Introduction

Part Three will discuss the Future and Independence Strategy, encompassing Monetary Policy, Taxes and Tariffs Policy, Energy Policy, Defence, Migration, Welfare, Education, Agriculture, Agriculture, and Language, highlighting the incentive structures adopting deflationary currency will drive for strengthening Welsh Independence against Government and Cardiff Senators, and the Labour Party in Wales.

As we move further into the digital future that originated with the Internet in 1994, and has accelerated since the invention of Bitcoin and internet native money since 2009, the Twenties of the Twenty First Century will see further decentralisation of information and communication alongside the growth of digital money outside the control of governments, undermining government influence over our lives and encouraging the movement of individual, family and community sovereignty, in rebuilding a flourishing Wales from the ground up. An exciting but cathartic next decade is ahead of us!

PART THREE: FUTURE

Independence Strategy

Part Three of the essay will discuss strategy and theory on the future in a Bitcoin Standard, and even though specific to Wales, it also applies to all other Nations over the world that will face the same dilemmas, as the trend of Centralisation and Union collapse under their insurmountable debts, and as Decentralisation and Independence create a number of new and smaller Countries in the decades to follow.

Monetary Policy

The most beautiful thing about decentralisation from the ground up by adopting the Bitcoin Standard, is that the public will have been adopting the new system for at least two decades before any Central Government, and as already discussed in Part Two the lobby for influencing Cardiff’s Senedd Members long established. This is dependent on the Welsh removing their bitcoins off Exchanges with the British Pound, and stored under self custody. Once the people are holding bitcoin themselves, this opens up the utility of Bitcoin’s network for transacting peer to peer trade, and buying or selling through a mobile phone using the payment layers being developed and deployed on Bitcoin today, from the Lightning Network acting as the connecting medium to sidechains, statechains, e-cash and the distributed digital banking network of the future.

Once an individual has adopted the Bitcoin network as well as hodling the currency they are in effect independent from British and Welsh Governments, and rather have put their trust and faith in a worldwide accounting standard outside of Government, and despite the legal and physical force of whatever is left of the Welsh Senedd, the public will decide how much attention to pay or how hard to squeeze Cardiff to bend to the democratic will. The all important point to understand is that the Bitcoin Standard eliminates the inflation, taxation and regulation apparatus of the British Pound, over the short to long term the trend will be away from the financial prison of the Pound to the financial freedom of Bitcoin, the bigger the incentive for Bitcoin users in Wales to lobby and influence Welsh Gov to lower taxes and barriers on using bitcoin officially. Any attempts by Welsh Gov to strictly regulate or raise taxes on the use of bitcoin in the economy would incentivise the public into the black market of peer to peer trade, avoiding inflation, taxation and regulation entirely, that would obviously decimate the Government’s fiscal spending plans and public sector employment to enforce taxation and regulation. In effect paying taxes to the Welsh Gov becomes voluntary on the Bitcoin Standard, and therefore the power and fiscal spending to steer the Country off the cliff will suffer enormously, and a foundation for de-nationalising and de-socialising the Welsh economy and the Country in the next few decades.

Bitcoin’s growing adoption among the public will also influence strongly the Welsh Government’s adoption of Bitcoin on the State level, and it could be argued the only way for Welsh Gov to survive and thrive in the long run would be to accept bitcoin for domestic taxation and foreign tariffs, and store in the Welsh Treasury as capital and collateral to back the National Currency, as we will call it from now on. To accept Bitcoin in payment of taxes or tariffs, it would need to legalise Bitcoin as legal tender and remove the current Capital Gains Tax of 20% on using bitcoin in trade. Lowering and eliminating this legal barrier would bring Bitcoin trade back from the black market to the white market, following the path of pioneers in El Salvador, the Central African Republic, and a growing number of National Parliaments in the world’s smaller countries considering and passing the laws for making Bitcoin legal and national tender. The trend is already establishing in the developing world, it is only a matter of time until the developed world will be facing the same trend.

Public and state adoption of Bitcoin lays the foundations for the banking system of the future. In the case of the Welsh Treasury storing bitcoins as their financial reserves, they could then issue national paper currency and the Welsh Pound, without the inflation and the monopoly over taxation and regulation. Indeed, any efforts to inflate the currency would show up nearly overnight, leading the public to abandon the currency and back to the digital scarcity and independence of Bitcoin. In the case of local and regional banking, Bitcoin would act as the accounting foundation for the public in lending to community or regional banks for an interest rate and yield on their deposits, and allowing banks to lend out those deposits as loans at a higher interest rate and yield to borrowers, to create or expand local businesses. Local or community banks could also issue their own paper currencies with values tied to bitcoin, which could be adopted by locals and businesses, bringing back the physical dimension to trade and returning some of the romance of the past back to local shopping. Banking will obviously cost a premium over using bitcoin via the smartphone, community banks will need to purchase a building, pay wages of managers and clerks, and the production cost of banknotes and anti-fraud measures. This is the inherent problem of banking that led the trend of fractional reserve banking and inflation so users and businesses will have to pay for this communal banking apparatus, however in a world of persistent deflation that is inherent to Bitcoin’s network, increasing purchasing power and falling costs of living, banking costs will effectively fall and become more affordable to maintain over time.

Adopting Bitcoin as a monetary/accounting standard could reinvent the colourful history of Welsh Banking (source)

This is of course far in the future for now, presently the grip of London’s Parliament and Banks is firmly around our throats, inflating, taxing and regulating the Union into a disorderly collapse. While the value of Bitcoin although massively inflating over the years is volatile day to day, against the stable day to day value of the Pound despite its continual debasement over the years. The trend and process of transforming Wales from measuring wealth in the Pound to measuring wealth in Bitcoin is going to take at least the next decade, a birth and death at a time.

Tax and Tariff Policy

A short story to make the point, our tax rates and fiscal spending is out of all control

For the purposes of this section, taxes are defined domestically upon the indigenous population, and tariffs as external taxes on imports and exports.

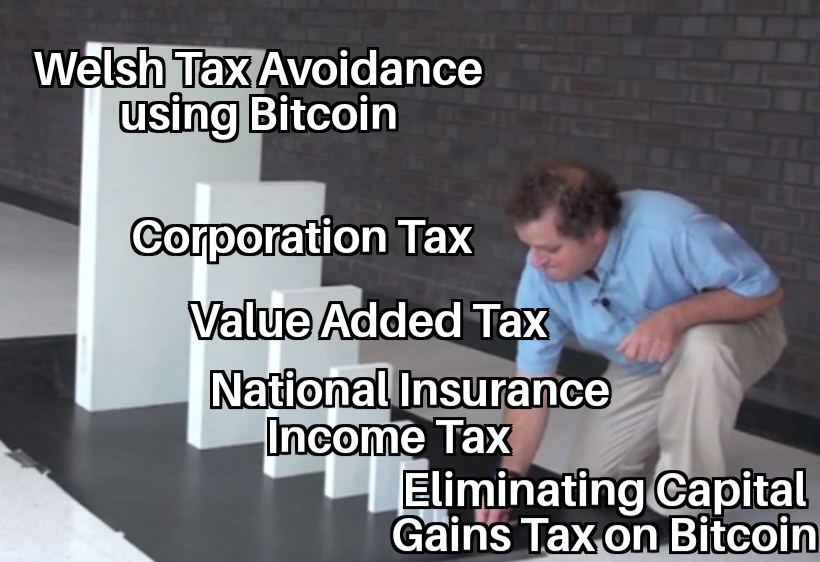

To begin internally, as already discussed adopting Bitcoin makes taxation voluntary in that it is possible to sell bitcoin for national currency (the pound) officially and pay the 20% capital gains tax currently, or bitcoin can be sold for pounds unofficially through the black market without revealing a word to the tax authorities. There is also a third choice, in selling bitcoin for goods and services, peer to peer with someone willing to accept it in trade, which is again practically impossible for the Inland Revenue to detect without the declaration of the traders. Peer to peer trade through bitcoin will also destroy taxes on production, especially the income tax, national insurance, value added tax and corporation tax, because the incentive once familiarised with using Bitcoin will be to declare less and less tax over time, starving the Treasury of fiscal spending, starving public sector employment and weakening the authority of the taxman over free trade on the ground. This trend will emerge at the margins amongst the ranks of the self employed and small businesses that are today flexible for avoiding and evading state taxation through physical cash, but feeding into larger businesses and corporations over time mirroring the reduced budgets of tax authorites and enforcement.

It should be clear that eliminating the Capital Gains Tax legalising Bitcoin as currency, is the first domino to strike the government’s ability to tax income, corporations, sales taxes, and in general hurting the revenues and ability of government to tax trade

The digital and ethereal nature of Bitcoin is going to make a massive long term mess of fiscal revenues and employment of Cardiff’s central government, but government also taxes our physical property for which there is no efficient method of avoiding, and the most important of these is Property Taxes and Council Tax. Because a home and car as the most valuable and common property for individuals and families are physical, it is straightfoward for local or national authorities to licence and tax those items, through property and land registers (HM Land Registry) and vehicles (the DVLA with its headquarters in Swansea). Legalising Bitcoin as national currency would make it possible to pay these taxes in bitcoin, and because of the trend of bitcoin to increase in value over time the value of the taxes and local authority reserves would increase to make up for the losses in commerce taxes, while there would also be a strong lobby amongst taxpayers to reduce property and council taxes to reflect the increased purchasing power of bitcoin. The future looks far brighter for local authorities than central/national authorities based on these scenarios.

Milton Friedman predicts Bitcoin in 1999!

The other main classification of taxes that would aid in the funding of fiscal spending and in the control of central government to enforce via physical control over borders and transport infrastructure, is Tariffs. Tariffs on exports and imports was the traditional method of tax collection, because of government control of borders, and over roads, railways, canals, and ports. Furthermore, we have already discussed in Part One about Mercantilism and the British Empire’s rise to world power via Protective Tariffs on imports and generating trade surpluses, while the history of the fall of Britain to a post-industrial shell in chronic debt follows the Liberal mindset of Free Trade and running trade deficits with the rest of the world, and so Tariff Policy is an intrinsic part of Independence Strategy.

Theorising that England will be Wales’ largest trading partner under Independence, then Welsh Gov tariffs would have to reflect England’s tariffs. For example, if England placed a protective tariff of 10% on Welsh exports, this would in effect be a 10% subsidy for native English production over foreign Welsh imports. If on the other side Wales placed no tariffs upon English exports, there would be no corresponding subsidy for native Welsh production, and an effective 10% penalty for producing in Wales. This would lead to Wales running trade deficits with England, increasing our debt to England while undermining the Welsh economy in the long run. Therefore if England places 10% tariffs on Welsh exports, then Wales must raise 10% tariffs on imports from England, to balance trade flows while creating revenue for the Welsh Treasury for financing enforcement and policing of the main border checkpoints between Wales and England, such as the A5 and A55 in the North and the A40 and M4 in the South. Welsh Gov would also be enforcing tariffs with Ireland and the rest of the world, principally through the ports of Holyhead on Anglesey, and Milford Haven and Fishguard in Pembroke. We will be discussing control of the borders in more detail in Defence and Migration Policy.

In the future following adoption of the Bitcoin Standard, Welsh Government will lose much of its power for tax collection on Welsh inland trade, supporting and flourishing the wealth and independence of the Welsh public from central government, but it will continue to control borders and the main arteries of trade flows in and out of Wales over land and sea. This means that within Wales foreign imports will be more expensive than domestic goods, protecting Welsh industrial and agricultural jobs, and an effective subsidy to compete in the industries and goods that have to be imported into Wales. Trade restrictions, barriers and taxes on foreign countries lead to lower restrictions, barriers and taxes inside the country, and is a further example of the advantages of an Independent Wales.

Energy Policy

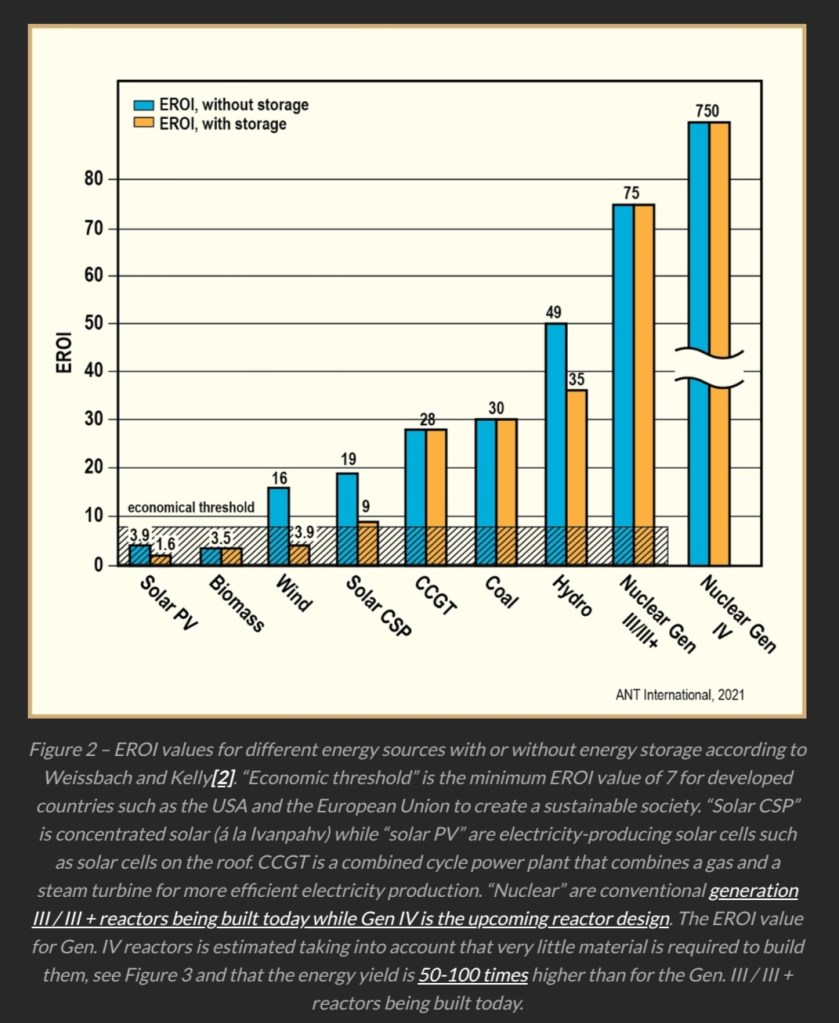

Energy Returned On Energy Invested – the most important number in any Energy Policy (source)

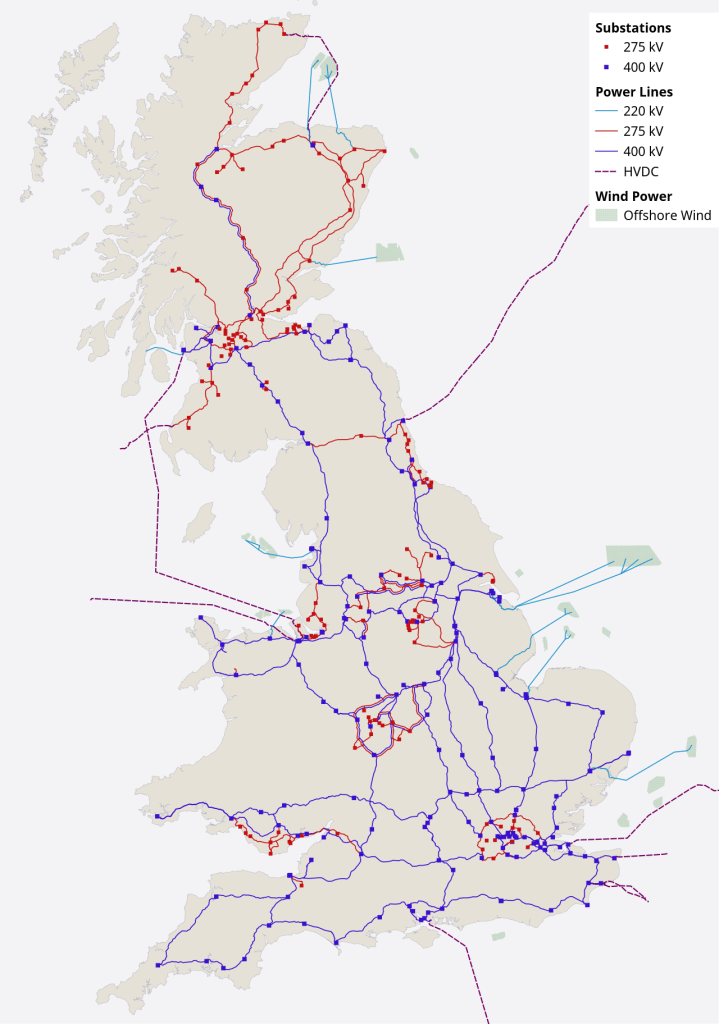

Third only in importance after monetary and tax policy is Energy Policy, as it is alongside money the foundation of production, trade, industry and economic growth, especially so in a digital money and accounting age that is completely dependent upon the production and distribution of electricity. Even though the roots of power stations and electrical grids of Britain are in the private sector and originate locally and distributed, following the First World War the Electricity (Supply) Act 1926 sees London Parliament centralise and standardise the grid to develop a national electrical network. Following the Second World War Parliament fully nationalises the electricity grid with the 1947 Act, alongside the coal and gas industries, and the birth of the nuclear industry with the Atomic Energy Authority Act in 1954, making Britain one of the earliest countries to create nuclear energy.

The energy and industrial sector catharsis of the Seventies and Eighties are already covered in Part One, since the Nineties the British Government under Conservatives and New Labour has moved away from the old cheap and reliable energy that founded the Industrial Revolution that Britain once pioneered, and towards unreliable and expensive energy from the weather since the turn of the Millennium. As electricity costs and energy poverty increase, alongside the threats of brownouts and blackouts when the wind is not blowing and the sun is not shining, it will become clearer to the Public and especially Westminter Politicians that redistribute all the subsidies and succour from British taxpayers to the energy sector, that our recent catastrophic experiment with wind and solar and power is completely unsustainable, and in the process of destroying our industries and economy that requires cheap and reliable electricity.

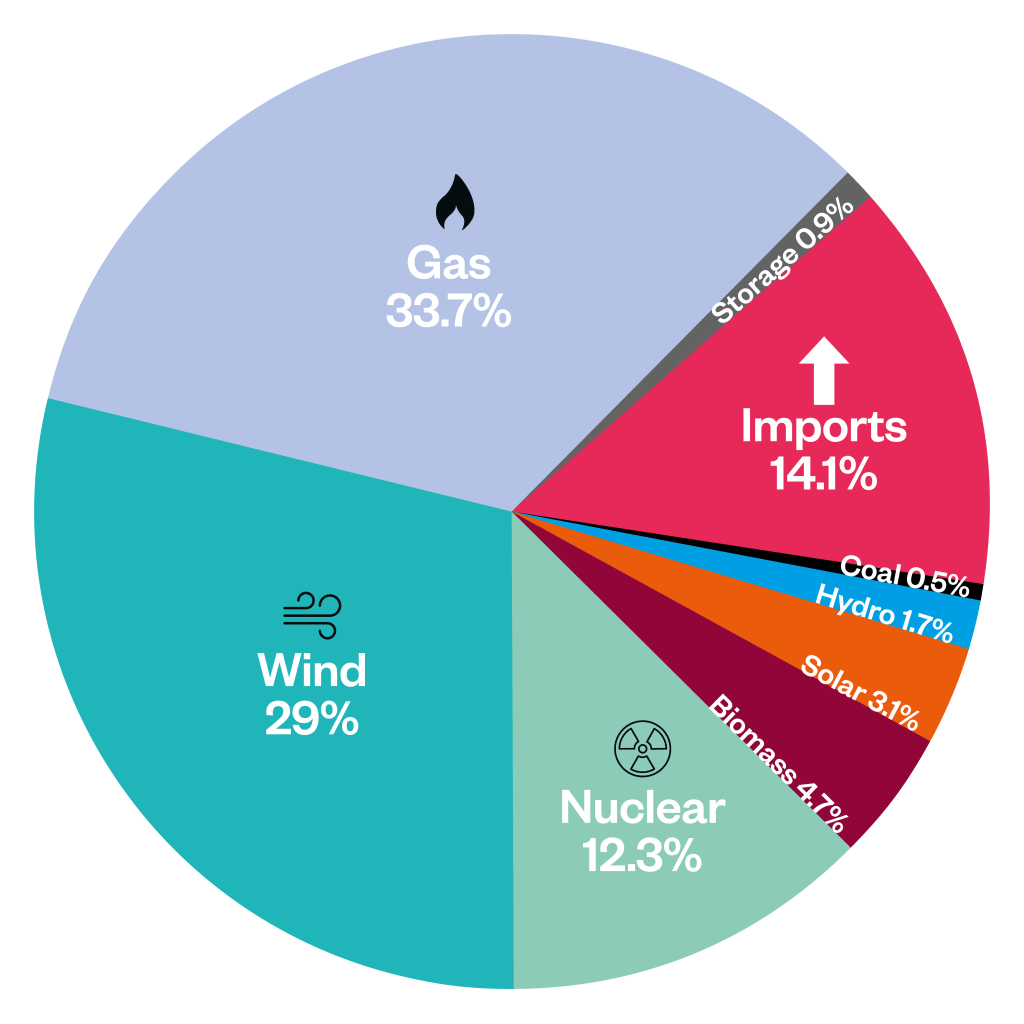

Britain’s energy mix to produce electricity in 2023, demonstrating that a third of our electricity is now created by the unreliable weather. Is is any wonder that imports are exploding and electricity bills have doubled in the last three years, and we are headed into a severe energy and cost of living crisis in the next few years? (source)

In the grip of the Climate Religion and the Carbon Gods, the British Government have closed down their coal sector and starved the gas and nuclear sectors, for the benefit of importing wind turbines and solar panels from our greatest geopolitical rivals in the East, with 60% of wind turbines and over 80% of solar panel production worldwide made in China, due to its cheap and reliable energy from coal that melts the metals and polysilicon and cement that are the inputs of this so-called “renewable” energy. Britain has exported its carbon footprint and all its environmental destruction to the East, to import this energy back as clean and green, pretending the up-front carbon and environmental destruction was never created! This short term mindset of unconscious Politicians have decided to enslave us to expensive and unreliable foreign energy imports, instead of investing in cheap and reliable energy domestically to compete with the energy supremacy of coal burning China, leaving us increasingly uncompetitive with the rest of the world, reflected in trade deficits and emptying what is left of this country’s industry, as they relocate to countries such as China, threatening National Security and Energy Independence in the process. Incredible!

From the cradle of the Industrial Revolution (and coal) to a Third World energy importer, Britain and Europe’s lobotomised Politicians have turned their backs on cheap and reliable energy, emptying the West of its industry to the countries that produce cheap electricity (source)

As the above chart on Energy Returned On Energy Invested demonstrates, the starting point of any Energy Policy for strengthening National Security and Energy Independence, is a moratorium on any further wind and solar projects, and use what is already built and operational for the next ten to fifteen years and the short life cycle of this catastrophic energy, and in the meantime develop strategies and national subsidies to ressurect the British coal, gas and nuclear sectors, with their high EROEI and 50-60 year life cycles. If Wales is ever to return its heavy industries and produce the materials that is essential for future independence at home, then coal, gas and nuclear have to be central to this policy.

Britain’s National Electrical Grid, allowing power stations to plug in and transmission to the distribution network to allow consumers to plug out (source)

Even in the event of the Dissolution of the British Union to its constituent Home Nations, the island’s infrastructure will remain connected, whether a road, railway, canal or energy networks, especially the gas transportation pipelines and the electrical grid. This allows the Home Nations to buy and sell electricity between each other, developing competition and possibly diversity of energy policy. No-one country can become over-dependent on another without endangering National Security and Energy Independence, so Wales will need to develop a strategy for subsidising, developing, and promoting power stations within Wales, also meaning that Climate Worshipers will have to suffer some pollution and environmental destruction. This is the price that must be paid for cheap and reliable electricity to power all the digital technology of modern Wales, and we are blessed by geographical fate in being rich in natural resources for creating energy, and inherit a number of renewable power stations built in the Union’s past.

Coal

We know since the Industrial Revolution, that the South Wales Valleys and the North Eastern strip are rich in coal deposits (source)

It is relatively easy to theorise that the ressurection of Wales’ coal industry will be far different from the one that died at the hands of Thatcher in the late Eighties, and a future of colliers plunging underground a hundred at a time, are unlikely. To be competitive with the rest of the world’s coal industries, Welsh Coal will be dependent on machines more than labour, meaning less jobs but cleaner and higher paying jobs, for the dirty work of digging for coal. The development will also likely be open cast over deep pit mining, because coal is such a cheap resource to excavate and coal stations are relatively cheap and quick to build for the energy created, any short term energy policy should include a new coal industry. This would be dependent on Welsh Gov development licences removing their boot off the necks of coal businesses, prioritising creating cheap energy and local jobs over the screeching of the green and renewable lobby.

Gas

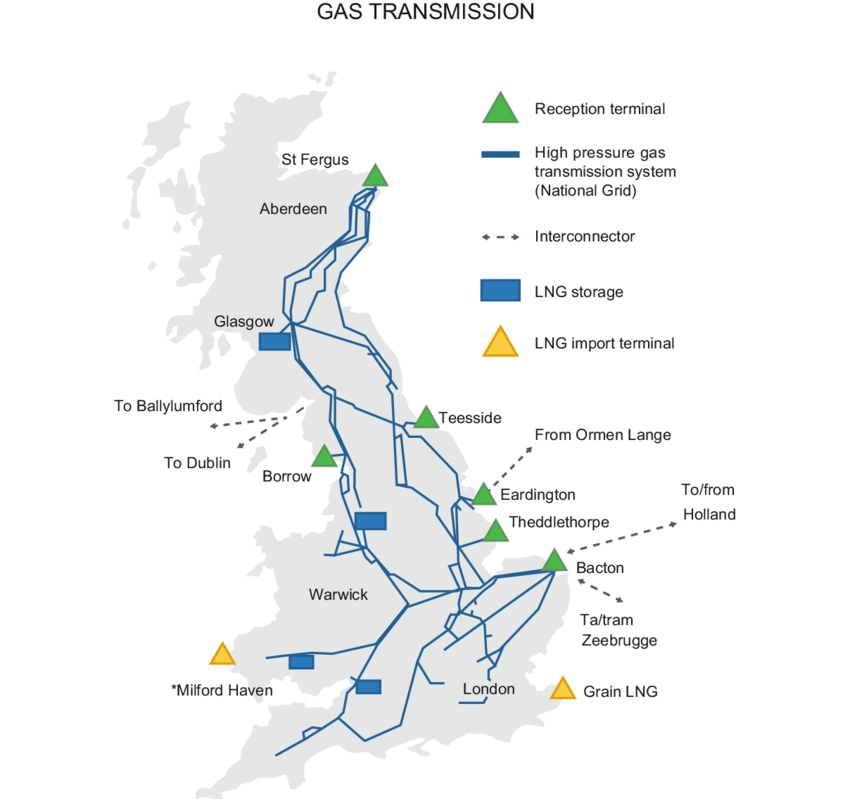

Gas, like electricity, requires a transmission network to connect British gas consumers, the port of Milford Haven is an important terminal for gas imports by ship (source)

Gas provides a slighly lower energy density than coal, but burns a lot cleaner and creates less environmental destruction and scars than coal, while it is also much harder to transport over distances, adding the infrastructure requirement of gas pipelines, which is again National. Like electricity therefore, existing grids will enable the transport of gas within the Home Nations, and Milford Haven will play an important part as main import terminal of an Independent Wales.

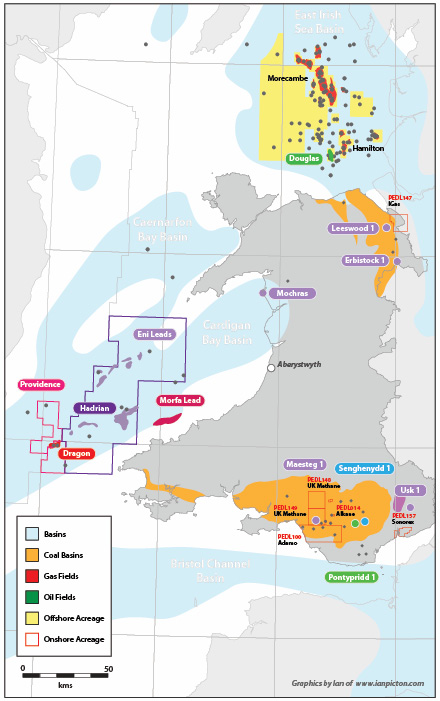

Very interesting article on the history of Welsh oil and gas exploration (source)

As in the example of coal, for National Security and Energy Independence in gas, Welsh Gov can licence the exploration and extraction of underseas gas in Welsh territorial waters for domestic use and/or exports. Gas is already over a third of the British electricity mix, and with the transmission infrastructure already built and new gas power stations the cheapest of the fossil fuels to build cost effectively and quickly, gas alongside coal should play an important part of short term electrical policy, to support and grow industry and Welsh economic growth.

Nuclear

Welsh nuclear history is in the North, with Trawsfynydd Power Station since 1965, and Wylfa since 1971 (source)

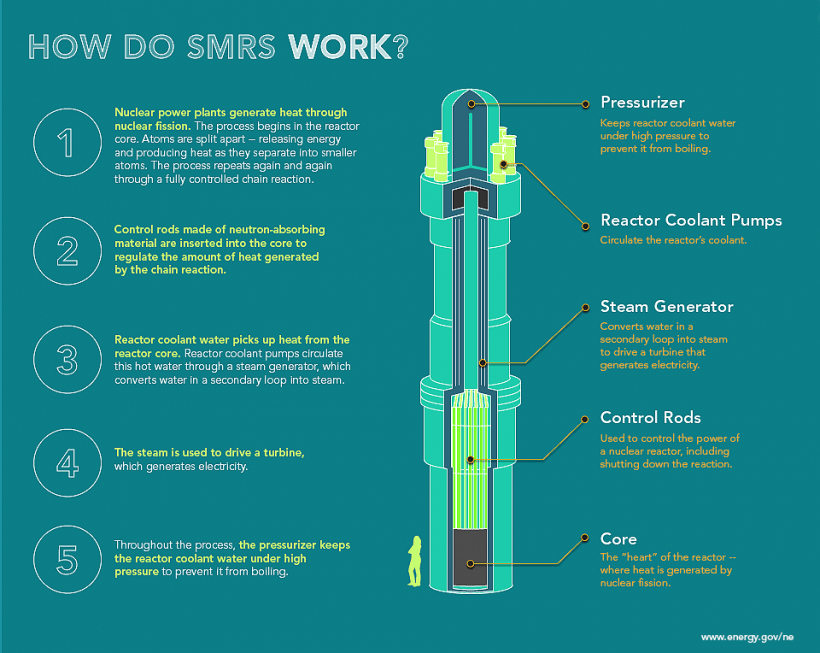

Britain was among the first countries to produce nuclear energy following the 1954 Act, and uranium energy has proved over the decades to be an extremely dense energy source creating an abundance of clean, cheap and reliable long term electricity, with the disadvantages of acute environmental destruction in rare cases such as Chernobyl in the Eighties in the last decade of the Soviet Union and Communist collapse, the up front costs are enormous with long lead times in commissioning and de-commissioning power stations, and there are also costs and considerations in storing and containing radioactive waste potentially for centuries. Nuclear should therefore be considered as far more expensive and long term energy policy for the Government to invest in and subsidise, with the current generation technology.

Redeveloping the Trawsfynydd site with Small Modular Reactors would create clean, cheap and reliable electricity, and estimates of 500-2600 jobs for electrical, mechanical, systems and safety engineers (source)

It is also common sense that it is much easier and cheaper to redevelop historical nuclear sites, than construct a power station and grid connections from new, and so probabilities favour Wales’ nuclear future remaining in the North. Indeed, Welsh Gov has already established Cwmni Egino in 2021 to redevelop the Trawsfynydd site for Small Modular Reactors and next generation technology to create the clean, cheap and reliable electricity and a foundation for industry and economic growth in the North. There is also recent correspondence that preliminary infrastructure works are continuing on the proposed £20 Billion Wylfa Newydd scheme for either a new reactor, or a series of small modular reactors. Redeveloping these two sites would be a major boon to North Wales in attracting new industry, and playing in to the potential of North Wales as future Bitcoin mining hub.

Small Modular Reactors are receiving some hype in the media, and within Government’s lately. The future is bright! (source)

Hydro

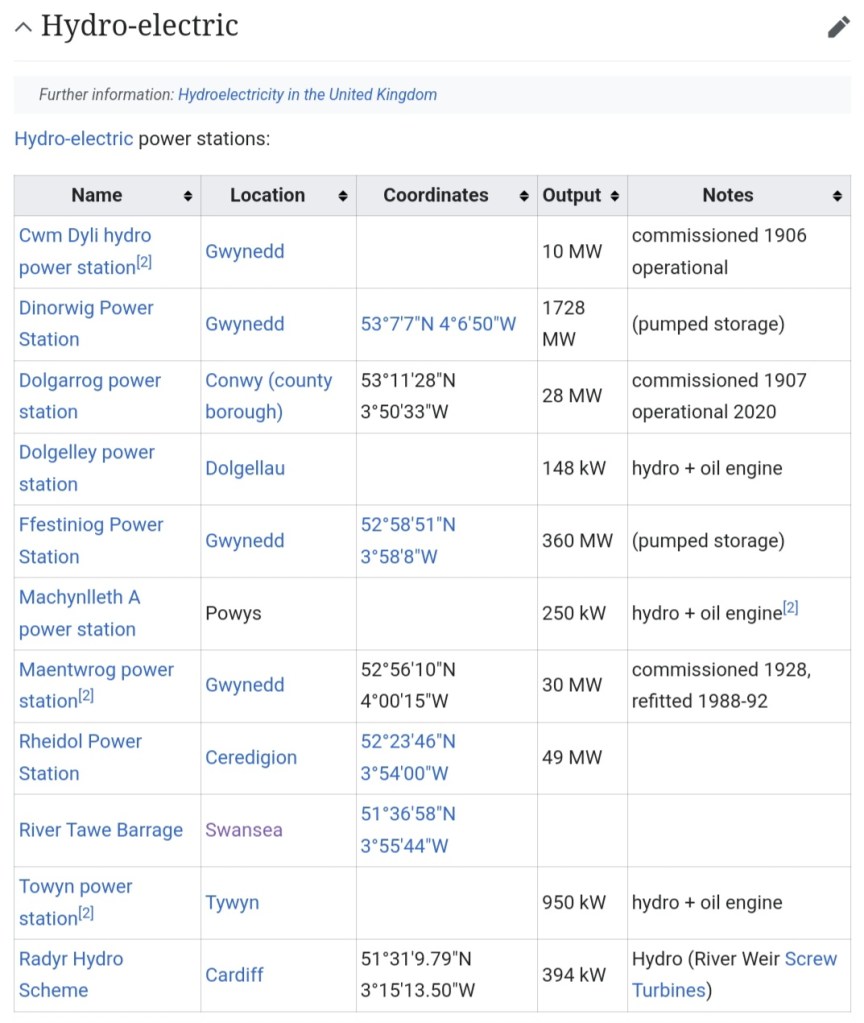

Shortlist of Wales’ largest hydroelectric plants (source)

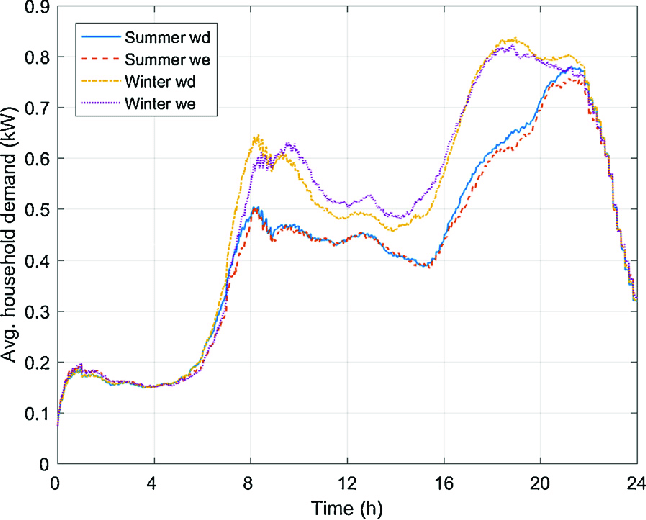

It could be argued that water is Wales most renowned resource, alongside its mountainous terrain especially in the North, by geographical destiny its rivers and lakes lend toward harnessing the energy of water through hydroelectric stations. Standing out on the above shortlist are two stations that possess a pump to recycle storage for continuous cycles, imitating the properties of a battery, making hydro far more reliable and valuable to a national electricity grid, freeing it from the unreliability of rain and weather. Because the demand for electricity is sporadic in nature, with huge demand spikes at the top of the morning and the top of the evening, before and after work, hydropower stations with pumped storage were developed for creating a flood of electricity to supply this demand for only a few hours a day, while in the small hours when everyone is asleep and electrical demand at its lowest, the water is pumped from the bottom lake to the top to be stored for the following cycle. Even though it uses more electricity to pump the water back up than coming down, because the station sells the electricity to the grid at highest prices and buys it to pump it back at the lowest prices, a profit spread can be captured while protecting millions of families in Wales and the North of England with reliable electricity when the demand for it is at its highest.

Electrical demand over the hours of the day, and over the Seasons. Sporadic demands increases the value of hydroelectric with pumped storage (source)

Ffestiniog Power Station is a 360-megawatt plant with storage up to 1.4GWh operating for four straight hours and is an engineering masterpiece, but the example of Dinorwic Power Station in the heart of Snowdonia towers as one of the largest energy and engineering projects in British Government history, taking ten years (1974-1984) and costing nearly half a billion that was worth a lot more half a century back. But for this enormous sum, Llanberis’ Electric Mountain can produce 2000-megawatts of power with a storage capacity of 9.1GWh, an incredible resource of electricity at short notice to ease strains on the national grid. Hydro will play an important part in in Wales’ energy future under the current order or under a new order.

The largest man made cavern in Europe was excavated between Marchlyn Mawr Lake and Peris Lake to create Dinorwic Power Station (source)

The huge costs and environmental destrucion of large hydro projects means that hydropower is not cost effective in the short run, it is likely therefore that few of these projects will be developed in the future. However, the Stations already built are essential for balancing grid demands, and justify their maintenance costs in the future.

Wind

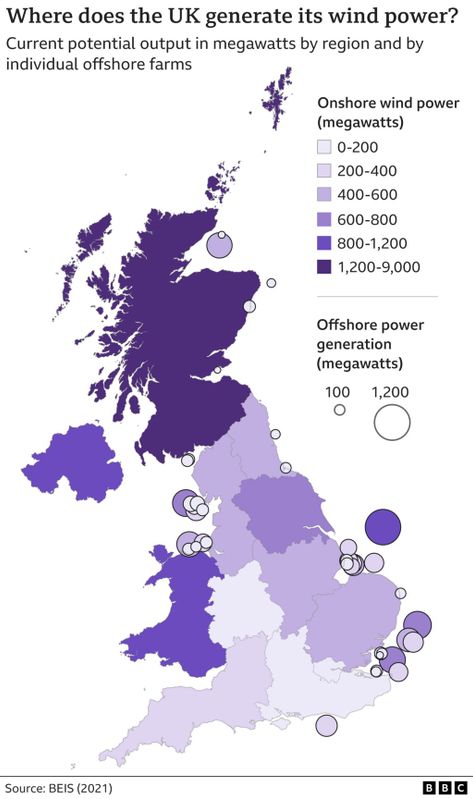

Another abundant resource in Wales is wind (source)

British Governments in the wake of Thatcher have been hypnotised by the green and renewable lobby, beginning with onshore wind farms, until the restrictions of a fading David Cameron Government in 2015, and since then moved offshore. Indeed, the fundamental problems of wind as an unreliable resource has been completely ignored by Westminster’s Parliament and their unending subsidies to the wind sector, resulting in the production of a third of our national electricity currently. In the same time the electricity costs of British consumers have exploded contributing heavily to the energy crisis the West has suffered since the Covid debacle, rendering the UK dependent on electricity from France’s nuclear power fleet, and re-firing coal plants in the last two winters when the wind wasn’t blowing. Additionally, higher interest rates and increasing coal prices to melt the metals and the cement and all the rare earth minerals that go into the modern wind turbines, have increased so much lately as to threaten the viability and future of the renewable wind sector, as such an essential component of our electricity grid. It is likely that the foolishness of trying to power a techno-industrial economy off such an unreliable resource as wind will start winding up soon, as the legacy media and London politicians wake up out of the coma of their disastrous energy policies, with the shift back to coal, gas and nuclear. The author sees no long term future for the wind revolution, losing its subsidies and capital misallocation, but still leaves us with the present generation of wind turbines that will for the next decade or two and their short life cycles compared to coal, gas and nuclear power stations, continue to generate intermittent electricity.

The main disadvantage of wind as an electricity source is there is no predictable time to when it is blowing, and so can lead to shortages of electricity threatening the stability and demands on the grid with blackouts, while on the other hand in strong winds turbines overproduce electricity when there is little demand, that also threaten the grid with blackouts. This could be balanced and solved perhaps by a storage network and batteries, but imagining the rare earth metals such as lithium and cobalt that would be need to be excavated and refined to build this network boggles the mind, and impossible without further environmental destruction and chronic pollution in the countries of the East. This problem of electricity storage brings us to the short term solution of stranded wind energy, and doubles up as an energy policy for an independent Welsh Government, Bitcoin mining.

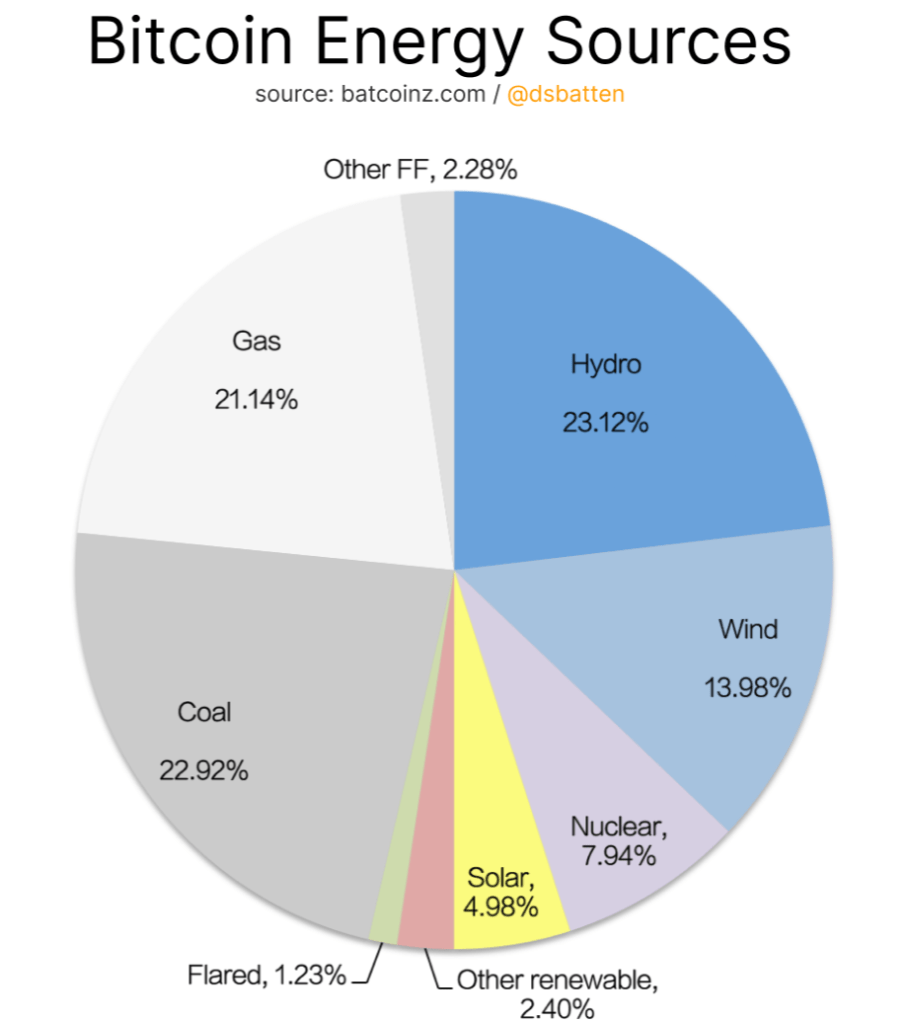

Bitcoin energy sources worldwide (source)

As demonstrated in the above chart, Bitcoin is attracted to renewable sources of electricity because they are unreliable, and therefore more profitable to mine at certain times. The advantages include co-locating Bitcoin miners quickly and flexibly in remote areas while it is possible to turn the mining computers off and on in seconds, reacting to the unpredictability of the weather. Bitcoin can also be considered an electrical battery, by converting electricity into digital currency with a sixteen year track record as a premier store of wealth, and in effect increase the value of the electricity mined today far higher in the future. For this reason mining bitcoin will become a more important policy for every electricity company and power station to reduce wasted electricity in every country over the world, connecting the energy network worldwide and through the internet. This will become even more imperative for the renewable energy sector, because of the unpredictable weather and flexibility of Bitcoin miners, mining heavily in periods of over-abundance of renewable electricity (and cheapest prices), and switching off the machines during periods of shortages when there is greater demand upon it (and higher prices). The cheap rates of renewable electricity off the grid as compared to the higher rates of electricity on the grid, means that Bitcoin has evolved more toward wind and hydro electricity historically, alongside solar providing nearly half of Bitcoin’s energy mix today. Bitcoin will become invaluable for stabilising electricity companies especially in the water, wind and sun sector, heading into uncertain times, and perhaps even making the companies profitable and sustainable without the subsidies and handouts of London Politicians drowning in energy affordability crises.

What is true for electricity companies, is also true for National Governments. As discussed in Part Two, a handful of Nations are already mining bitcoin on the State level, and because national grids and electricity companies are in public sector hands in most of the world’s countries already, it should be obvious the intersection of Bitcoin with energy and governments are meeting soon, over the world. By turning state electricity into bitcoin, a country can create a Bitcoin treasury or settle international trade, pressuring and forcing other countries to also mine bitcoin. And looking at Wales’ rich resources in electrical energy, from coal, gas and nuclear to wind and water, the Welsh Government would be in a strong position to take advantage of Bitcoin mining, for the treasury and fiscal spending.

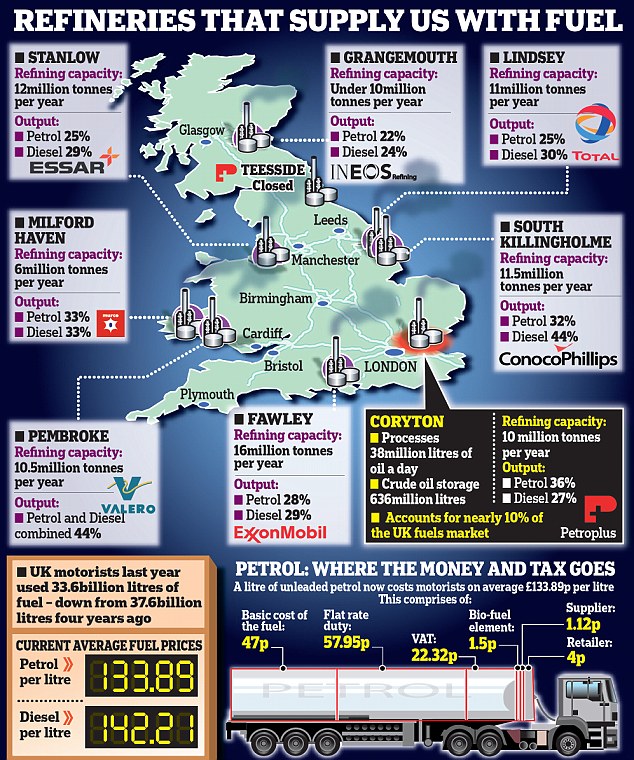

Before ending a long section on energy, as essential as electricity is to living standards and economic productivity in modern Wales, diesel (and petrol) are perhaps even more essential. Despite all the hope and hype of the electric vehicle revolution, it doesn’t compare to the advantages of fossil fuels and oil distillates. Indeed, diesel especially is the main foundation of today’s moving machines, from the tractors that maintain and increase agriculture productivity in the countryside, to the construction industry and transportation moving stuff around the country, oil is therefore essential to the present and future of this Welsh economy.

Britain’s oil refiners in 2012. The Milford Haven refinery has been shut but the Pembroke refinery is still open, so at least Wales has one domestic refinery producing fuel (source)

The Welsh Government, outside of oil exploration licences in Welsh waters, would be dependent on oil imports either from the North Sea (and Scotland) or from the European continent and the Middle East, in either case we would be running a trade deficit forcing us to export our produce to maintain a balance of trade. Cutting taxes on fuel would also make it cheaper for Welsh agriculture and industry to produce. Oil imports and domestic refineries are extremely important to the future of an Independent Wales.

Defence Policy

The history of Wales is a sad series of external invasions, from the Romans, to the Irish, the Saxons, the Vikings, the Normans and the English Crown. Wales’ geographic fate consists of coastline on three sides and a land border with a far larger country has made Wales open to invasion, so defending and defence has to be one of the most important policies of an independent country.

With a coastline of nearly 1700 miles, would require a Navy operating out of the main commercial ports and tying in to Tariff Policy, after all the reason for the imperial wars of European and British history was for and against free trade, and for enforcing protective tariffs (Mercantilism) to recycle into the growth of the Navy to protect the merchant ships and trade flows. In addition to trade, a Navy would defend against overseas attacks by foreign enemies. Wales’ recent history without a native Welsh Navy would force us to create a Navy from scratch, but we would inherit the Royal Navy’s infrastructure in Wales for building one.

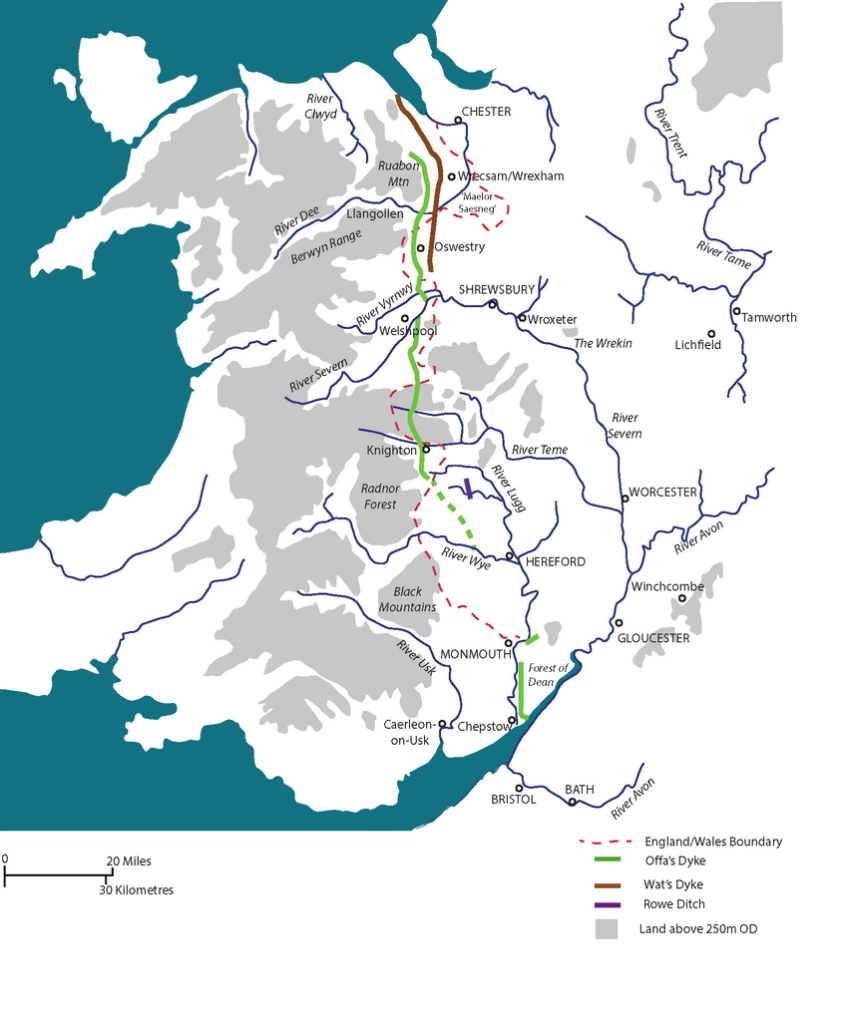

Offa’s Dyke begins construction in the Eighth Century (source)

The hard border between Wales and England begins officially with Offa’s Dyke in the Eighth Century and a major early medieval engineering project, but over the centuries as England slowly conquers Wales politically and militarily the borders melts, and by the Welsh Acts of Union when Wales is legally a part of England, there is no need for a border as such. In any question of Independence that will increase as the Western Unions break down, and as newly independent countries grow in number and shrink in size in the Twenty First Century, then hard and physical borders are the main way to protect against a land invasion, and a critical part of enforcing Tariff and Migration Policy controlling the flow of trade and people.

Wales’ modern but soft border with England since the 1536 County/Shire System (source)

The advantages of a hard border for independence would be erecting a physical barrier against a foreign army, and also control the flow of trade and population entering and exiting Wales. The disadvantages would be the costs and resources to erect the barriers, and the costs of surveillance and enforcement. In the case of Wales and splitting one country into two, perhaps England would have the same incentive to build a hard border and share the costs of the 160 mile wall separating two independent nations. There would also need to be gates and checkpoints and border police to enforce, while also allowing the flow of trade and people. The wall would cost a tremendous amount of money and resources but is a one time cost, and only low ongoing costs of repair and maintenance thereafter. The permanent costs are the policing of choke points and would probably be financed out of the Tariff Budget, paying for itself through taxing imports from external countries. The biggest controversy arising from a hard border would be land and property rights violated, including splitting farms, villages, and the requirement of checkpoints on the dozens of back roads of the Welsh Marches from north to south. When discussing such an expensive and challenging infrastructure design and build, it is much easier to talk than to act.

In addition to the Navy and the border, there would be a requirement for an Air Force and an Army to defend the country. To take the air force first, we would likely be inheriting the infrastructure of the RAF including 34 Stations over Wales, but we would have to import the aircraft and fuels, alongside pilot training. Building and maintaining an Air Force is another costly item on the expenditure list, and would have to reflect the spending restrictions of the Welsh Government as an independent country, again likely financed from the tariff budget.

Lastly to the army, which is a far more interesting subject. The old traditional way of maintaining a defensive army was through arming the aristocracy and the peasants via Militias, an amateur, distributed, and communitarian/regional army, favoured by monarchies because of the costs and threats of a full time standing army. As Parliamentary and Democratic forces overpowered monarchies, the last few centuries has evolved to national armies, centralised, professional, and a full time occupation. There are huge differences between the two mindsets, the first army from the bottom up and trusting in the native population to arm and defend their Country in the case of invasion for relatively low Government resource and spending, and the second army top down, centralised, disconnected from the population on the ground and working on the orders of a central government, and a major spending item on the budget of modern governments.

The trend under a professional army is to arm for conquering other countries or colonies as an offensive force while restricting the native population from bearing arms as a protective force, and it is always jarring to hear politicians glorifying the use of arms and armies overseas, while glorifying domestic restrictions on the ability of natives to arm themselves, without taking a second to contemplate the hypocrisy. Indeed, looking back at Welsh history, one of the main purposes of the Penal Laws of 1402 by English politicians was to disarm the Welsh, to stop attacks but also to disarm the Welsh against English armed encroachment. Also in the case of the new United States Republic broken free from the yoke of the Empire, and following their experiences in the Revolutionary War of 1775-1783, in the 1789 Constitution the First Amendment and the right to free speech, to be protected with the Second Amendment, the right to bear arms.

With the coming of the Industrial Revolution in the Nineteenth Century came also the revolution in the production of cheap and reliable guns, and to an extent balance the increasing power and threat of the domestic population against democratic government and their armed forces. British population armament peaked around the end of World War Two with the German threat, and since the Fifties witnessed progressive efforts to disarm the British public under the cover of public safety, penalising the law abiding gun owners while enobling the illegal gun owners of the black markets who have no interest in following any laws. The New Labour handgun ban following the actions of one criminal in the Dunblane Massacre of March 1996 was a big step forward in disarmament (except for the criminals of course), and in most of the countries of the world restrictions and prohibions have increased, especially in the cities where armed crime statistics are on the rise, while in the countryside where legal firearm ownership is higher, gun crime rates tend to be lower. The official gun ownership rates of England and Wales are less than 5% today.

Based on the financial probabilities alongside the decentralisation trend, both working together to undermine the debts and fiscal spending of Western Unions in the next few decades, Unions will breakdown to create numerous smaller and independent countries. The ability of national governments to maintain professional Armed Forces will suffer, leading financial cuts and the starving of the war industry and arms companies, with the probability that armies will devolve back towards the traditional, of local or regional militias to defend the country in the event of an invasion. The governments of the future will therefore have to trust in their domestic population and give independence in the form of relaxing firearm restrictions and/or subsidising firearm ownership, training and exercises, and geographical strategies in topography for defensive purposes.

Switzerland provides a modern example of this type of army, a country of 9 million people in mountainous territory and bordering powerful historic countries and empires, Germany, France, Italy and Austria. Amazingly, Switzerland has been an independent country since 1291 through neutrality, haven’t fought in an international war since 1815, and avoided the destruction of Two World Wars endured by its neighbours. Switzerland’s military strategy includes a small professional army of 9,000 full time soldiers, with another 110,000 compulsory and voluntary soldiers. Military regulations include compulsory military service for men aged 16 to 20, with exceptions, and voluntary for women, with training lasting between 18 and 21 weeks, it is a requirement for every man to store and secure his firearm and ammunition at home, making Switzerland one of the world’s most armed countries, with low firearm crime rates.

A quote attributed to Admiral Isoroku Yamamoto on any strategy by the Japanese Empire to invade the United States during the Second World War, because of the Second Amendment (source)

Law and Order Policy

Following the dissolution of the Union Wales would be an independent nation, but would also inherit English Law, that restricted the Laws of Hywel and the old Welsh Law since the Rhuddlan Statute of 1284, would have the choice of adopting and adapting Welsh Law from English Law, or return to the primitive laws to control crime and retribution. Indeed, modern state prisons are another symptom of Parliamentary centralisation with a central bank printing press creating an ineffective and bureaucratic justice system, to penalise criminals on the taxpayer’s purse rather than the old order of compensation and the indentured servitude of the criminal to his/her victim. For examples, Galanas was an inter-family compensation law for murder and common to the Celts and Anglo-Saxons, as was Sarhad for physical slight or libel. Whichever way the cookie crumbles, in a future of decentralisation and in a financial order where it is easy to evade central government taxation and starve the legal system, will inevitably localise Law, increasingly financed by Council Taxes, for County Courts and jails.

The biggest side effect of the collapse of the English and Welsh Parliamentary legislative swamps, will be the reduction in administration of the law and starvation of the legal sector

Having dealt with Law comes enforcing Order, that historically was administered by a Sheriff or Policeman. Before the Nineteenth Century, communities would arrange the police to maintain and enforce Order and London’s Government had no direct interference, until the establishment of the first Professional Police in the City of Glasgow in 1800, through a Parliamentary Act. The modern history of police centralisation is synonymous with Robert Peel, establishing the first centrally planned police order in Northern Ireland in 1814, still identified to this day by their nickname “Peelers”. The central planning of professional policing was taken up by Peel as Home Sectretary from 1822, and Peel established the London Metropolitan Police in 1829. Further Parliamentary Acts were passed in the 1830’s to present borough policing, and by the 1850’s nationalised policing was established.

Despite the centralisation of the police as a legal branch of Westminster Parliament, order was enforced locally and on the ground. There was a policeman for every village, who knew his community if not from his community, strengthening the relationship between enforcer and enforced, romantically portrayed in programmes such as Dickson of Dock Green. The reality since the Second World War and the Nationalisation of the British economy is that the number of laws has increased, tying up the police in bureaucracy and paperwork to administrate the Ten Thousand Commandments in back offices, while gutting local policing and the village policeman and disconnection from the ground, reaching its peak in the last few years with Wales down to four regional forces, with political chatter of further centralisation to one Wales Police, as Cardiff’s Senedd eyes more central powers over the rest of Wales.

The four police regions of Wales (source)

As we move into a future of decentralisation and the increasing failure of Parliamentary Acts and Fiscal spending, Law and Order will decentralise towards the old order of local police that is already half funded by local authorites and Council Taxes. It is also possible that local authority failures could lead to further decentralisation, and towards community based law and order, that existed before the last two centuries.

Migration Policy

An imagined Welsh Passport (source)

Migration policy ties into defence and border policy, in the meaning that Wales for the first time would be controlling its borders, and trade and population flows in and out. The traditional method to control immigration and emigration for the last century has been through identification papers or cards, whether a passport or driver licence, in addition to visas with classifications for travelling and tourism, education and study, work and employment, or a permanent visa/legal citizenship. This system is already operational within the United Kingdom, and anyone arriving at Cardiff airport or the sea ports of Holyhead and Fishguard, requires identification documents to enter the Union from Wales.

One of the main purposes of the Union of 1707 between England and Scotland was to expand a Trade Customs Union, and the biggest side effect for migration policy was freedom of movement within the British Isles, and between England, Scotland and Wales. Following the dissolution of the Union that would have to come to an end, the price for Welsh Independence are new restrictions on travel or living in England, Scotland or Northern Ireland, in addition to the existing restrictions in the rest of the world. The reality of devolution is the British population will have to get used to passports and visas between the home nations with significant implications for Britain’s internal demographics, promoting the development of cultural isolationism, and the increase in cultural diversity between the home countries.

Obviously as policing and enforcing hard borders costs resources, so does enforcing migration policy at the costs of a new department of administrators and public sector employment, processing domestic requests for passports and visas to travel or live overseas, and processing requests and issuing visas for tourists, students, workers, or those seeking permanent residence, in addition to enforcers of migration policy in ports, airports, and the border between Wales and England.

Welfare Policy

The card everyone receives on their sixteenth birthday. Welcome to adulthood, the Welfare State and paying taxes! (source)

In the decentralised future described, tax and fiscal policy will shift from inland revenue to customs revenue on imports from abroad, that will have to fund the army, the navy, the air force, and policing the borders of an newly independent country. The coming of Bitcoin and the increase in anonymous peer to peer trade will make it easy for the Welsh to avoid National Insurance, income taxes, value added taxes, and all the other taxes on domestic trade, that will obviously increasingly drain the fiscal spending of the Welsh Government. This will lead to the weakening of Government and its inability to afford the payouts of welfare state dependents, whether a state pension in retirement, to public sector pensions, the National Health Service, and all the promises of a public monopoly since the explosion in the welfare state following the Second World War. As discussed in Part One, the peak of Parliamentary powers came in the late Forties with the Nationalisation of Britain’s energy and heavy industry infrastructure, alongside transportation, health, and the other services that used to be private. The Stagflationary Seventies and the sorry state of Britain under the New Communism brings the country to its knees, the Eighties was the decade of privatisation for energy and heavy industry, for better and worse. The Stagflation of the Twenties of the Twenty First Century will accelerate the collapse and privatisation/localisation of remaining national monopolies over health and other services where there is no competition today, and we must fund with our extortionate taxes.

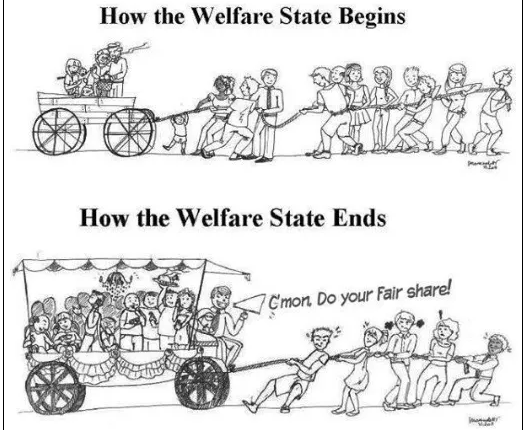

It could be argued that the Welfare State is already unsustainable with the demands of more dependents on less contributors, and a prime cause of the demographic collapse birthing less children to pay into the scam system in the future, only hastening its demise. As the younger generations realise they won’t be receiving state pensions or a reliable health service for their national insurance contributions, they will increasingly avoid it completely by adopting Bitcoin (source)

To close the chapter on any argument that government services are “free”, we only need look at our tax servitude backed by the threats of prison for anyone who tries to avoid them. To take National Insurance first, the current rate of 13.8% on workers from age sixteen onwards as everyone realises when the card comes in the post, as insurance against unemployment, sickness, retirement and death, alongside the basic income tax of 20% for a tax burden of one third of earnings, before adding any of the other taxes. Despite all the hard earned and valuable resources the Welfare State swallows, unemployment, sickness and pension benefits never keep up with the rate of inflation that devours their future value, while the enormous resources thrown into the bottomless pit of the Welfare State go to employ administrators and the bureaucratic sector in the paperwork industry, rather than improving the efficiency of frontline services. In short, as the demands and costs of the welfare state increase, inflation, taxation and the national debt will further squeeze the younger generations, to such an extent that they will choose to avoid by adopting a currency that cannot be inflated or taxed, starving the Welfare State until its collapse under unsustainable forces.

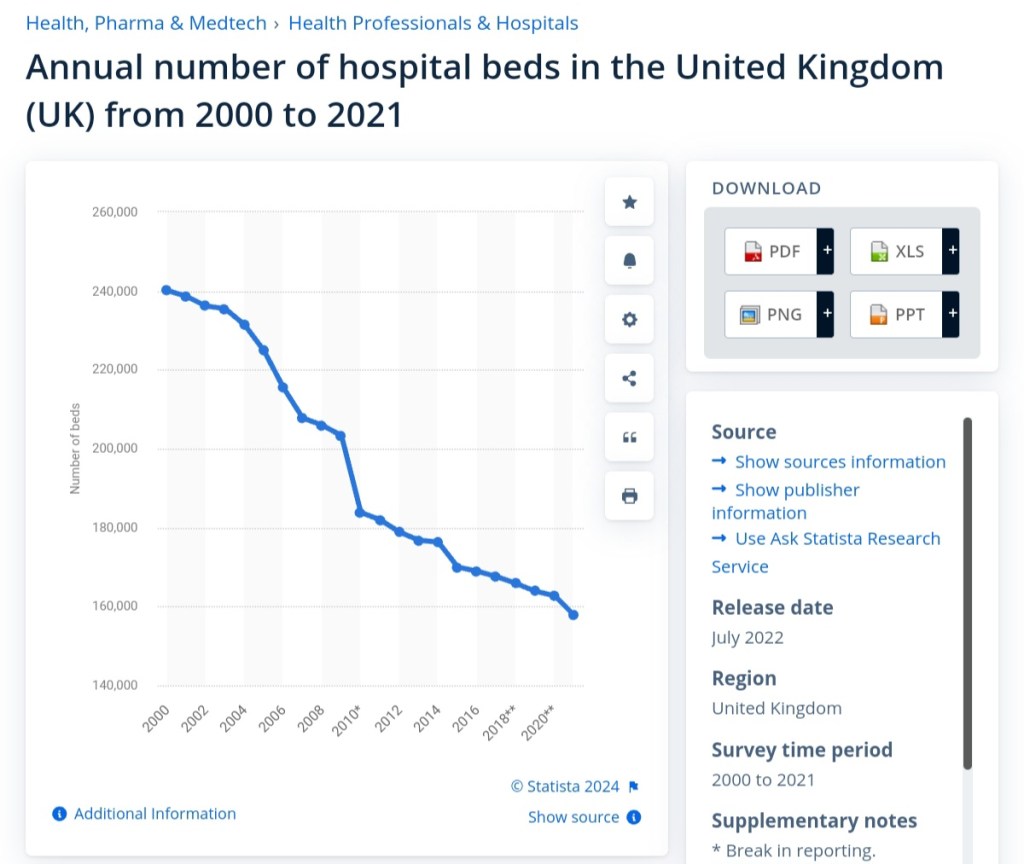

Despite record expenditure of nearly £187 Billion for the National Health Service in the most recent financial year, the sixth largest employer on earth, and the UK’s largest employer with 1.5 million full time jobs, beds for patients have fallen from 240,000 to under 160,000 over the last two decades (source)

If there is no longevity to the Welfare State leviathan as it is today, then what will replace it in the future? The simple answer is to return to the age before the National Insurance Act 1946 and National Health Service Act 1946, re-decentralising and denationalisation/privatisation from central government, and towards private insurance for unemployment, sickness, retirement and death. Avoiding dependence on the Welfare State and National Insurance would save nearly 14% of income, that could be recycled into private insurance against the uncertainties of work, health and life, and is already on the rise in Britain with one in eight Britons, despite paying the Stamp their whole working life, paying to go private for operations and healthcare rather than suffer on years long waiting lists in a public health system. Additionally, the adoption of Bitcoin and deflationary currency increasing in value over time, is a natural insurance to protect individuals and families against the uncertainty of the workplace and life in general, as the costs of living decrease so do the costs of healthcare and retirement as they become more affordable. The movement towards private insurance will also decentralise the healthcare system towards more local hospitals, and the promise of training local doctors and nurses rather than a national health service dependent upon importing third world labour, stealing the best health workers of these countries to work in Britain that hurts the healthcare systems of the developing world.

As volatile as Bitcoin’s price can be day to day, over the last 13 years its annualised returns have been 150% against national currency, and developing into a very valuable insurance (source)

Independence is an easy word to throw around by intellectuals proposing devolving dependence from the Parliament of Westminster to Cardiff’s Senedd, but true and sustainable independence is independence from government, and escaping its inefficient and expensive services. Adoption of a worldwide digital currency at home gains network effects and value from a global scale, while promoting independence from national government and its collapsing currency, that will obviously weaken fiscal spending and the claw of the state over its dependents, transforming the mindset from dependence to independence and freedom.

As national taxes on income and trade will become easier to avoid, avoiding local taxes and council tax will be far harder. A physical house or business are easy targets for taxation, giving local councils the ability to collect taxes and finance their future. On the expenditure list, local authorities already finance County infrastructure such as the police and courts and local order, to services including refuse collection, highway road maintenance, schools, and social services. If county councils were also starved and unable to fund all the fiscal spending above, then these services would demand further decentralisation to the local/parish council, directly funded by users/customers, far cheaper and more efficient to be sure. Even so, the probability is high for County Councils to be able to tax and fund local authority, but priced in bitcoin, the costs of living including council tax will be declining as a percentage of net worth year after year, cushioning the individual and families against the costs of funding local government.

Housing Policy

| Year | House Prices in Pounds | House Prices in Bitcoin |

| 1st January 2013 | £ 163,056 | 14,823 ₿ |

| 1st January 2014 | £ 178,124 | 272 ₿ |

| 1st January 2015 | £ 188,566 | 891 ₿ |

| 1st January 2016 | £ 198,564 | 629 ₿ |

| 1st January 2017 | £ 206,665 | 239 ₿ |

| 1st January 2018 | £ 211,792 | 19 ₿ |

| 1st January 2019 | £ 212,694 | 71 ₿ |

| 1st January 2020 | £ 217,911 | 40 ₿ |

| 1st January 2021 | £ 231,644 | 10 ₿ |

| 1st January 2022 | £ 260,771 | 7 ₿ |

| 1st January 2023 | £ 258,155 | 19 ₿ |

| 1st January 2024 | £260,791 | 7 ₿ |

House prices in pounds, against Bitcoin. Sourced from British Average House Prices, and Bitcoin in Pounds chart

Housing and house prices are a burning topic in Welsh history, from the Stagflationary Seventies and the acceleration of English wealth hoarding second homes in rural Wales, to the arson campaign of Meibion Glyndŵr through the Eighties over North and South West Wales, and the flood of elderly foreigners who have settled here forcing our young people and most valuable resource, to move away in search of work and cheaper housing. Due to the inflation and debasement of Pound Sterling over the last half century, the Cantillon Effect flowing out of the City of London and Westminster Parliament have enabled those closest to the printing presses to hoard cheap property in the areas furthest away from the presses, that have taken houses out of the traditional housing stock and are now second homes or holiday lets for tourists, driving the value of the remaining housing stock higher and out of reach for young locals, forcing them to leave rural Wales to the rest of Britain and the world. The perverse incentives of the inflationary British Pound is to empty rural Britain of its youngsters sucked towards the printing presses of London and secondary cities, to be replaced by the elderly who have profited most from investing in the decades long housing boom and storing their value in property over currency, for obvious reasons.

A smaller Cantillon Effect is playing out within Wales too, following the establishment of the Assembly in Cardiff Bay that is now the Senedd, over the years the money and fiscal spending flowing via Cardiff’s central government have attracted the Welsh rural population down to the big bad city for subsidies and public sector employment, sucking productive and valuable resources out of the countryside and into the big cities of the Union. This whole destructive incentive structure that promotes nationalisation and centralisation while undermining localisation and decentralisation, is derived from national currency and central banking, so it is important to discuss the incentive structure under a competing deflationary currency, in a word, Bitcoin.

The above chart of house prices demonstrates two things: that an ordinary house has risen by nearly £100,000 in the last decade, while that same house has collapsed from 15,000 bitcoins down to under 10. The chart therefore demonstrates how catastrophic Pound Sterling is as a store of value compared to housing, and how catastrophic housing is as a store of value compared to Bitcoin. Indeed, defeating the inflationary forces of the British Pound and superceding it with Bitcoin and its deflationary forces is going to turn the price discovery system upside down, with massive implications for the relationship between capital and labour, and between young and old.

Under inflation, it is the value of labour that is debased through the purchasing power as the value of capital increases, acting as a subsidy for hoarders and the older generations at the expense of penalising labour and the younger generations, driving a capital affordability crisis that increasingly destabilises society, and releasing dangerous tensions between the minority who own property, and the majority who do not. Under deflation this relationship is flipped to the opposite, as labour stored in money (bitcoin) devalues capital making it more affordable for the young to become property owners. Deflation is also an effective penalty or tax on capital and the older generations that will be adopting Bitcoin last, but Bitcoin will incentivise housing and capital hoarders to sell their properties to invest in a better store of value, distributing property more equitably between old and young, stabilising society as more of society become property owners and defenders of private property, at the expense of the rental sector, holiday lets, second homes, and the tourism industry.

A further detailed essay will be published on the Affordable Housing Crisis on welshmoney.blog in the future, on this burning subject.

Education Policy

In earlier times due to the limitations of communication and travelling, education tended to centralise in institutions of learning, evolving from the rare universities of the middle ages to the development of primary, secondary, and college education over the centuries and centralised by Parliamentary Acts, towards a national education system, and even worse, a National Curriculum. It doesn’t take long to imagine why Politicians and government regulators would yearn for central control of national education, for standardising subjects and education methods for Britishising and Nationalising the next generation, and tame as much as possible for their future as a cog in the machine maintaining the Union. Pupils can also be tested and examined with the information included in the national curriculum to identify potential and intelligence, so that they will leave home for the University Cities of Britain, with a good chance they will not return to enrich communities, but sucked closer to the jobs and money of the British State. Further long term damage was wreaked by the fantasies of Tony Bliar and New Labour at the turn of the millennium to send too many of the young to universities and into debt, to compete for made up jobs created in the public and bureaucratic sector, and for degrees in fields (especially the humanities), where there were never enough jobs or an industry could sustain.

The coming of the internet and a decentralised mode of communication, information sharing and education, is already undermining the education system that is yet to fully play out, the next decades will see the loss of control of central government over education spending and the collapse of the national curriculum, alongside public sector unemployment as education privatises and decentralises to local authorities and taxes, and/or voluntary payment for child and adult education locally. Despite the disruptive powers of the internet over the traditional education system, the schools and buildings will still exist over Wales, to be repurposed for the more realistic education requirements of a future Wales, in local education for children and adults, career education for training skills for the jobs and sectors on the ground, in agriculture, construction, engineering and industry, night classes for adults, etc. This will enable local eeducation from the ground up and for keeping the young at home to enrich the community, rather than education as a tool to suck the gifted out of their local communities towards the monetary printing presses of Welsh cities and public sector employment.

Transport Policy

The roads are as old as humanity, having started as local transport networks to allow moving around and trade, over the centuries the movement was toward centralisation in Parliamentary hands, to pick the winners and losers in the wars between merchants for faster methods of transport. Centralised transportation infrastructure began with the canals in the middle of the industrial revolution, via Acts of Parliament came the Canal Mania between the 1790’s and 1810’s, but soon enough Westminster would abandon the canals for railways and faster transport technology over Britain, by investing in railway companies and feeding the Railway Mania of the early 1840’s as covered in Part One. Railway supremacy lasted a near century, until the invention of the motor car at the beginning of the Twentieth Century. Following the Second World War and the 1947 Transport Act that nationalised the highways, railways, canals, ports, and even bus and lorry companies for a short period, British transport infrastructure came directly into the hands of Westminster politicians.

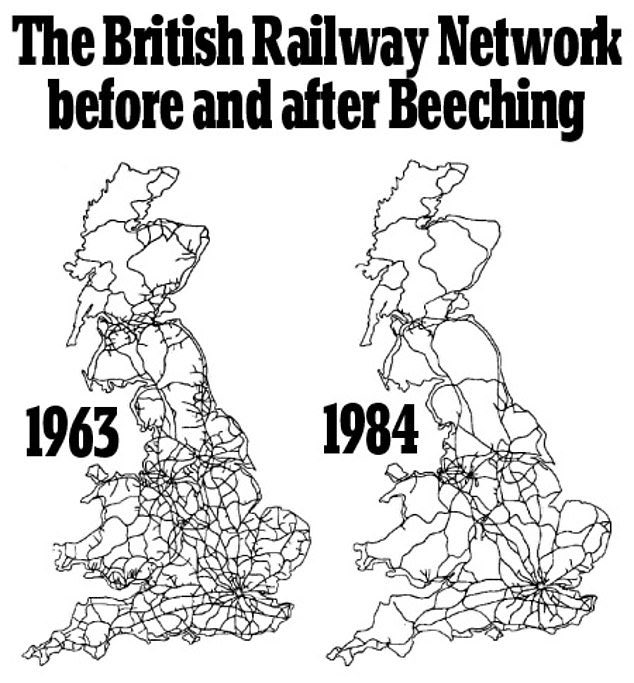

With the Beeching Cuts in the Sixties, railways and trains in rural areas suffer due to the shift of Parliament towards motorways and cars (source)

After the Second World War the British government decides to prioritise roads over railways, and following the German development of the Autobahn from the 30’s, in 1949 came the Special Roads Act, and the beginning of the motorways with the official opening of the M1 in 1959. Subsidising the roads under the relentless lobbying of the car industry, came at the expense of gutting the railway network of rural Britain alongside public transport, the last half century has witnessed the nationalising of motorways and dual carriageways and the opening up of Britain by car, undermining local economies and their independence, for the benefit of national dependence upon agricultural and industrial networks.

As the trend of tax losses hurts central planning and undemines Westminster Parliament and Cardiff Senedd spending in a decentralised future, it will also starve the ability of National Government to continue their spending on roads and motorways to rip up the countryside further, we are likely close to the peak of new road building, and the future will therefore be a matter of financing and maintaining the present highway and motoway network, either via tolls or Council taxes and decentralising the maintenanve of roads to local councils. The same will be true for the railways, and with the failure of central government it is possible to ressurect private and voluntary railways, as is already happening with old railways being rebuilt and reopened by volunteers and enthusiasts recently, following the cuts of Beeching. Decentralisation could also radically change Britain’s flying infrastructure, and the movement away from huge central airport hubs such as Manchester and London, toward a network infrastructure of smaller local airports, making domestic and international travel far more convenient for rural populations.

Agricultural Policy

There is nothing more essential to an independent future for any country, than the industry that produces our food (source)

A prosperous agricultural sector rests on two main pillars, outside of monetary policy as the foundation of the future, in energy policy and toll/tariff policy. As a National Government should at least consider subsidising cheap and reliable energy to increase productivity and domestic production, it can also be argued strongly for subsidising agriculture as a part of national security for feeding the Country. The disadvantages of direct subsidies is creating agricultural dependence on government and its paperwork industry, which also enables half witted politicians to force their destructive bureaucratic policies and insane climate regulations to centrally plan agriculture, determining what farmers can grow and not grow. Rather than direct subsidies, and for the benefit of agricultural independence from politicians and the state, indirect subsidies could include Energy Policy for producing cheap electricity and fuel to the Welsh agricultural sector increasing their competitiveness compared to other countries, and enriching farmers directly. A balance of trade would also have to be ran with the rest of the world’s agricultural sectors and reciprocative tariffs with external nations, rather than the chronic trade deficits the British Government runs today with Europe’s agricultural sector and some of the Commonwealth countries, allowing a flow of cheap foreign food from the Continent to undermine the food prices and values for British farmers.

More than anything, adopting a decentralised and deflationary currency like Bitcoin will increase the value of money and the savings of Welsh farmers, enabling reinvestment into farms and starve the debts of farms that today work for the bank and debt serfdom for life, and hostages to Bank of England interest rate policy driving poverty, depression and suicide among British farmers.

As we see with increasing agricultural protests exploding through Britain and the European Continent in the last year, Western authorities will learn the lesson of pissing off farmers. Farming independent of central government regulation is a cornerstone of Welsh Independence

Industrial Policy

As goes the agricultural sector, so goes the industrial sector. For Welsh industry to thrive, cheap energy is a critical foundation alongside a balance of trade and reciprocative tariffs to compete with foreign imports, and again a matter of National Security, for producing ores, metals, supply chains, and domestic machinery to avoid dependence. Central government failure will also lift many of the national regulatory and environmental restrictions, allowing the decentralisation and localising of Welsh industry, promoting diversity and competition, creating local and self sustaining employment.

Language Policy

Language policy flows downstream from all the policies discussed above, for keeping Welsh speakers in their communities and environment, rather than being sucked away towards Britain’s cities and the English language. We have already discussed how monetary policy and the Cantillon Effect of the Pound attracts Welsh speakers towards London’s printing press, the present educational system that empties rural Wales of its best and brightest towards the education system and public sector employment of the Union, our catastrophic energy policy hollowing out small and local industries and employment in Welsh agriculture, and the housing affordability crisis where the old outcompete the young and send them away from home. All the policies of the Welsh Government to promote Welsh in schools and within the public sector, are not going to correct the trend of the dying of the Welsh language in its West Wales hearlands and on the ground, and the language will continue to die as long as this present system survives.

The only strategy therefore for keeping the Welsh language alive in the heartlands and a ressurection in non-Welsh speaking areas, is in isolating ourselves from Britain and develop an inward independent country with its own culture and language. In a decentralised future where Bitcoin replaces the Pound as our financial and accounting foundation, deflation will consume inflation and the taxes and regulations of Westminster and Cardiff, destroy the education matrix that sucks young people towards universities and the cities, and collapse house prices making them affordable for the young and indigenous to remain at home, raising the families and Welsh speakers of the future.

Conclusion

The purpose of this essay is to share ideas and stimulate thought, based on the past, present and future of Wales. The study of Welsh history was essential to understand where we have come from, and the most important events that have influenced our past. The study of the present is essential for today, to the crossroad we have reached and what realistic choices we have in the years to follow, as historical continental trends move away from established old orders, to new orders slowly establishing. The study of the future is theoretical, describing what is possible and probable as the new order establishes and expands.

We are in an extremely interesting and exciting period in Welsh history, and the world more generally. After five centuries of monetary and political centralisation since our unfortunate Protestant Reformation following the invention of the paper printing press, it could be argued centralisation peaked either following the Second World War or at the end of the Seventies, but the Nineties and privatisation of the internet was the beginning of the multi-decade decentralisation trend, starting with communication. In the last three decades we have moved into a digital life, for better and worse, collapsing the cost of communication to nearly free, and a radically altered relationship with our political elites, now realising the reactionary forces of the internet against their dreams of centralising and controlling the future and further destruction of the nation.

Following the disruption of communication and education, the next digital frontier of disruption was trade and the slow but steady move toward e-commerce, that has certainly disrupted traditional high street shopping and also dragged the banks and tax authorities into the new digital world. It is safe to disclose that our political elites and banking system are now as addicted as the general population and the private sector to a digital future, as we see today with the manic censorship of the old order fearing losing their monopoly over their subjects. The biggest remaining monopoly, and the last to be disrupted that will turn the whole world upside down, is the monopoly of national currencies over trade and the debasement of commerce through inflation and taxation.

The final frontier for the internet in decentralising the world to its utmost, is monetary competition by competitors of the internet age, culminating in the invention of a decentralised accounting system, digital and native to the internet, solving the Byzantine General’s Problem that was the fatal weakness of the old digital age, requiring centralised custody and enslaving to one point of failure. Since Satoshi’s solving of the problem, all of a sudden a decentralised system is not only possible, but a reality that will continue to consume and swallow the centralised systems we have spent the last centuries imprisoned within, since 2009 Bitcoin has grown to international scale serving tens of millions of people all over the world, and future adoption to hundreds of millions, before billions of users.

As we approach Bitcoin’s sixteenth birthday, we are entering the age when Bitcoin moves from the private sector to the public sector, forcing Countries to adopt Bitcoin as capital/collateral and store of value in National Treasuries and mining bitcoin with nationalised electricity, that will explode national competition for securing the welfare of their domestic populations, with the movement towards legalising and exempting Bitcoin from taxes. With Bitcoin’s decentralising forces operating on a national level, will accelerate and cushion the process of decapitating International Monetary Unions, and an all important foundation for the explosion in small and newly independent nations of the Twenty First Century, including Wales. As a part of Welsh Independence, Bitcoin will also destroy the taxation and fiscal spending of the Cardiff Senedd, weakening the control and socialist claw of Welsh Labour over Wales that has defined the last century of our Nation, liberating us for a future of local, self sufficient flourishing.

The next decades promises amazing changes for us all!

Bitcoin donations gratefully accepted:

bc1q49a3y9anq3a2pjqvq3gm8wj8aqqld3pnva9phwna2ftdar73mf3qak275j

Gadael sylw

Ysgrifennwch sylw…