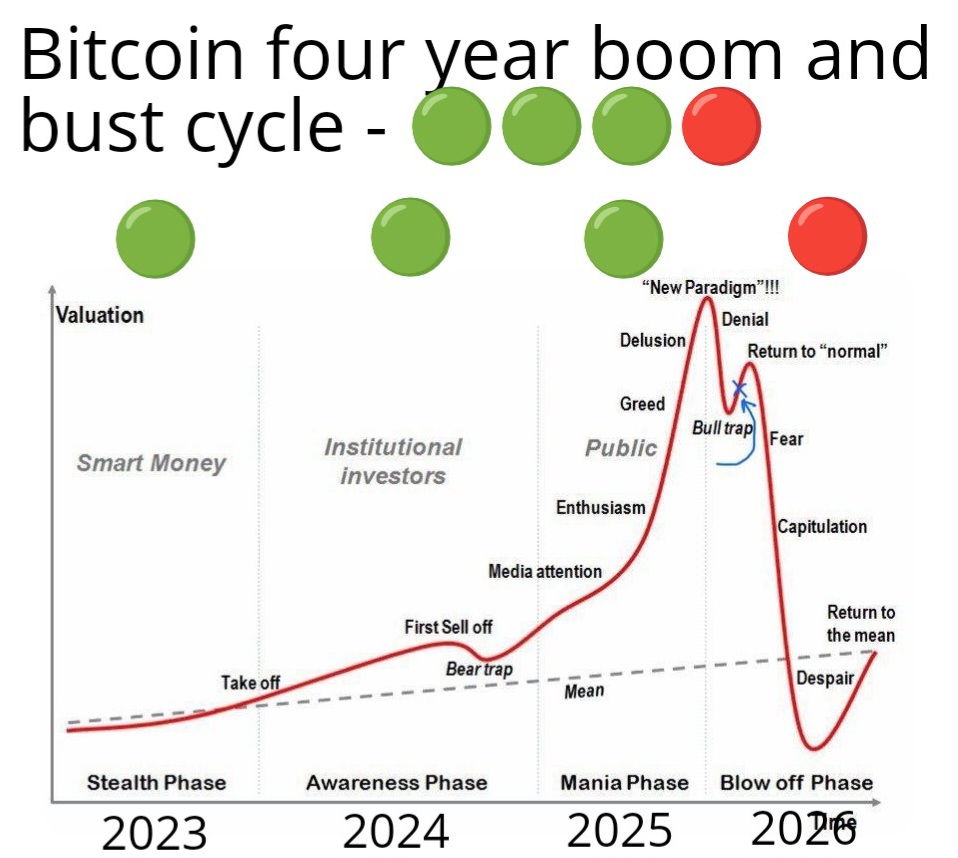

The above table provides a brief snapshot to Bitcoin’s value on one particular day in every year since inception to demonstrate its deflationary and currency appreciating powers over the last fifteen years, however does not tell us much on how the halving effects upon what I would call the Bitcoin boom and bust cycle.

Bitcoin’s Yearly Candles Chart captures the boom and bust cycle well –🔴🟢🟢🟢(source)

Bitcoin Intra-Cycle Volatility – Boom and Bust Cycle

Following historical patterns Bitcoin should have taken out all time highs in Quarter 4 of 2024, however it has already broken all time highs this cycle in Q1, probably due to the ETF Approvals that are a big deal! (source)

To try and explain the above chart, the block subsidy halving halves the inflation and flow rate that are created remember, by the miners. The halving effectively doubles the cost of production to mine bitcoin overnight, that will force the more uneconomical and unprofitable to turn off their machines and disconnect from the network for the time being. The halvening is also a Supply Shock increasing the scarcity of supply compared to its demand from the four corners of Earth, the only way to balance supply and demand is via prices, and a rising Bitcoin price.

While the supply shock may not show up in the price of Bitcoin on the day of the halving, history has demonstrated that the price has started shooting up in the six months following the halving, passing the all time high around the end of that year. The year following the halving is the parabolic bull market, when it is being talked about by everyone believing the moon will be reached, before imploding by 80% in the year after, shaking out all the corrupt exchanges and institutions, paper hands investors and gamblers, and re-setting supply and demand for the next four year cycle.

In the 2012-2016 Cycle, Bitcoin halved on the 28th of November 2012 around $10, before mooning to over $1,100 in the cycle high on the 5th December 2013, one year and one month since the halving. Bitcoin then fell 80% over 2014 to hit its cycle low around $200 on the 17th January 2015.

In the 2016-2020 Cycle Bitcoin halved on the 10th July 2016 at $650, before zooming to the cycle high of $20,000 on the 17th December 2017, one year and five months since halving. Bitcoin then again imploded another 80% to the cycle low of under $3,500 on the 15th of January 2019.

In the 2020-2024 Cycle Bitcoin halved on the 11th of May 2020 around $8,000 before thundering to hit a cycle high of $70,000 on the 10th November 2021, eighteen months since halving. Bitcoin then fell another 80% to a cycle low of $16,000 on the 20th November 2022.

It should be noted here rather astoundingly that Bitcoin’s cycle highs in the last three four year cycles, have hit in December 2013, December 2017 and November 2021, four years apart in the last twelve years, and in the eighteen months following the halving. It should also be noted that Bitcoin’s cycle lows hit in January 2015, January 2019, and November 2022, one year following the cycle high, and eighteen months before the next halvening.

If the historical pattern strikes for a fourth time, the halving in April 2024 will likely lead to the cycle high at year end 2025, fifteen months from today.

At year end 2024, we will be halfway through another four year boom and bust cycle. Next year, the mania phase!

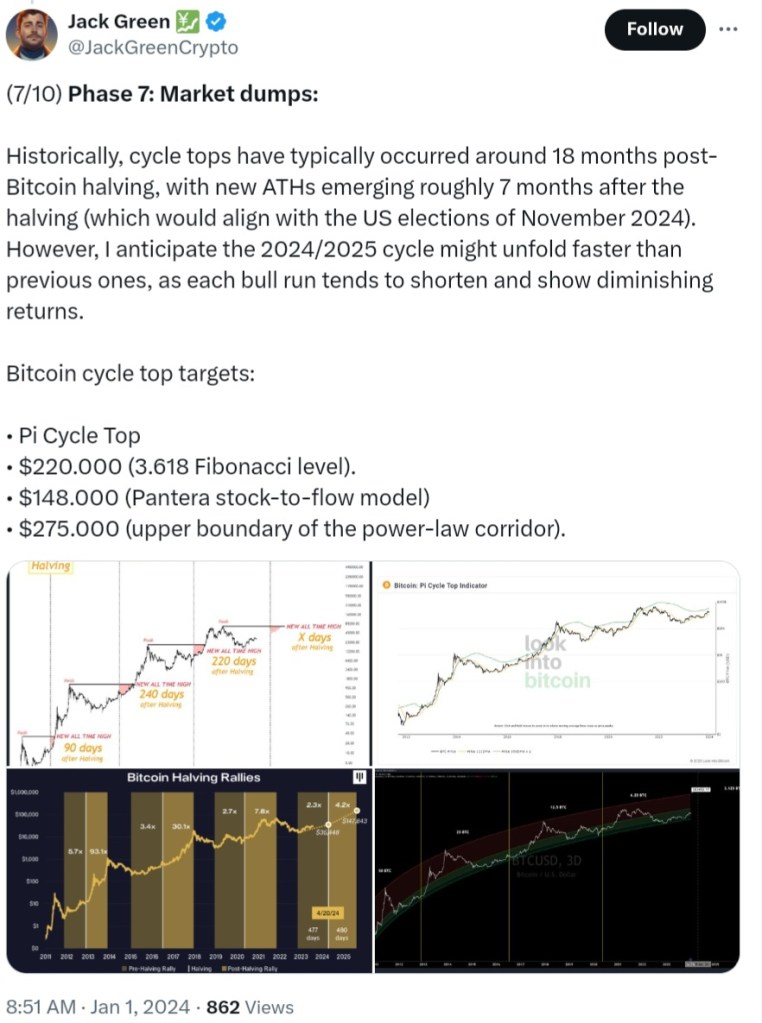

Interesting tweet thread on price targets for 2025 mania phase between $150,000 and $275,000 (source)

Adopting Bitcoin – The Global North and Global South

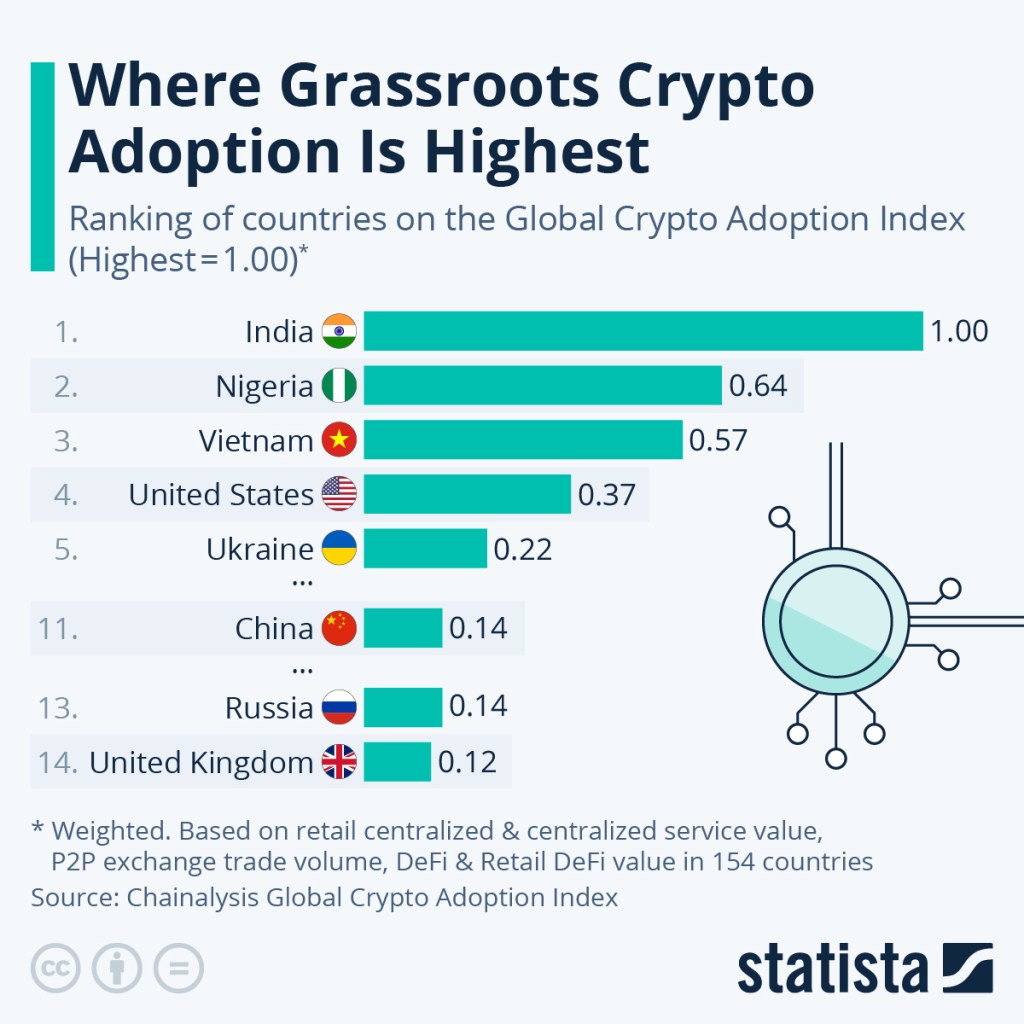

The adoption of crypto-currencies on the whole are spreading fastest in countries with weak national currencies, and under developed banking systems. According to statistics, out of the top twenty countries on the above index, nine are in Asia, three are in South America, and two are in Africa (source)

Most of the geopolitical discussion divides the World between the West and East, but for this section we will divide between the North and South. The Global North is on the whole developed countries with stable governments and banking/financial systems with relatively high trust levels by their domestic populations and lower cost inflation, including Europe, the UK, the US, Russia and China. The Global South on the whole are developing countries with less stable governments and financial systems, lower trust among domestic populations and higher cost inflation, including The Middle East, India, Southeast Asia, Africa and South America.

In the Northern countries with more developed financial systems, Bitcoin has developed more as a store of value and a method of saving for the population, while banking remains superior on payment rails and medium of exchange and unit of account at least for the time being. In the Global South where the banking systems are still developing and where sections of the population are under-banked or even unbanked, Bitcoin is developing as a store of value AND the payments system, alongside crypto-currencies more generally, for example stablecoins. It is likely therefore that the Global South will adopt Bitcoin sooner as a payments rail and every day money, than in the Global North where Bitcoin is developing more as collateral and a future foundation for the banking system and payment rails.

Adopting Bitcoin – From the Private Sector to the Public Sector

As already discussed, Bitcoin started from scratch and from the bottom up, the earliest adopters were individuals, businesses and corporations in the private sector, building the exchanges and infrastructure to scale the network to more users, and in a time when national governments and the public sector didn’t know and didn’t care about Bitcoin. As Bitcoin passed its Tenth Birthday in 2019 things started changing in this respect, with National Governments and traditional financial systems waking up to the opportunities and threats of adopting Bitcoin before other countries.

Bitcoin Adoption by Countries

Nayib Bukele, President of El Salvador, the first country to legalise Bitcoin as money (source)

El Salvador with a population of 6.5 million, became the first country to make Bitcoin legal tender on the 7th of September 2021, and the Central African Republic with a population of 5.5 million became the second country on the 27th April 2022. Additionally there is reporting on the islands of Tonga (population of 105,000) and Fiji (population of a million) considering accepting Bitcoin as legal tender to ease their dependence on Western currencies, there is also the case of Panama (population of 4.3 million) where there are clear regulations, and even though Bitcoin is not legal tender, there are no capital gains taxes, putting Bitcoin on the same footing as the US Dollar and the Panamanian Balboa, the official currencies in Panama.

Additionally, acording to recent whispers Suriname (population of 630,000) and Colombia (population of 52 million) in South America are considering a Bitcoin adoption strategy, while the rise of Javier Milei in Argentina (population of 47 million) has led to freedom in using bitcoin to settle contracts, and more importantly has removed all taxes on bitcoin exchange removing governmental barriers, that will fuel domestic adoption of Bitcoin and attract capital and expertise of Bitcoin’s worldwide ecosystem, to flood into Argentina to build the future.

What do the above countries all have in common? They are all developing countries on the periphery of the global financial system, dependent on Dollars and Western currencies, with financial and banking defects that stop the people and the economy from creating and growing capital and wealth, and even more heartbreaking suck the youth out of these countries into the West to work and send money home. The trend should therefore be clear, politicians in the poorer countries on the peripheries will drive Bitcoin adoption for financial freedom and independence from the West, for the benefit of the future. The likelyhood at the Nation State level is that the developing countries of the South on the peripheries will adopt Bitcoin as legal tender first, and the developed countries of the North at the core will adopt Bitcoin as legal tender last.

Nation States Mining Bitcoin

From the above, and the movement of eight countries containing over 100 million people towards Bitcoin, the question arises of how to conveniently get hold of it? This is another aspect where Bitcoin excels, because bitcoins can be created within the Country by mining and via national electricity grids, that in most of the Countries of the world are in State hands already, one way or another. By diverting state electricity currency can be created domestically, thus strengthening National Security and Independence. For this reason, Bitcoin will become an important part of global geopolitics in the next decade.

Examples of Countries mining Bitcoin:

Iran – Because of Western economic and financial sanctions banning the sale of oil and gas in Dollars to settle trade, Iran has decided to burn its oil and gas into electricity and for mining Bitcoin. Indeed while the Iranian Government has banned Bitcoin mining for the public after mining operations were established in mosques as receivers of free electricity from the government, Iran is mining on the Nation State level through the Armed Forces, and explicitly with the blessing of the Government. The bitcoins are then used to pay for imports that cannot be paid for in Dollars, and Iran has been mining since at least 2019.

Venezuela – Another Country suffering Western sanctions, after jailing private bitcoin miners in a country where electricity is practically free for the public, Maduro’s Government and the Armed Forces have been mining bitcoin since 2020 to stabilise their financial foundations, as the Bolivar national currency melts in value by the hour in the hands of the public.

Bhutan – The news came out in only the last year that the tiny Kingdom of Bhutan, a Nation of 700,000 in South Asia, have been secretly mining since 2020 using renewable energy and hydropower to create electricity. Bhutan’s reasons for adoption of mining on a Nation State level, includes loss of tourism revenues since the Covid catastrophe, and an attempt to stem the flow of emigration of the young out of the Country to work in Western countries for their fiat currencies (1.5% of the population have emigrated to Australia alone in the last two years).

El Salvador – In addition to making Bitcoin legal tender, Bukele has gone a step farther in utilising renewable energy and geothermal heat from volcanoes to mine for bitcoin, for its national treasury and for leveaging debt in the form of Volcano Bonds to build out the country’s Bitcoin infrastructure further.

The four examples above demonstrate how Countries and Governments can produce bitcoins at home, breeding energy and monetary independence from the shortages and perfidy of Western currencies, as the global trust in the Eight Decade Eurodollar System wanes, and its financial sanctions and restrictions on the rest of the world increases. Iran, a country of 88 million, has already turned to Bitcoin to evade sanctions, that has extended to Russia and a country of 147 million people, in the process of legalising Bitcoin as a foreign payments system and rumours that the Government is secretly mining Bitcoin as a strategy to reduce dependence on the EuroDollar in international trade. It should also be clear that Governments can legalise Bitcoin on the State level, while stricly regulating or banning Bitcoin at the Public or individual level, and this is the strongest probability in the short term, that Nations will take advantage of Bitcoin at the international level while stricly regulating Bitcoin’s use as a domestic medium of exchange and payments rail, lest it threaten and undermine the monopoly of their national currencies over the domestic population. But over the longer term and as the value of Bitcoin increases, it will become a matter of National Security to legalise bitcoin for payments, even considering the mortal threat this would create for the banking and taxation apparatus.

Bitcoin in the West – New Foundations For Western Debt Unions

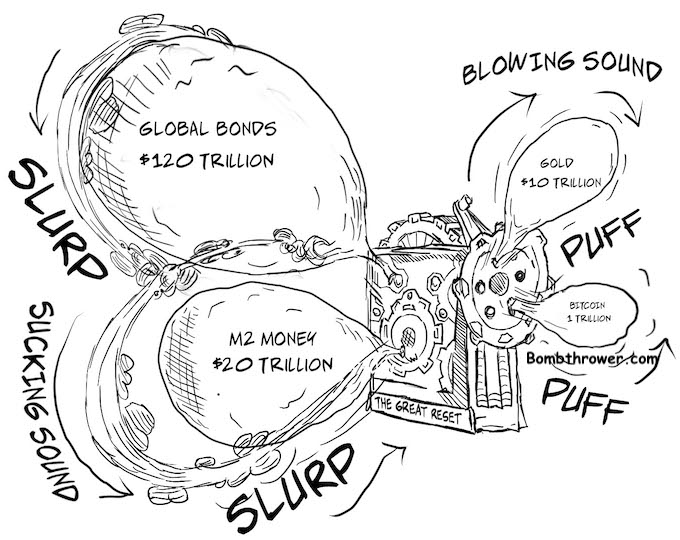

Re-setting global collateral standards will include the revaluation of Gold far higher, with Banks and Governments using Gold and Bitcoin and intrinsic scarcity both physical and digital as the foundations for a reformed financial system, at the expense of debasing national fiat currencies and government bonds disabling Western Unions and their ability to create national debt and government spending (source)

We arrive at the heart of the Global Financial System, and three monetary and fiscal unions that strangle dominate trade settlement over the world. Despite the neverending and nightmarish debts the United States, the European Union, and the United Kingdom have created since their inception, inflation and debasement is generally lower in these currencies and the banking and payments systems operate more efficiently, meaning the probability that it will take longer for Bitcoin to take over as a payment network, but Bitcoin offers far more short term value for the West as a store of value and scarce and valuable collateral to back the debts currency and treasury.

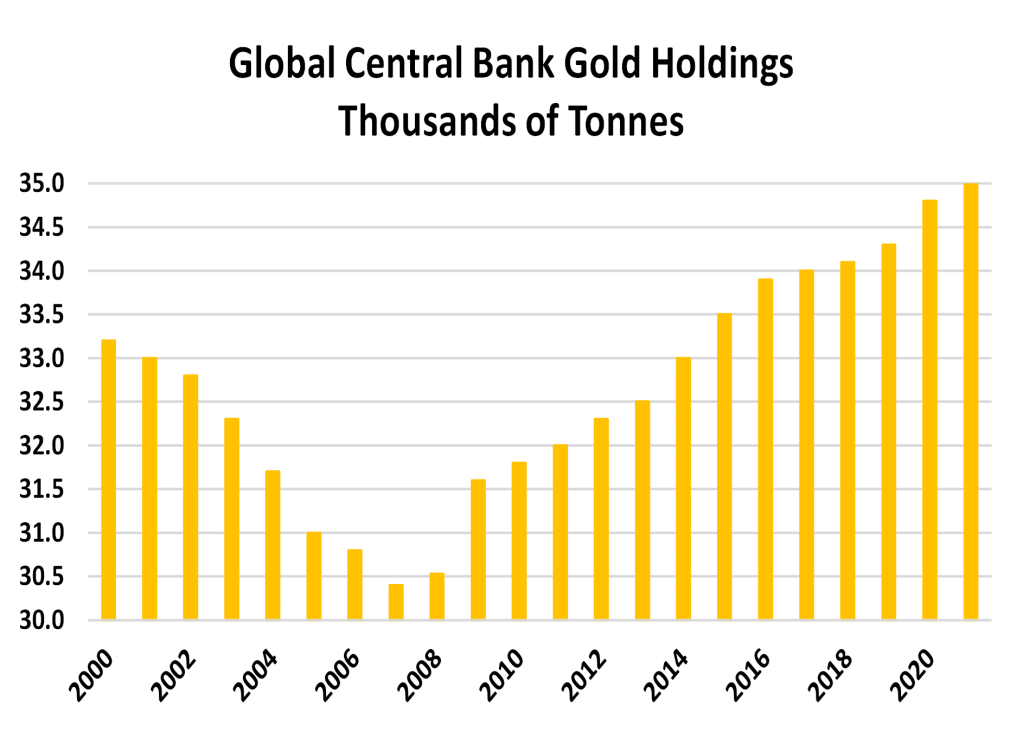

2008 was the peak of trust in the EuroDollar Financial System – ever since the world’s Central Banks have been preparing for a change in the financial order. Gradually, then suddenly

Because of Gold’s historical role as foundation of the old monetary and banking system, and for the simple fact that the Central Banks of the World still hold gold on their balance sheets as independent and sovereign collateral, then it is relatively easy to predict that the Western Debt Unions, amidst the collapse of their international bond and debt markets and increasing domestic inflation and currency debasement, will decide to revalue their gold reserves higher and through the fraud magic of Accounting, will revalue their balance sheets higher, increasing the demand for gold buying and storage in the West.

Latest Bitcoin to gold exchange and market cap, courtesy of Clark Moody’s Bitcoin Dashboard

What is true for Gold, is true for Bitcoin. If the Banking System and National Governments begin creating Bitcoin Treasuries as a foundational asset on their ledgers, as the price and value of Bitcoin rises to does the value of the collateral underpinning banking and treasuries increases, allowing the banks to increase loans and “economic growth”, increasing the tax take and government spending on the liabilities side. The price that will have to be paid for revaluing superior collateral in Gold and Bitcoin higher is by debasing the value of national debt lower, making Western debt undesirable to the rest of the world, disabling out of control Government spending and trade deficits, but this price will be worth paying compared to financial and debt crises and higher inflation and currency debasement.

Western Banks Adopting Bitcoin

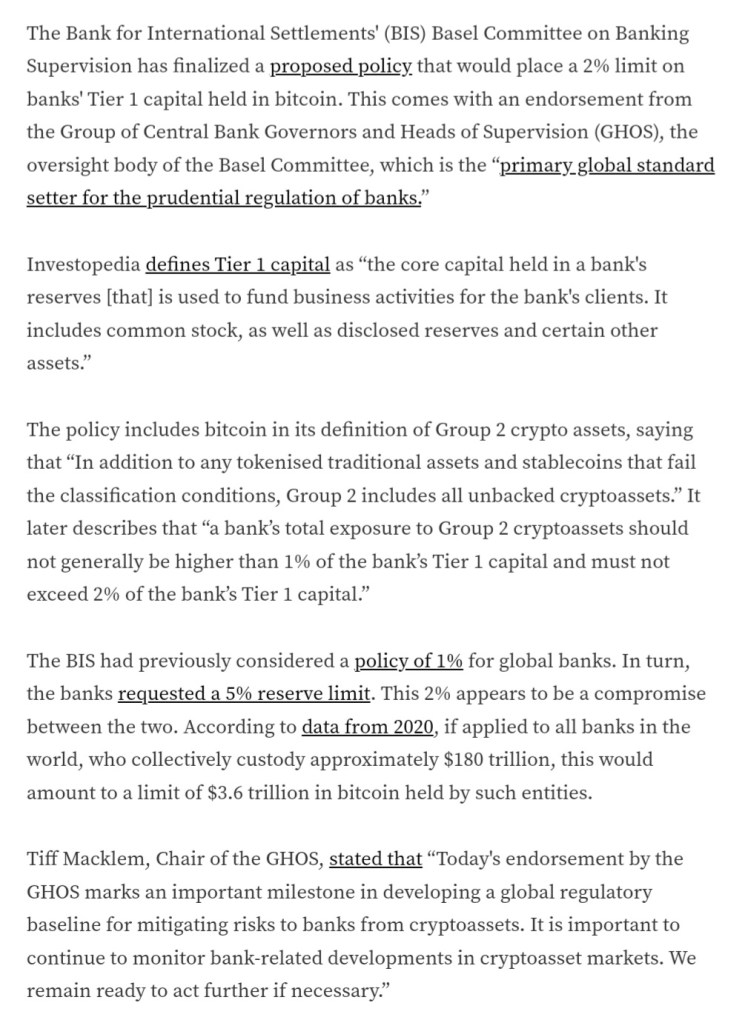

We begin with the unelected financial bureaucracies that supervise the world’s Central Banks. The Bank for International Settlements is recognised as the Central Bank of Central Banks, with its god awful ugly headquarters in Basle, Switzerland, and its Committees decide capital and collateral standards for the global banking system, so it’s important to pay attention to regulatory developments in crypto-currencies at this level.

Basel Committee Finalises Policy Suggesting 2% Exposure Cap For Banks. With approximately $180 TRILLION under custody, 2% would be roughly $3.6 TRILLION, nearly 3X Bitcoin’s current market of $1.3 Trillion (source)

The Basel III Accord, is the latest framework that sets international standards for bank capital adequacy, stress testing, and liquidity requirements, and is intended to strengthen bank capital requirements by increasing minimum capital requirements, holdings of high quality liquid assets, and decreasing bank leverage.

It is Basel III that promoted physical and allocated gold to Tier 1 Capital, in December 2022 the Basel Committee on Banking Supervision (BCBS) finalised its proposed policy on hodling Bitcoin, after consulting with banking lobbies (including J P Morgan and Deutsche Bank), a limit of 2% of Tier 1 capital in Bitcoin. Based on $180 trillion in bank capital, 2% would be around $3.6 Trillion.

While the above does not mean that all the world’s banks are about to flood into Bitcoin in the near future, the door has been opened, by the banks themselves, into holding Bitcoin as collateral on their balance sheets. For example, if the price of Bitcoin were to increase 10X from here, 2% would multiply to 20% of balance sheet capacity, and ten times the capacity for banks to issue loans and the economic growth that would follow in its wake.

Updating Accounting Standards for Bitcoin

As well as Banking Accords that define capital allocation and balance sheet composition of the global private banking network, there is also the institutional side to explore, covering pension funds, insurance funds, mutual funds, money market funds, exchange traded funds, and the whole corporate space in general. Institutions, like banks are heavily regulated in what they can and can’t invest in, their hands are tied to accounting standards and the world of bean-counting.

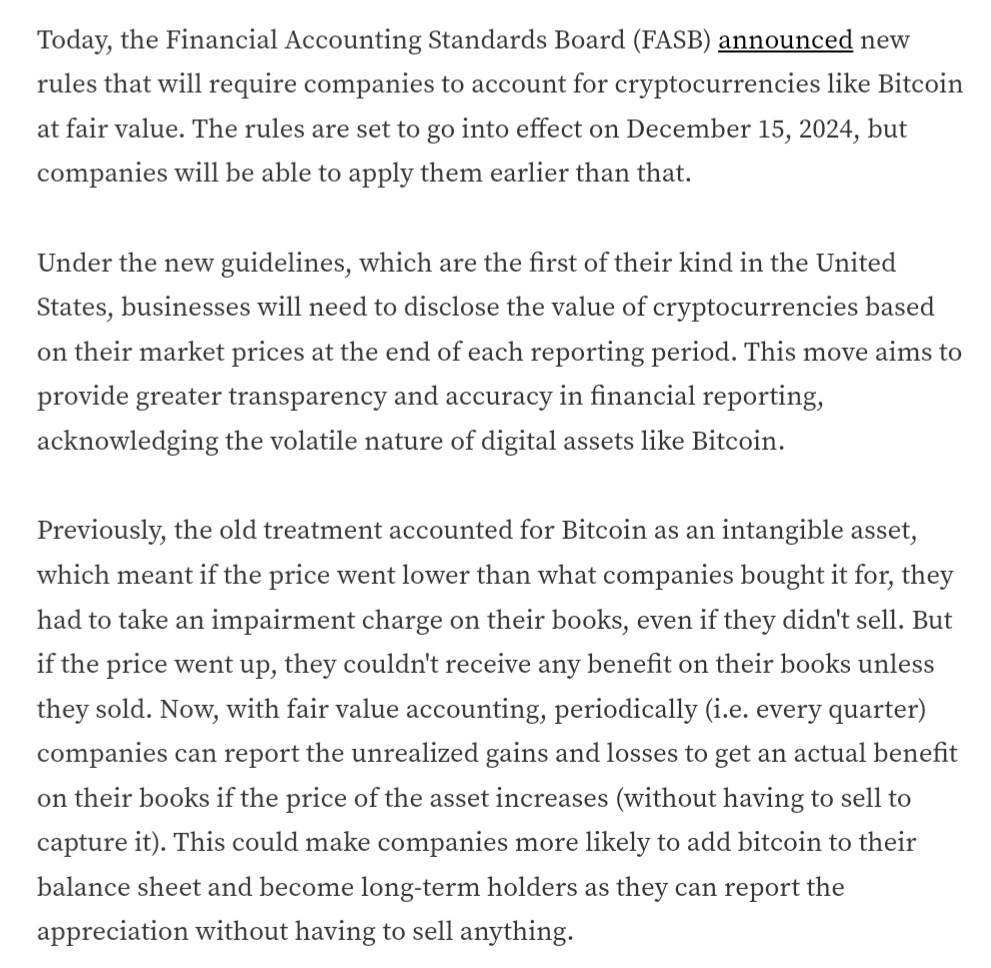

While there are many institutions already investing and invested in Bitcoin, there are accounting penalties and disincentives for doing so at present, holding Bitcoin as a balance sheet asset for example under current GAAP Policy is classed as an indefinite-lived intangible asset, which has only downsides for Bitcoin in balance sheet accounting. If Bitcoin falls during a quarter, the company must recognise the impairment charge if the fair value decreases at any point below the carrying value, however if Bitcoin increases this is not recognised as a gain nor reflected in the asset’s carrying value on the balance sheet.

This ludicrous designation as indefinite-lived intangible asset, that thas inhibited institutional investment in Bitcoin on corporate books is now set to be revised, as the Financial Accounting Standards Board (FASB) moves forward to fair value accounting for Bitcoin.

FASB is the private standard-setting body whose primary purpose is to establish and improve Generally Accepted Accounting Principles (GAAP) within the United States in the public’s interest. The Securities and Exchange Commission (SEC) designated the FASB as the organisation responsible for setting accounting standards for public companies in the U.S (source)

This one accounting tweak has huge ramifications for Bitcoin’s future, as the US and the world’s most financialised economy adopts fair value accounting, it forces Accounting Standard Boards in other countries to take the same stance towards Bitcoin as a treasury reserve asset, allowing their private companies to buy into the Bitcoin Accounting Standard… From now on companies holding bitcoins on balance sheets can mark to market every quarter at fair value, the increasing value of Bitcoin increases the value of institutional balance sheets and the company’s financial health, allowing it to expand operations and growth for the future… And because bitcoin’s issue schedule is completely predictable and halving every four years, all these institutions will be scrambling for a share of the 21,000,000 maximum cap, of which nearly 20 million have already been mined and with the issue schedule halved in April from 900 per day to 450 per day, will drive a demand for Bitcoin that far outstrips supply, I argue a persistent and insatiable institutional bid for Bitcoin could abolish the four yearly boom and bust cycles that have repeated three times since the 2009 inception… The liquidity unleashed into Bitcoin is sure to reduce its volatility, which increases stability against Bitcoin’s wayward price swings, that would make bitcoin even more desirable as a reserve asset and collateral to hold, contributing further to the feeding frenzy that revalues the whole balance sheet and solvency of corporate America and beyond even higher still! Just take some time to think about that…

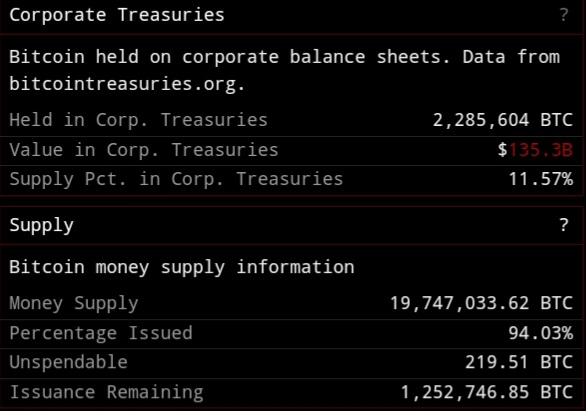

Bitcoin corporate treasuries currently at $135.3 Billion, 2,285,604 bitcoins, or 11.6% of supply, according to bitcointreasuries.net, courtesy of Clark Moody’s Bitcoin Dashboard…

Bitcoin Adoption by Western Governments – Parliamentary Laws

In addition to the unelected private bureaucracy and supervisory bodies, there are also public and elected bodies and the Laws of the Land, Parliamentary Laws and Politicians will have a bigger influence on the future of National Bitcoin adoption.

To discuss the West and the beating heart of the EuroDollar global banking network, against all expectations, the European Union have taken the lead with Markets in Crypto Assets – MICA signed into Law since the 20th April 2023, and to mixed reviews. Even so, European companies and banks now a have a far clear picture of what is and what is not possible with Bitcoin, with Germany’s largest bank, Deutsche Bank, one of the earliest movers offering crypto custody to its clients.

After looking as the most promising Union for adopting Bitcoin under the Presidency of Donald Trump, the United States have fallen to the back of the class during the Presidency of Joe Biden and the Democrats, their obvious hated of Bitcoin out in public, and strongly influenced Operation Chokepoint 2.0 and the mildly successful attempt to starve Bitcoin Exchanges and Crypto-Banks from the TradFi Sector. Despite the efforts of the Democrats, on Wall Street the financial system continues to warm with the dozen new ETF’s launched in January 2024 by some of the world’s biggest companies such as BlackRock and JP Morgan, showing an increasing appetite to invest. Even within Congress, there are Crypto Bills working their way through the legislative swamp, from the bipartisan Lummis-Gillibrand S. 4356 Responsible Financial Innovation Act – RFIA since July 2022, the Market Structure draft bill and Clarity for Payment Stablecoins Act 2023, by the Chair of the Financial Services Committee, Patrick McHenry and Republican House of Representatives Members, as the US falls behind in Bitcoin adoption and dependent on the second coming of Trump and a Republican landslide in Congress in November.

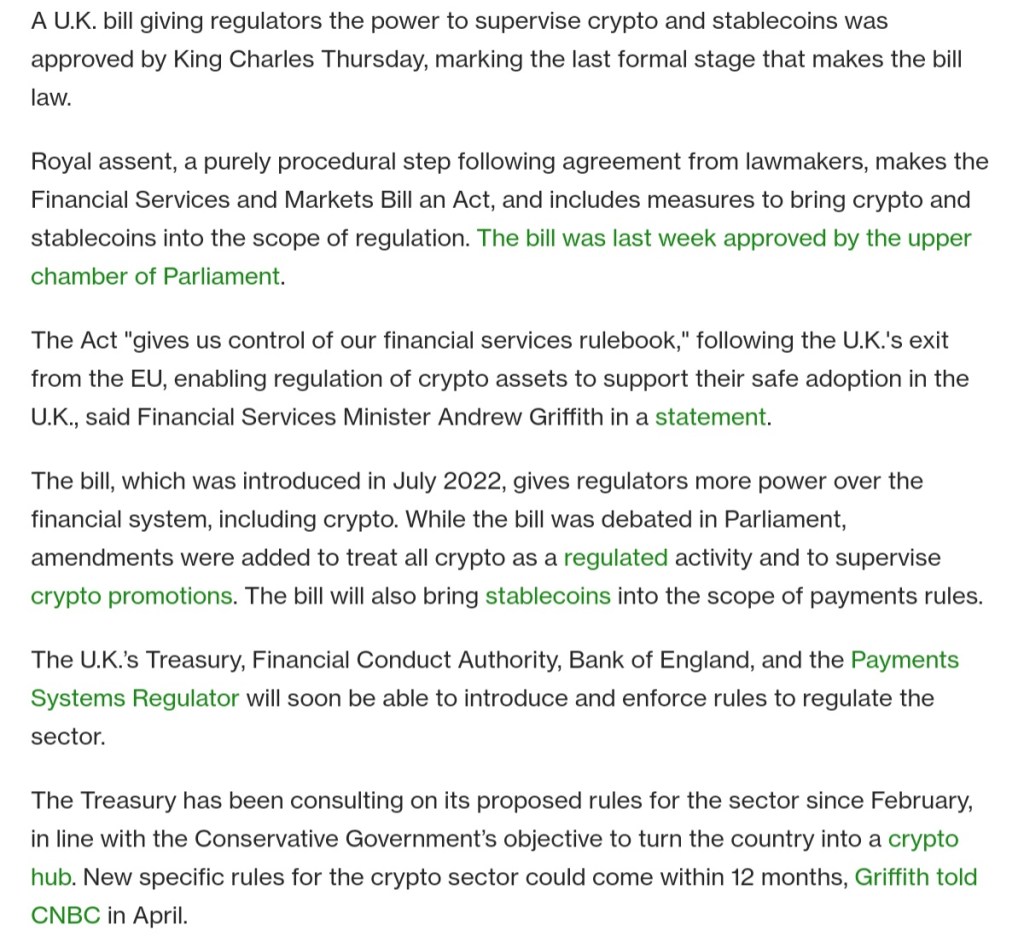

Finallu to London, where the Financial Services and Markets Act 2023 passed into Law, for regulating the crypto-currency sector. The lobbies of the Treasury, the Bank of England and the Financial Conduct Authority will consult with remaining lobbies in the private and public sector, that will decide the extent and the speed at which Britain will financialise Bitcoin.

Brexit has been a heavy blow to the City of London’s financial sector, with many European banks having repatriated to the Continent, more than likely behind the last Conservative Party’s efforts to transform Britain (read London) into a crypto hub (source)

The Future of Bitcoin in Britain

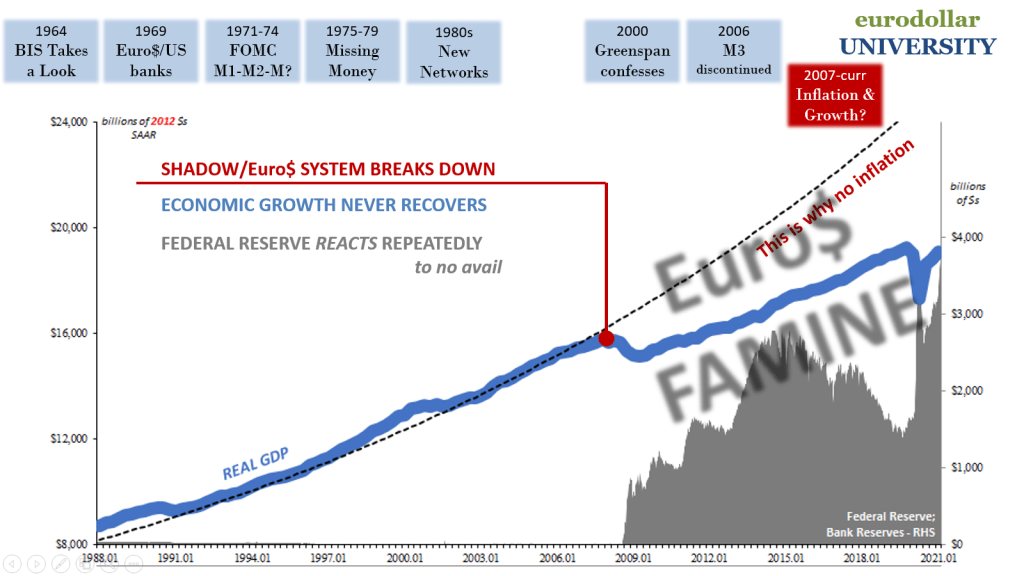

Britain was at the peak of its power at the end of the Industrial Revolution, it spent the second half of the Nineteenth Century running trade deficits with the US and Germany (in exchange for Pound Sterling’s and the City of London’s status as the world’s financial centre), the productive economy was sacrificed until Britain’s suicide in the First World War. By the end of the Second World War Britain’s power and Empire was spent, losing world reserve currency status to the US and London losing the world’s financial centre to New York. Britain would reinvent itself from the residues of financial hegemony, and the City of London became the main hub of the offshore EuroDollar that evolved following the Second World War, alongside smaller European centres in Germany, Switzerland, Italy and France. The EuroDollar and shadow banking exploded following the severing of the Gold Standard in 1971, coming to dwarf the actual Dollar in size and complexity, especially from the Eighties manifesting as the Big Bang and deregulation of London’s financial sector. The effects of the Big Bang were dramatic, and by 2006 many considered London to have recaptured the global financial centre, and co-incidentally this would prove the peak of the EuroDollar system.

Peak EuroDollar (and London) is August 2007, when something snaps inside the system and trust between New York and London banks break down, unleashing the Greatest Financial Crisis since the Great Depression of the 1930’s (source)

EuroDollar shortages led to the Financial Crisis of 2008 (as Satoshi was releasing his whitepaper) and is remembered as one of the worst crisis in monetary history. Ever since the world and especially Britain has suffered from a weakness in lending amongst the banks, a by-product of low trust levels and aversion to risk that has translated into subdued credit creation hurting businesses and the economy in general, with GDP as one measure of economic productivity suffering and poverty increasing. Indeed, despite the best efforts of the legacy media and press to paper over the cracks since 2008, an increasing number are starting to recognise the period since 2008 as the Greater Depression and the Silent Depression, that no-one amongst economists, journalists, the Treasury or the Bank of England wants to discuss. Furthermore, the last sixteen years can be described as the end of world’s centraliastion aka globalisation, and the spluttering EuroDollar as the beginning of decentralisation and can be seen in the political upheaval of “de-globalisation aka re-nationalisation (populism) of the last ten years, such as the Brexit Referendum of July 2016 and Donald Trump’s election in November 2016.

The UK banking sector has suffered further since Brexit as a number of European banks scaled down or out of London’s financial headquarters, back to the smaller centres on the Continent, especially Frankfurt, hurting the financial sector of what can be argued is Britain’s major remaining export in this shell of an Union, with our increasing trade deficits that debase our currency, hasten the end of our industries, increase our debts, and breeds a dependence on foreigners and enemies for energy and industry that should be a matter of National Security to be produced domestically. With National Debt and interest expense soaring, in an energy and cost of living crisis, and a stagnating banking and credit creation sector heading into the the next Global Recession and Financial Crisis of the Twenty First Century, it appears obvious to the author that the Western Debt Unions and especially Britain will have to revalue stronger foundations for its monetary and accounting apparatus. By revaluing gold as historical and traditional collateral and also monetising Bitcoin and crypto-currencies as new collateral, this was the most probable reason for the movement of the prior Conservative Government to reinvent Britain (London) as a “Crypto Hub”, that obviously depends on how the British Bureaucracy regulates the new Crypto Act that recognises Bitcoin as a new monetary asset within the British Union.

The current strict regulations by the FCA are leading to the questioning of Conservative Party noises about turning Britain into a Crypto Hub (source)

As well as Operation Chokepoint 2.0 in the United States, a similar operation has been underway in Britain through FCA regulations, and the strict limits placed upon the High Street Banks (Lloyds, NatWest, HSBC and Barclays) and most Fintech Banks for buying and selling bitcoin on Exchanges, and as KYC/AML Compliance chokes the sector. Powerful financial and government lobbies still remain in one the world’s oldest financial unions, and will continue to try and slow down Bitcoin’s growth and adoption through unelected bodies such as the FCA, but it is ultimately Politicians and Parliament and lobbies that will decide the extent to which City of London banks and by extension the British economy, financialise Bitcoin adoption. If London’s Parliament decides to lightly regulate Bitcoin in this Island and critically drops tax rates, the barriers to rebuilding the British economy on the Bitcoin Standard will be lowered, allowing domestic Bitcoin businesses to thrive, and attracting foreign capital and businesses to move operations to a new and friendly global jurisdiction.

The British Crypto Lobby in 2023, was over 5.6 million or 11% of the population according to this June 2024 estimate (source)

Never forget that we are all ultimately customers of the British Banking System, and pay our taxes and elect Politicians to exercise the public will. Even though this seems unlikely at times, ultimately the banks are dependent on our custom and Parliament is dependent upon our taxes and votes to remain in business, and so ultimately the most powerful lobby over the monetary governance of Britain is the Public.

The Bitcoin lobby was 2.5% of the population or 1.3 million in 2023. However the 2024 update above suggests it is now closer to 5%, 2.6 million people.

As should be expected the British Bitcoin lobby is young, working, and three quarters are men. And even though only 5% of the public currently, the network growth and value of Bitcoin is going to grow the adopion trend among the younger demographics, as their wealth increases so the voice and influence within British Politics to pressure clueless MP’s.

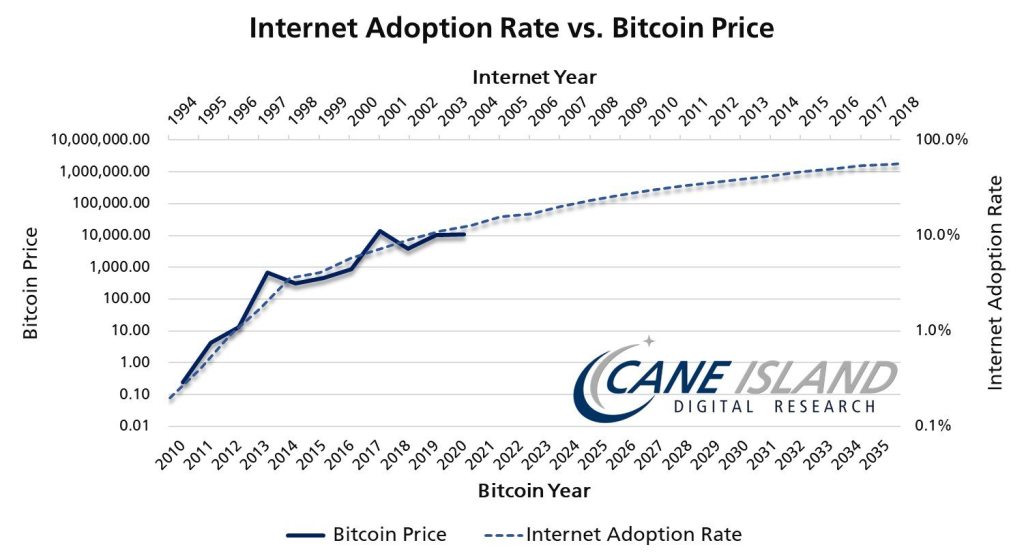

Comparing Bitcoin adoption with Internet adoption. Comparing 2009 to 1994, Bitcoin is today roughly where the internet was in 2009. We are still so early! (source)

The Max Plank Principle describes technological advancement happening one funeral at a time, in the meaning that over time young generations become immersed in new ways of operating while the old generations die out using the traditional methods, and this principle is incredibly important to understand in attempting to predict the future. By now there is barely anyone under the age of 30 that remembers the old age before the internet, and in another 15 years no-one under 30 will remember the old age before Bitcoin. If we wind forward a decade, when the Bitcoin lobby has swollen to a quarter or a third of the population, then this lobby will be voting for Politicians and Parties based upon their attitudes and policies towards Bitcoin. A lobby of 20% translates electorally to a swing of 40% between two parties, and can therefore make or break Britain’s political parties. This is the most powerful lobby to loosen Parliamentary and Government regulations on Bitcoin, and enabling the financial sector to monetise and increase Bitcoin adoption in Britain over the next decade.

The Future of Bitcoin in Wales

As part of a Legal Union for nearly five centuries Wales has no financial infrastructure of its own, it uses London’s inflationary currency, pays taxes into London’s Treasury, and receives public spending back to be wasted distributed by Cardiff’s Senedd in Corruption Bay. We are therefore completely dependent upon the infrastructure of the Union making any Independence from the top down from the Senedd impossible in the short term, but London bank infrastructure does allow the Welsh to buy Bitcoin on Exchanges and then withdraw to the Bitcoin network and self custody, which makes Independence from the bottom up likely and more likely as the Welsh adopt Bitcoin as an alternative monetary and accounting network. If we extrapolate from the estimated 5% of Bitcoin hodlers in 2024 within Britain, then an estimated 150,000 Welsh people hodl Bitcoin today, putting them on the path to monetary independence, the prerequisite to any legal independence for a Welsh Government in the future.

The future of Bitcoin in Wales brings us to Part Three of the Essay, discussing and theorising a realistic Independence Strategy and the essential Policies for an Independent Welsh, the only sustainable foundations for an Independent Wales.

End of Part Two

Bitcoin donations gratefully accepted:

bc1q49a3y9anq3a2pjqvq3gm8wj8aqqld3pnva9phwna2ftdar73mf3qak275j

Gadael sylw

Ysgrifennwch sylw…