In the depths of the Covid Pandemic, the decentralised future illuminates upon the Bank of England, the foundation of the Union through the British Pound since 1694 (source)

Introduction

Part One of the essay will deal with the Past, the history of Wales as an independent Nation from Roman roots, the evolution through the Middle Ages and Gwynedd’s supremacy over the rest of Wales, up to the Acts of Union with England in 1535 and 1542 under the reign of Henry VIII, bringing to an end the Catholic and Feudal order as Wales suffers its Protestant Reformation and the multi century process of Anglicising and Britainisation of the Welsh. The essay will discuss the all important role of the British Pound, particularly since the founding of the Bank of England, imprisoning the peoples of Britain in a common Currency and Customs Union, and a monumental subsidy to enrich London and the South East of England at the expense of impoverishing the North and Midlands of England, Scotland and Wales.

Part Two of the essay will deal with the Present, and the probabilities of an independent Welsh future based on monetary systems, exploring three different options: joining the EU and Euro, breaking the Union and inventing a new Welsh Pound and monetary system, or adopting a new worldwide monetary/accounting standard in Bitcoin, before demonstrating Bitcoin as the most likely choice for breaking the Union and reversing the last five century trend of increasing centralisation and interference by London Parliamentarians and the British Government over its subjects.

Part Three will discuss the Future and Independence Strategy, encompassing Monetary Policy, Taxes and Tariffs Policy, Energy Policy, Defence, Migration, Welfare, Education, Agriculture, Agriculture, and Language, highlighting the incentive structures adopting deflationary currency will drive for strengthening Welsh Independence against Government and Cardiff Senators, and the Labour Party in Wales.

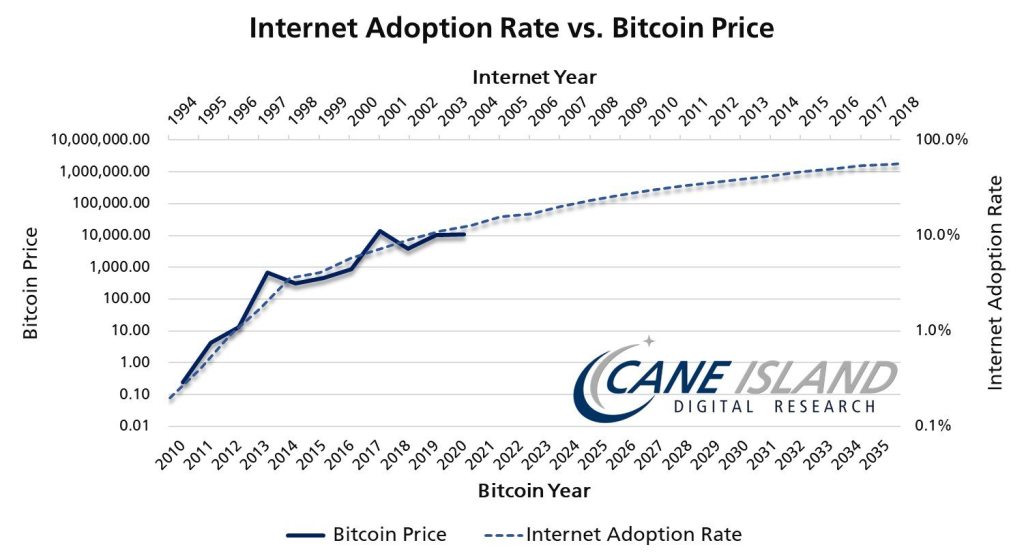

As we move further into the digital future that originated with the Internet in 1994, and has accelerated since the invention of Bitcoin and internet native money since 2009, the Twenties of the Twenty First Century will see further decentralisation of information and communication alongside the growth of digital money outside the control of governments, undermining government influence over our lives and encouraging the movement of individual, family and community sovereignty, in rebuilding a flourishing Wales from the ground up. An exciting but cathartic next decade is ahead of us!

Following the publication of this essay, the Three Parts will be published on welshmoney.blog as independent and standalone essays, to be read or dissected separately.

PART ONE: PAST

History of Wales as a Nation

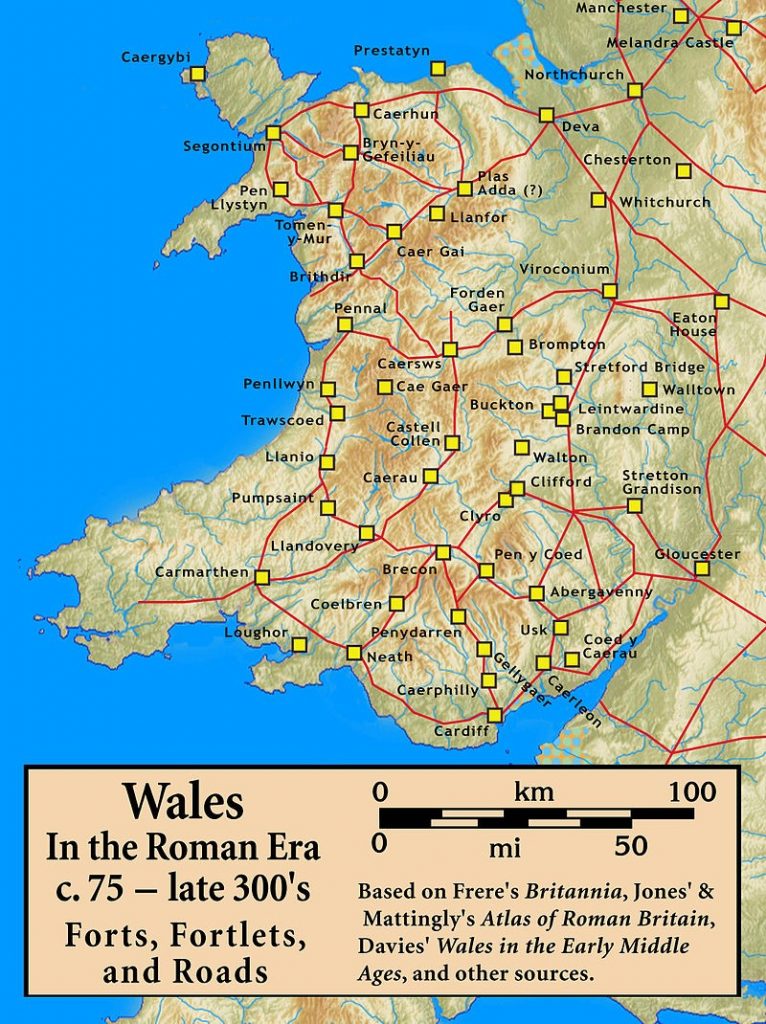

Roman Wales at the end of the Fourth Century (source)

While archaelogical evidence of people in Wales originates around 9,000 year ago, the history of Wales as a Nation is inextricably linked to the Romans following the conquering of Wales in 43 BC, in the reign of Julius Caesar. The Romans remain in Wales and Britain for over three Centuries and until the Year 383, when the slow motion demolition of the Empire on the Continent leads to their gradual withdrawal.

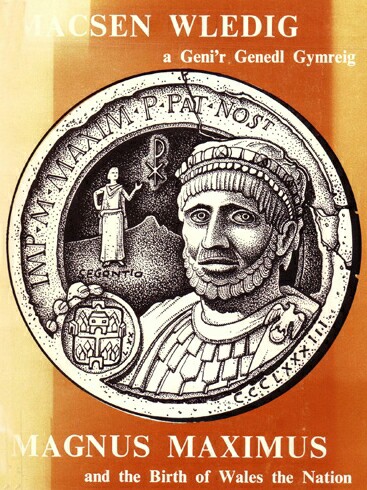

The Dream of Macsen Wledig Legend (source)

The establishment of Wales as a Nation is linked to the legend and mythology of the real life Magnus Maximus, the late stage Western Roman Emperor between 383 and 388, and the families of the Kings and Princes of Wales during the Middle Ages claim these Roman roots and lineage.

The Early Middle Ages (5th to 10th Century)

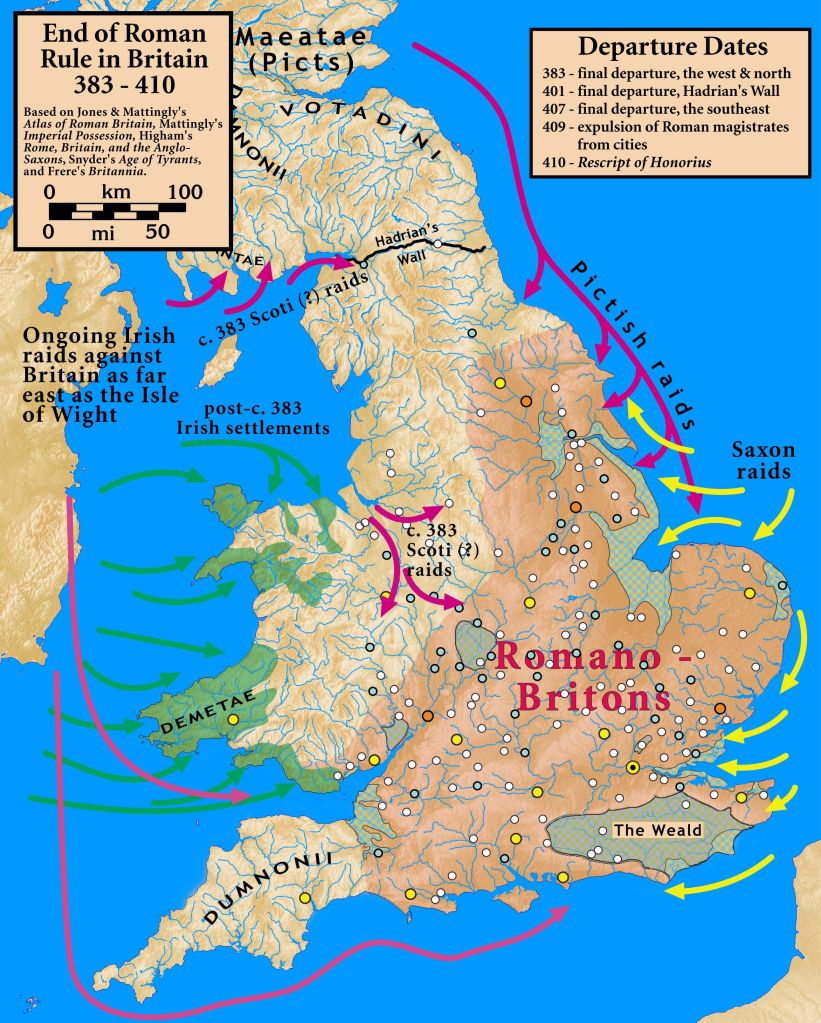

The decentralisation of the British Isles following Roman Departure (source)

Rome finally departs in the Year 410, leaving numerous regions controlling themselves distributing centralised power. Under the Romans the Welsh are already connected to Christianity, and the Age of the Saints lasts nearly three centuries from 400 AD to 700 AD, establishing churches and monasteries throughout Wales, through pioneers in Saint David, Illtud and Teilo.

The British Isles of the Seventh Century (source)

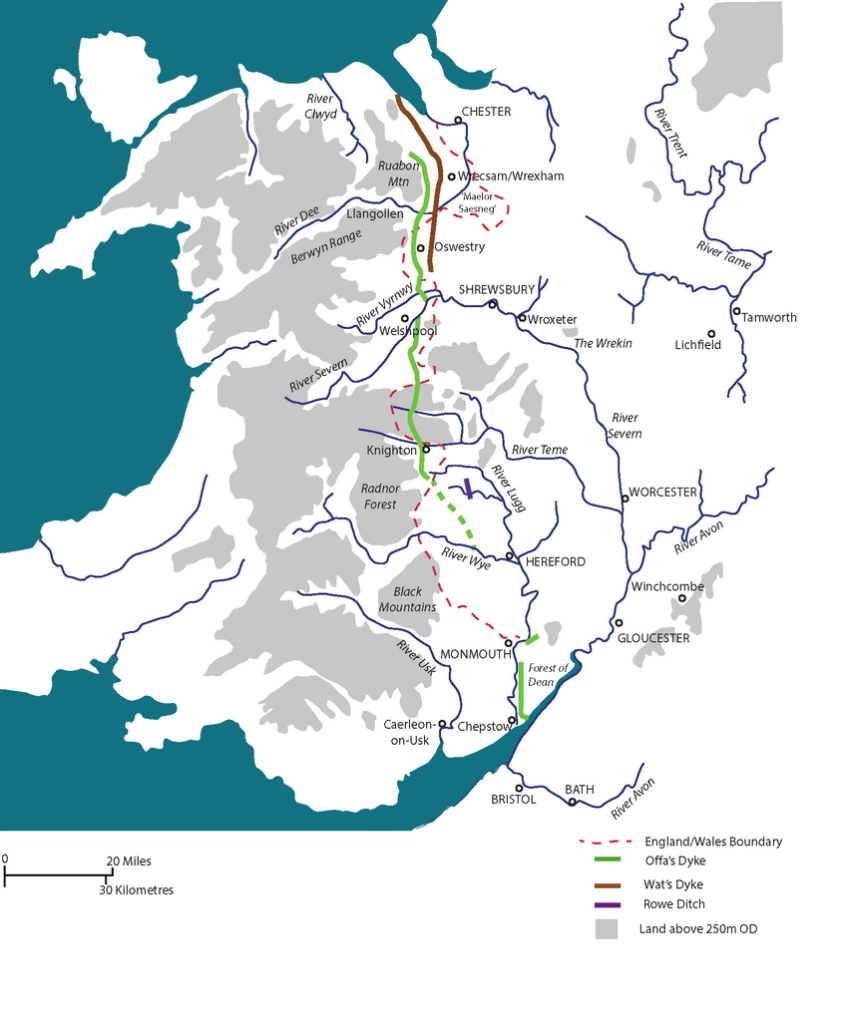

Roman departure encourages the Continental Saxons to invade and settle in the South East of England, and the Angles in the North East, over the Seventh Century the Britons lose the territory of England, and the Brythonic disconnection of Wales, Cornwall and the Old North.

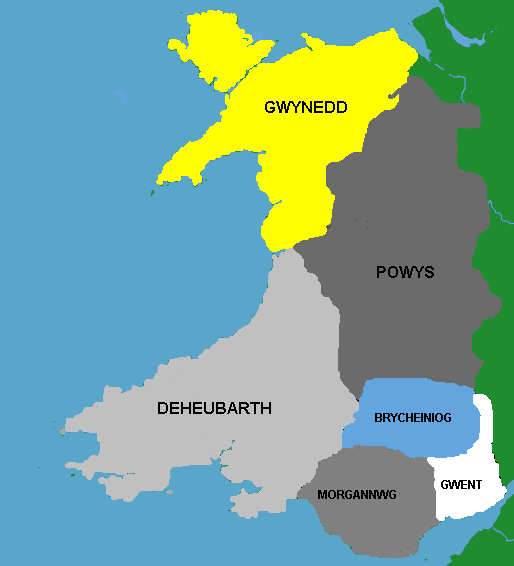

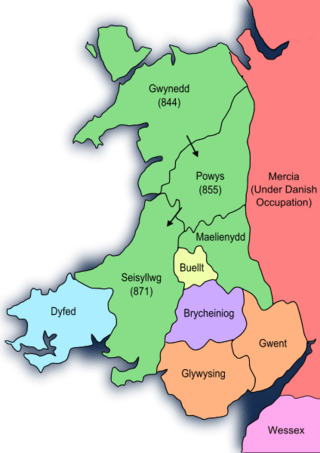

Early Welsh Kingdoms (source)

Within Wales there is a distribution of Kingdoms, the largest being Gwynedd in the North West and Powys in the East, because of the geography of Powys on the border with Mercia and their defensive battling against the English, ensures the supremacy of Gwynedd as the strongest Kingdom by the 8th Century. Despite Gwynedd’s fortitude, it is very difficult to unify Wales during this period because of the nature of Celtic Law that divided property and kingdoms between all sons, rather than Anglo-Saxon Law and the usual inheritance by the eldest son. The result is advantageous for the distribution of powers within Wales, but also at a disadvantage in weakening Wales as a defensive force against an united and more centrally controlled England.

Gwynedd expands under the reign of Rhodri the Great (source)

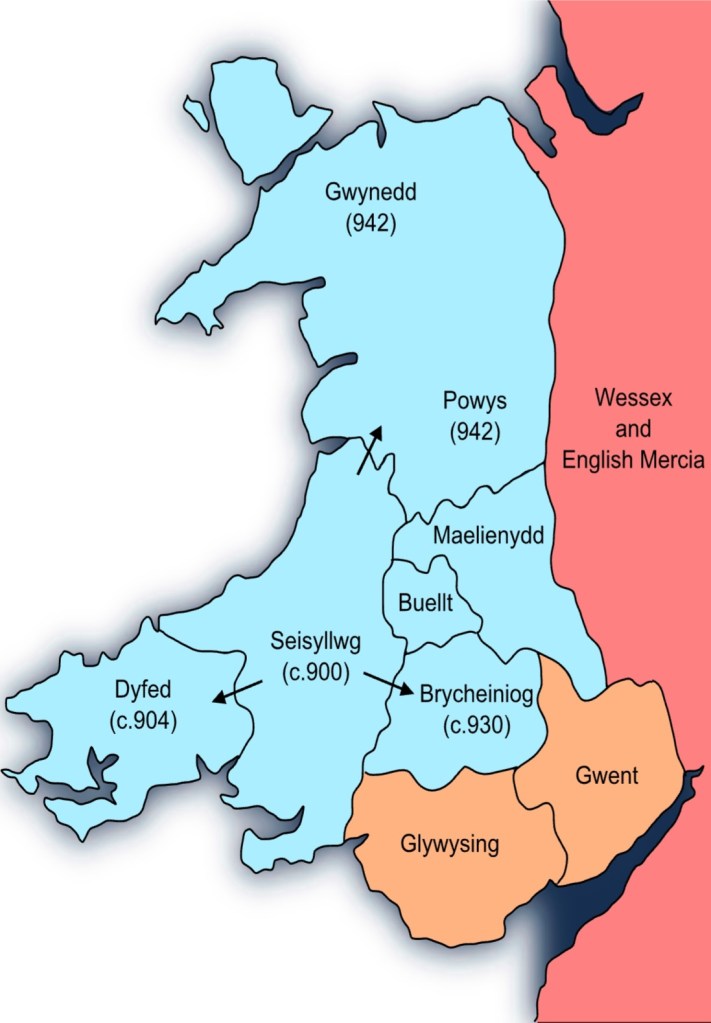

The Ninth Century sees the rise of Rhodri the Great King of Gwynedd, who also comes to rule Powys and Ceredigion. His Grandson, Hywel Dda (Howell the Good) would create the Kingdom of Deheubarth and standardise Welsh Law, aka The Laws of Hywel, and negotiates peace with England. After the death of Hywel in 949, Gwynedd breaks away from the Kingdom.

Wales is nearly unified under the reign of Hywel Dda (Source)

Late Middle Ages (11th to 15th Centuries)

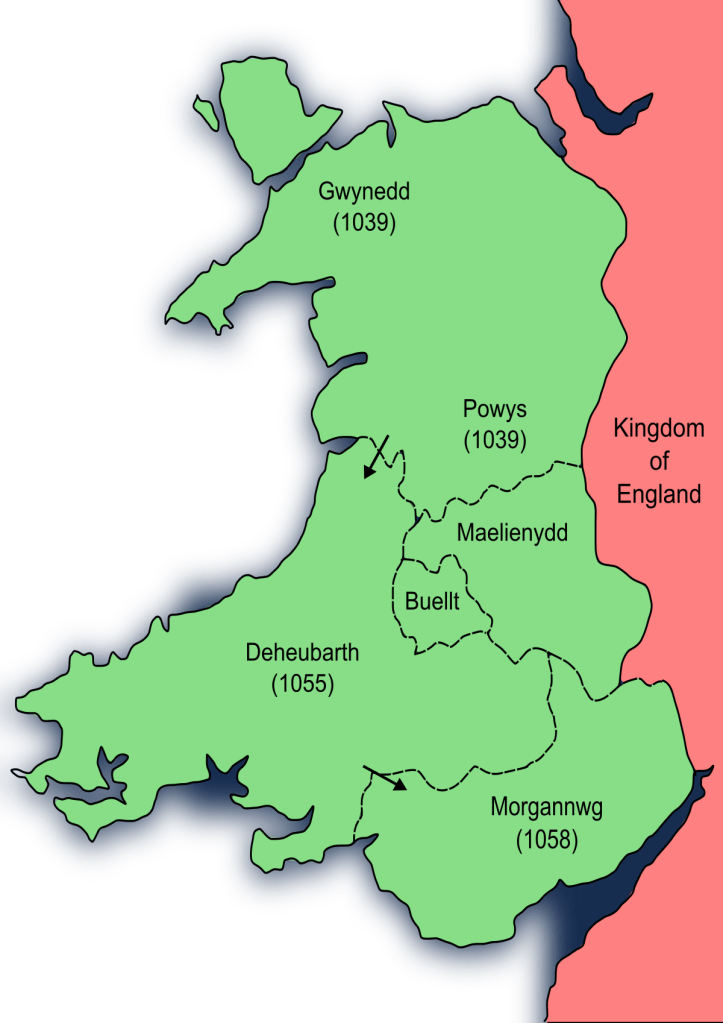

Wales is unified for seven years under the reign of Gruffudd ap Llywelyn (Source)

The only king to unify Wales is Gruffudd ap Llywelyn, who also defeats English armies winning territory from England, but only for a period of seven years between 1055 a 1063. Llywelyn is killed in 1063 by his internal enemies, after defeat by the last Anglo-Saxon king in Harold Godwinson, Wales again distributes into diverse kingdoms at the worst possible time.

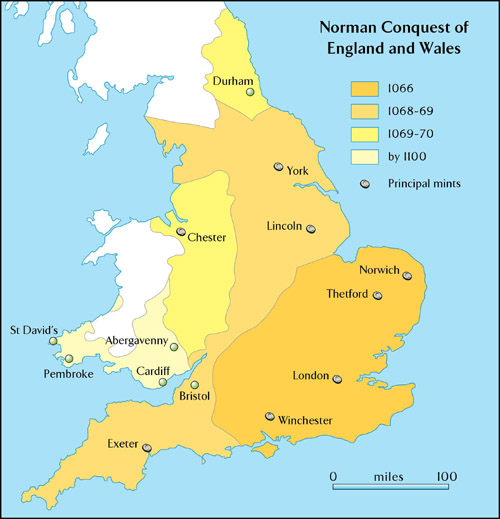

The Norman Invasion (source)

Wales suffers greatly from the Norman Invasion from 1066, and is conquered largely in its weakness, despite periodic counter-warfare in defence of Gwynedd and Deheubarth.

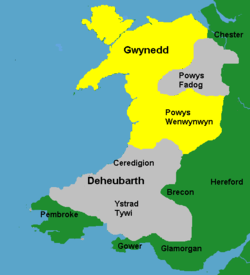

The rough borders of Wales in the Year 1217 (source)

Gwynedd again rises to prominence in the Thirteenth Century, with Llywelyn ab Iorwerth (Llywelyn the Great) Prince of Wales in 1195, and by his death in 1240 ruled most of Wales.

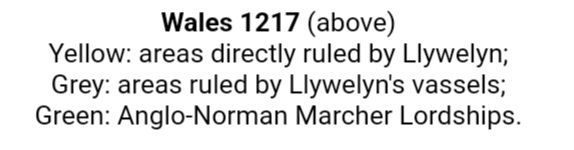

Welsh borders following the Treaty of Montgomery (source)

After a period of internecine squabbling, would see the rise of Llywelyn ap Gruffudd (Llywelyn The Last), grandson of Llywelyn The Great and the last true Prince of Wales negotiating the Treaty of Montgomery in 1267 with King Henry III of England, which unfortunately would not last long. The death of Henry and the crowning of Edward I (longshanks) would end with Llywelyn being deceived, ambushed and killed during a battle in Cilmeri in 1282.

The Ring of Iron – nine castles built at the command of Edward I to conquer and passify Gwynedd (source)

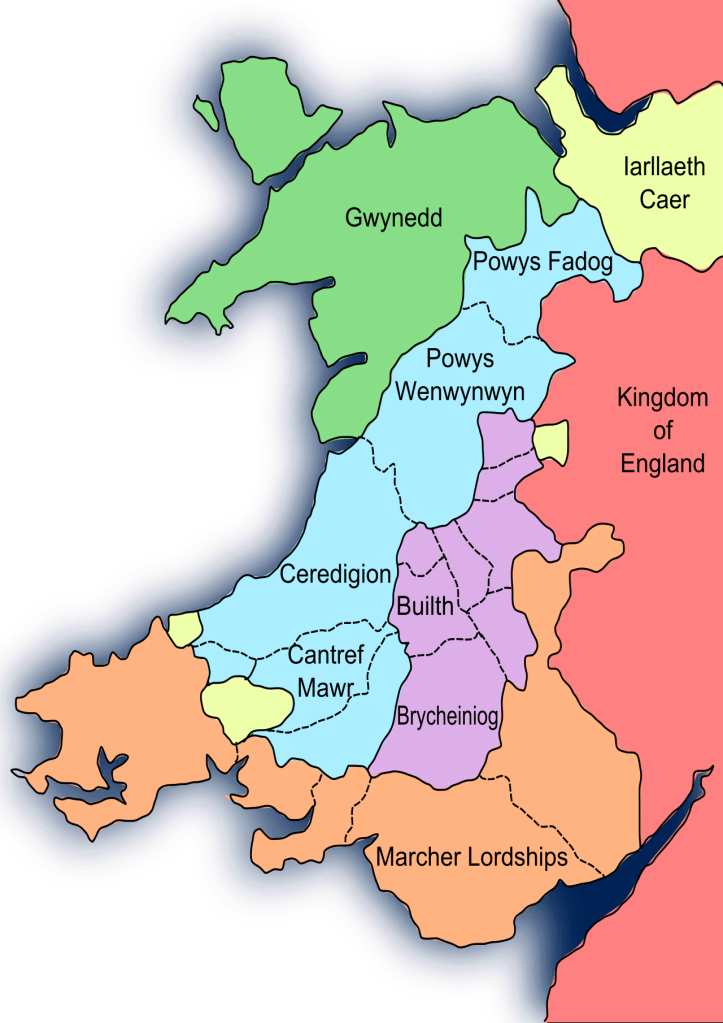

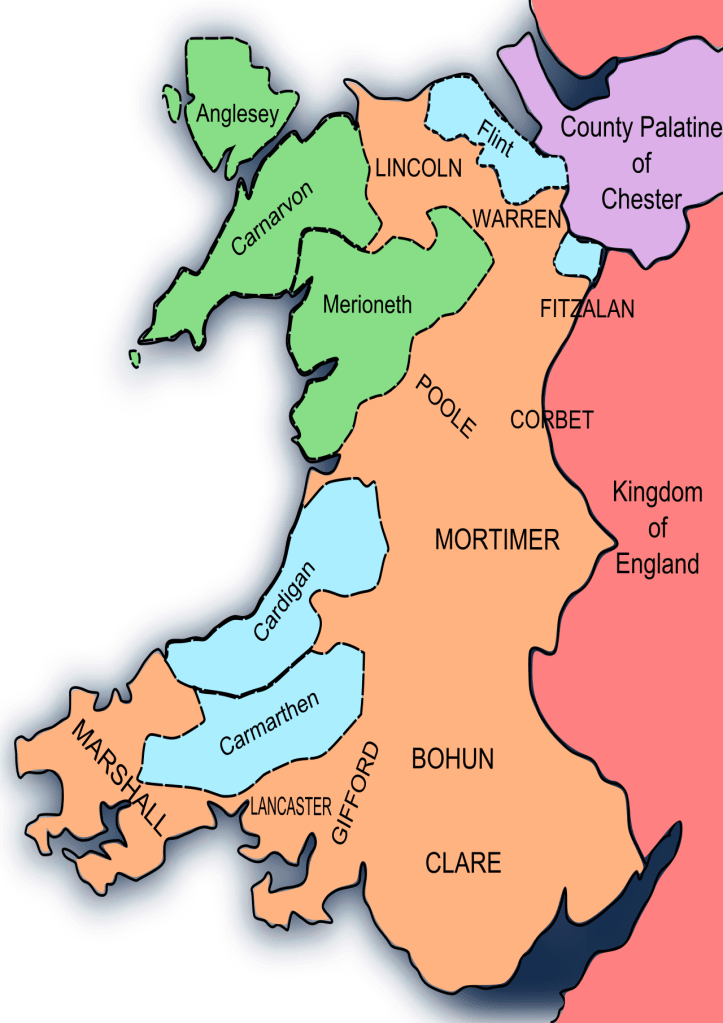

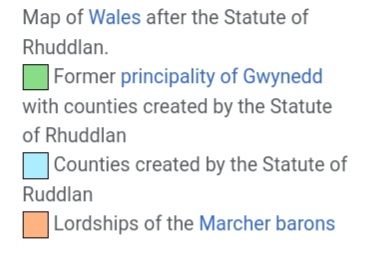

It is Edward I that ends Welsh independence and the stronghold of Gwynedd, and erecting a network of castles over North Wales to maintain control. He also decrees the Rhuddlan Statute of 1284, impinging upon the Laws of Hywel and a Constitutional change in absorbing the Welsh Principality under English Crown and Law. Longshanks crowns his conquering of Wales by making his son the first English Prince of Wales, and ever since 1301 the eldest son of the King of England has been invested Prince of Wales.

Welsh borders following the Rhuddlan Statute of 1284 (source)

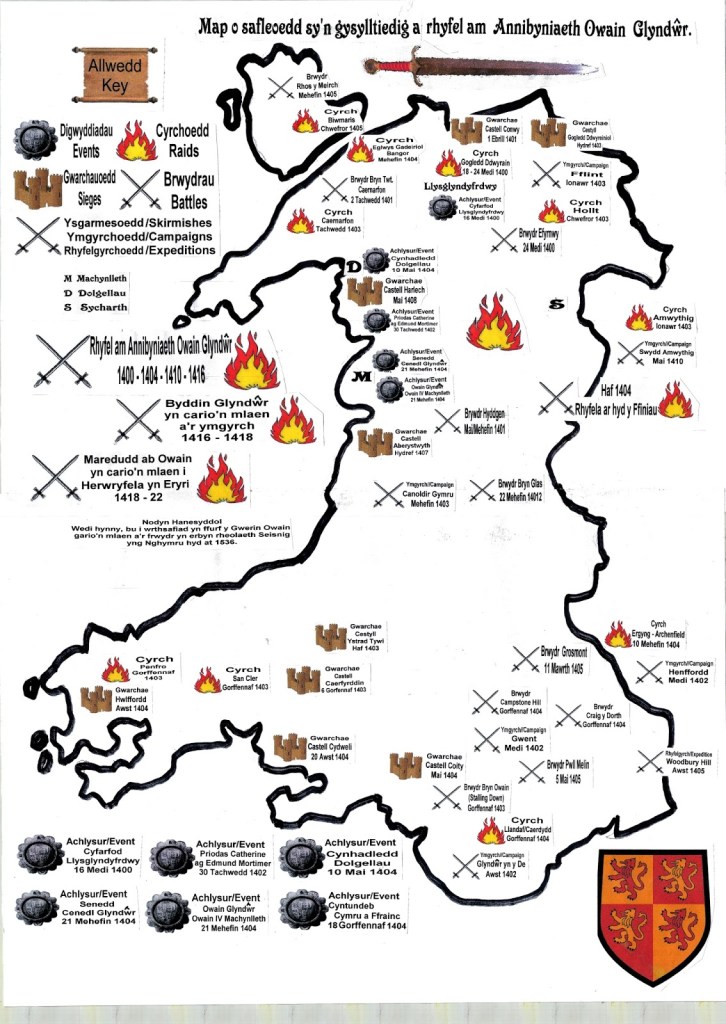

Despite the end of the lineage of Gwynedd Princes with the murder of Owain Lawgoch by an English assassin in 1378, a self inheriting noble named Owain Glyndŵr rises to prominence defeating the English in a few battles, and for a short period rules Wales with the support of most of the Welsh. Owain establishes the first Welsh Assembly in Machynlleth, and plans for two Welsh Universities. Alas, the English eventually re-establish order, and Owain disappears into the shadows.

The fifteen year campaign of the “The Destined Son” against the English Crown (source)

With the beginning of Glyndŵr’s campaign, the English Parliament pass the Penal Laws of 1402, forbidding the Welsh from bearing arms, public office, or buying property in English buroughs, even though these laws would be inconsistently applied for the next century and a half.

Wales plays a prominent part in the Wars of the Roses between the Houses of York and Lancaster, in a three decade civil war over the English Crown, beginning in 1455.

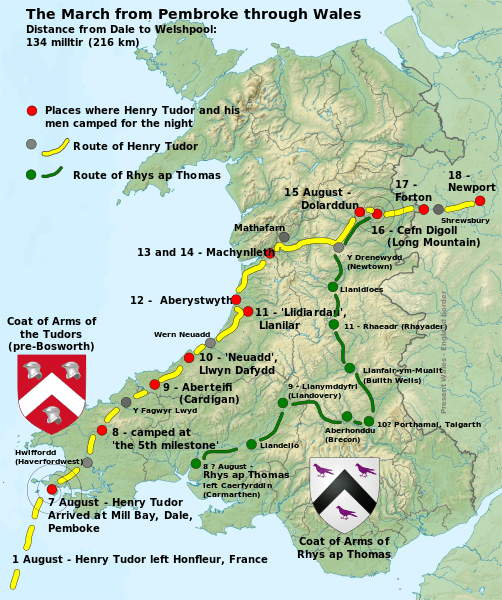

The journey of Henry Tudor from Pembroke to the English Crown, in August 1485 (source)

In 1485 Henry Tudor, of Welsh ancestry and claiming lineage from Welsh Princes such as Rhys ap Gruffydd, lands his army in Pembroke to battle for the Crown of England, with much support inside Wales. Henry’s armies defeat the forces of Richard III in the Battle of Bosworth including many Welshmen, and according to eye witnesses in Guto’r Glyn and Tudur Aled, it was Rhys ap Thomas that killed Richard. Victory promotes Henry to King of England, as Henry VII.

The Protestant Reformation

A thousand years of monastic and Catholic culture is sabotaged by a single madman (source)

We reach Henry VIII, the king that destroys the last millennium of English and Welsh history as Catholic countries, and the centrepoint of the Protestant Reformation in Britain. His divorce in search of a male heir leads to the creation of his own Church, the Church of England and Anglicanism, by stealing and destroying churches, desecrating the altars of saints, and dissolution of the monasteries of the “Old Religion’” over England and Wales. As the first king to weaponise Parliamentary powers against his enemies, and via the vandalism of Chief Minister Thomas Cromwell, the tradition of the monks end between 1536 and 1541. Henry is the first king to invade Ireland to undermine Catholic Ireland, following the Crown of Ireland Act 1542.

More importantly for Wales, Henry unifies Wales with England via the Laws in Wales Acts 1535 and 1542, extinguishing the remnants of Welsh Law and the Laws of Hywel, subjecting Wales to English Law. The Welsh Language is prohibited in official role or status, and for the first time the border between Wales and England becomes official, with the Shire/County system spread throughout Wales, for the first time giving Wales representation and Members of Parliament in London’s Westminster.

New Shire administrative order for Wales following the Acts of Union. One Member of Parliament for every Shire/County (source)

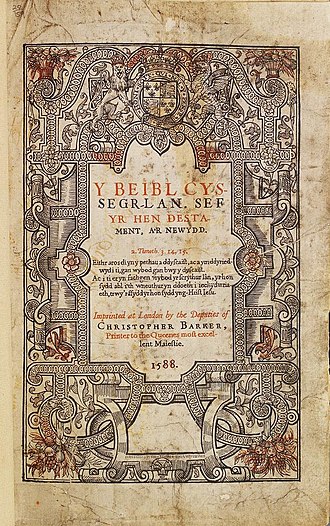

Following the vandalism of Henry VIII, Wales treads English footsteps into Protestantism and Anglicanism, with the publishing of William Morgan‘s Welsh Bible in 1588. The Bible standardises the Welsh Language and the dialects of North and South Wales, and the use of the Bible keeps the Welsh Language alive as an oral and religious language, against the creeping strength of the English Language in Wales.

Wiliam Morgan’s Bible and the main reason Welsh is still alive as a language today (source)

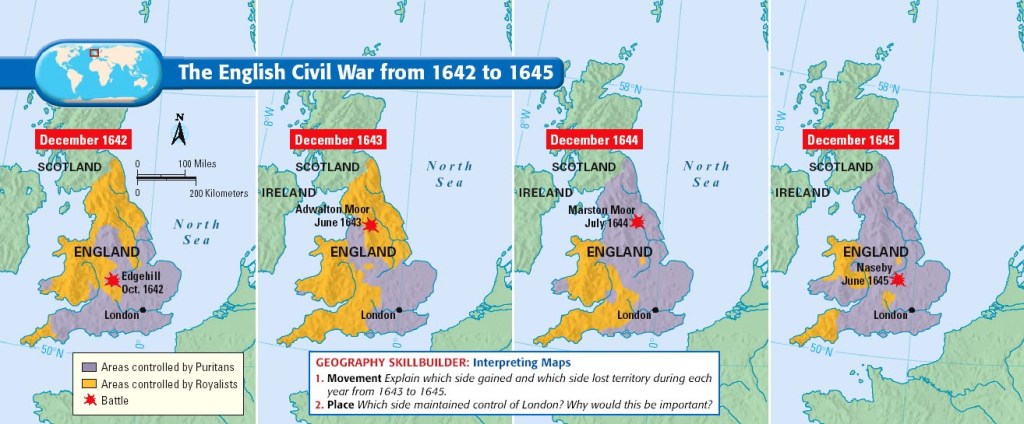

The Civil War – The Parliament versus the King

Wales predominantly supports the Monarchy in the Wars of the Three Kingdoms (England, Scotland and Ireland) between 1639 and 1651 against London’s Parliament, and many Welsh soldiers would fight in the armies of Charles I. After succeeding in the Civil War, Parliament publicly chops off the head of Charles I in 1649, and England (and Wales) begins the experiment as a Republic or Commonwealth. The history of Oliver Cromwell and the Roundheads are especially bloody for Britain and Ireland, persecuting Catholics and supporters of the Monarchy.

Wales remains monarchist on the whole despite Oliver Cromwell’s Welsh ancestry, and supporters like his brother in law John Jones, Maesygarnedd Member of Parliament for Meirionnydd and one of 59 signatures on the death warrant of Charles I, and the poet and author Morgan Llwyd (source)

Following the death of Cromwell there is a Restoration of the Monarchy in 1660, but tensions remain between Stuart Kings and Parliament culminating in 1688 with the Glorious Revolution, the deposition of Catholic King James II (VII) and imposition of Protestant King William III of Orange, with heavy Parliamentary backing. Catholics are forbidden from the throne under the Act of Settlement 1701, and Protestantism (and Parliament) takes over Britain once and for all.

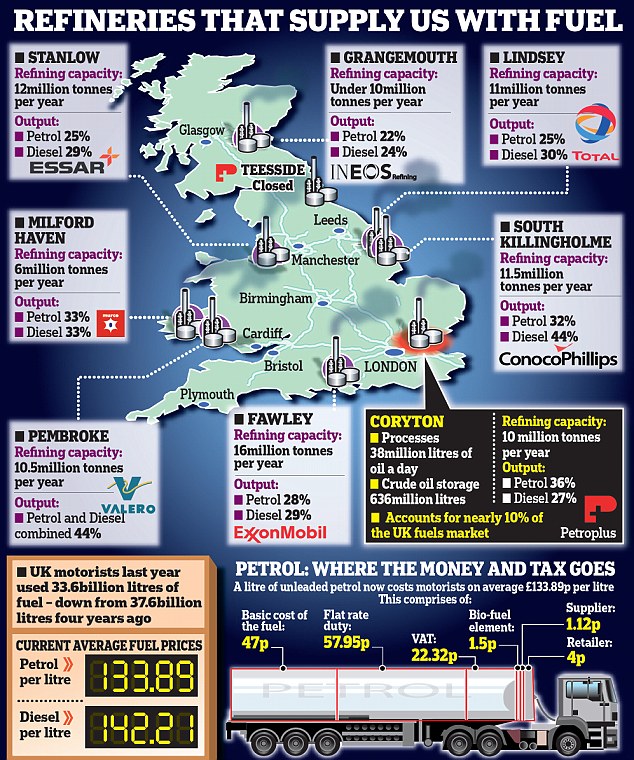

The Pound, The Bank of England, and The Union

The Pound, Shilling and Pence (£sd) is a historical monetary standard based upon silver, established first in France by Pepin The Short (father of Charlamagne) in 755 AD, before spreading to the rest of Europe and to Britain. The pound therefore has been money in Britain for nearly a millennium before the invention of the Bank of England, with minting of coins initially by a distributed network of mints over the British Isles that eventually centralised (by Royal decrees) in the Royal Mint.

Britain’s monetary standard before Decimalisation in 1971 – Pound, Shillings and Pence. 12 pence to every shilling, 20 shillings and 240 pence in the pound. Values over a Pound became paper money (banknotes) with the development of banking (source)

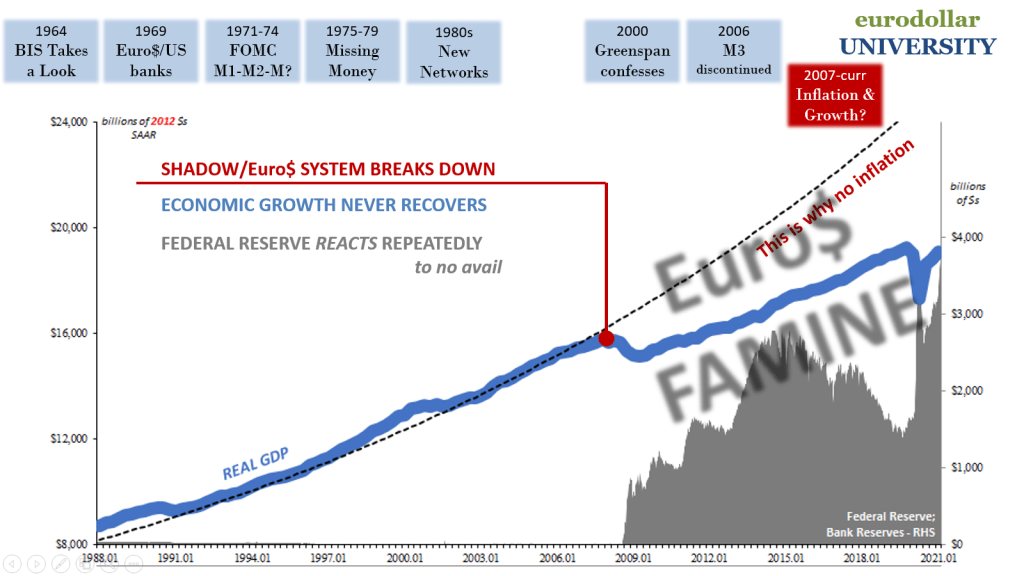

Only six years following the Dutch Invasion of 1688, the Bank of Holland England is established in 1694, to finance the wars of the burgeoning British Empire against the Dutch and French Empires over the Eighteenth Century, beginning with the central planning of ironworks and agriculture.

The Bank of England’s charter and the detrimental centralisation of Britain via Pound Sterling (source)

One of the ealiest projects of the Bank of England is financing the Acts of Union between England and Scotland in 1707, enlarging a Customs and Currency Union via the British Pound. In essence, England bribes the Scottish Elite to create the Union despite centuries of prior Scottish wars to maintain independence, for the main reason that Scotland’s Government had very unsuccessfully founded a trade colony in the Darien scheme of New Caledonia (today’s Panama) that had completely failed, threatening Scotland with bankruptcy and forcing them into the Union and the Kingdom of Great Britain.

In the first half century the Bank would work on behalf of the government, in financing the Royal Navy to supervise the oceans between Britain and her foreign colonies, chiefly in America, but later in India, Honk Kong and China, the Far East the Middle East and Africa. The Bank of England initially has little direct influence over the financial system and the rest of the British banking system, that is distributed locally over Britain.

Over the Eighteenth Century however, the Bank’s influence over the financial system increases and centralises, and by the the Renewal Charter of 1781 the Bank of England has become the “banker’s bank”, with the rest of Britain’s banks using it for trade settlement, with BoE banknotes exchangeable for gold, under the Gold Specie Standard invented by Sir Isaac Newton in 1717, dislodging the Silver Standard as the metal of choice by the end of the Nineteenth Century.

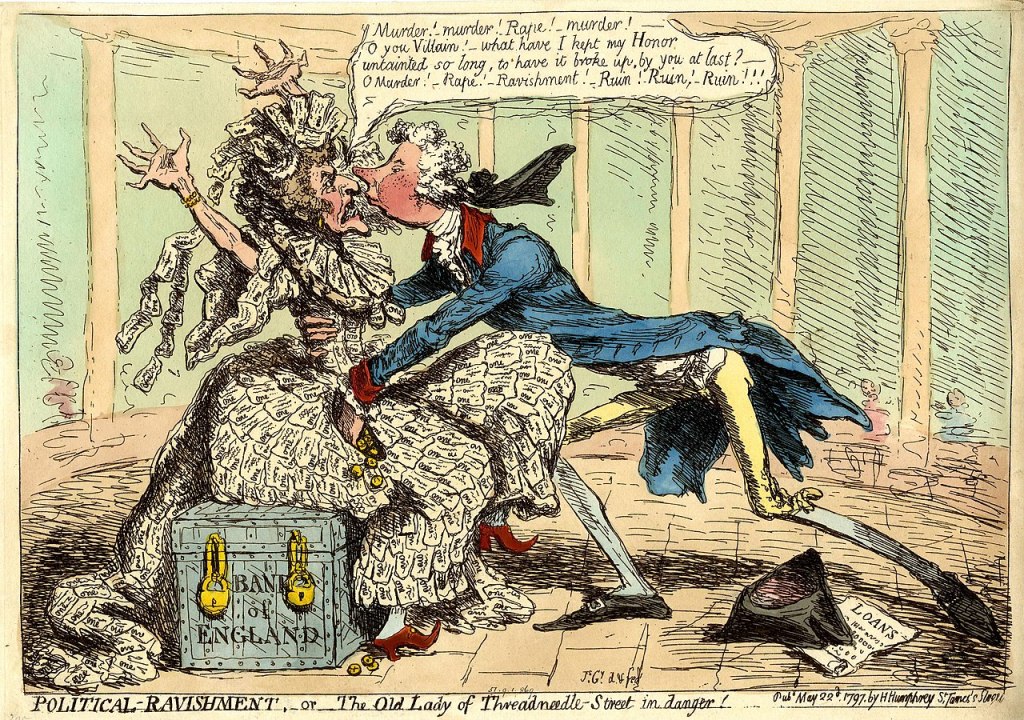

The Bank Restriction Act 1797

Satirical cartoonist James Gillray lampoons London’s Parliament under Prime Minister William Pitt the Younger, for turning to the paper money printing press to finance the ruinous wars of the Empire (source)

Britain has defanged The Dutch Empire by 1800, leaving France as its biggest international rival. The bloody French Revolution decapitating Catholic Monarchy between 1789 and 1799 turns France upside down and worries Britain, and in 1793 Pitt’s Parliament declares war on France. To finance the Armies and Navies for the French Revolutionary Wars, it is decided to print an excess of Bank of England banknotes without the gold reserves in the Treasury to back them.

This fraud fractional reserve banking leads to bank runs in the North East of England late in 1796, and worsens once news spreads that French soldiers have landed in Pembroke for the Battle of Fishguard in February 1797.

The legend of Jemima Nicholas rounding up French soldiers with her pitchfork in The Fishguard Tapestry, and the last time a foreign navy invaded Mainland Britain. (source)

The bank runs spark a panic in Parliament, and to avoid bankruptcy passes the Bank Restriction Act of 1797 forcing Britain off an internal Gold Standard to print the Napoleonic Wars (1803-1815) and the chronic inflation the domestic population has to suffer to defeat France, and establish Briain as the world’s greatest Empire over the Nineteenth Century.

Another satirical cartoon by James Gillray mocking the fall of the Old Lady of Threadneedle Street to a back street political prostitute, seduced and ravished by William Pitt the Younger. The Bank’s historical nickname “The Old Lady of Threadneedle Street” derives directly from this artwork (source)

William Pitt’s vandalism of Britain’s monetary standards (not to mention the introduction of the first income tax in 1799) would sever the domestic gold standard for 24 years, until the 1st of May 1821, accelerating the massive changes within Britain during this generation, from English population explosion to the energy revolution and industrial and agricultural revolutions. Reneging on the gold standard is a historical pattern that repeats, and even though this was the first time for Britain it would surely not be the last…

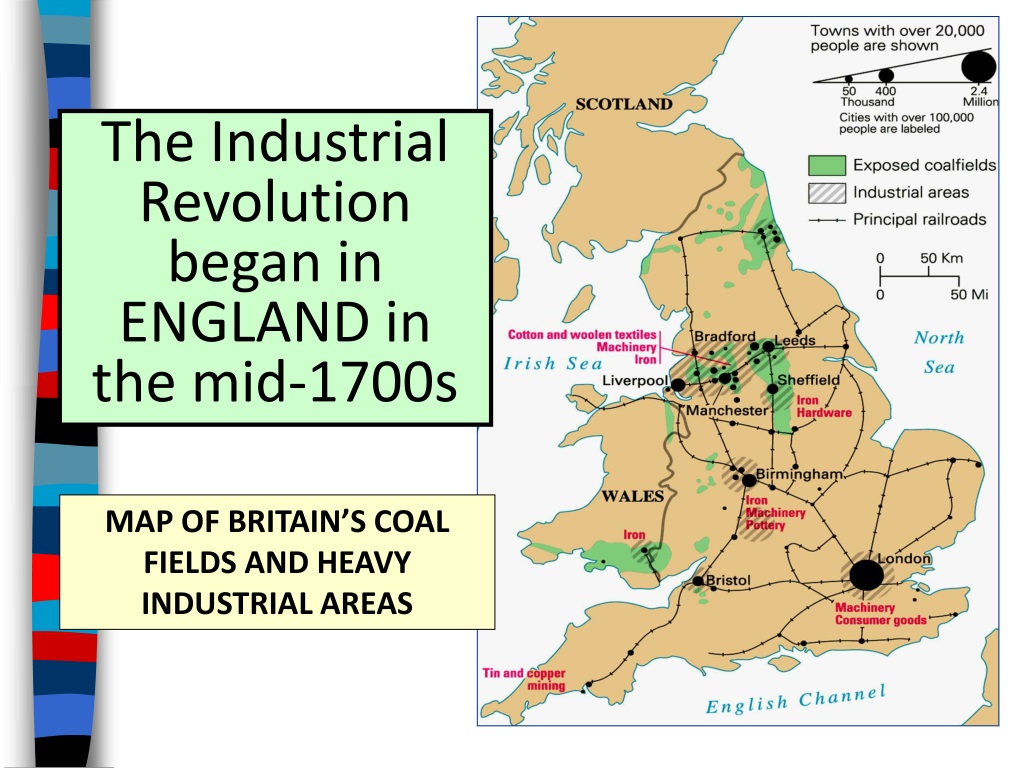

The Industrial Revolution

(source)

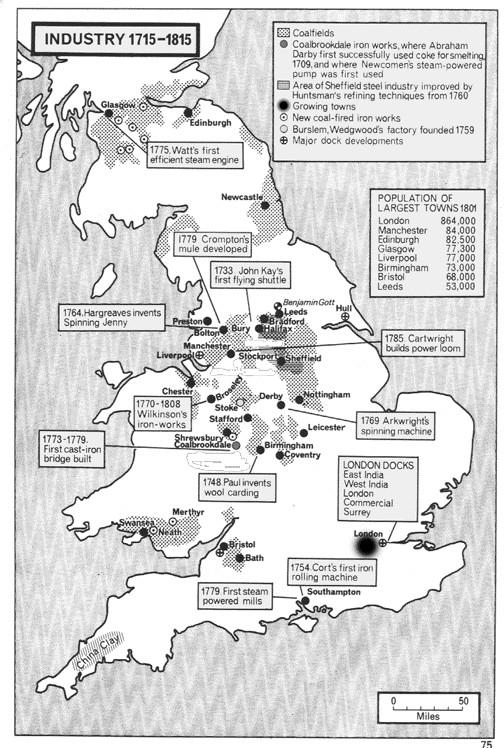

There is some disagreement on the beginning and end dates for the Industrial Revolution but roughly the Century between 1750 and 1850, barely half a Century since founding the Bank of England. The Watt Steam Engine is an important step forward in 1776, the same year as the American Declaration of Independence during the Revolutionary War of 1775 to 1783, against British Parliament and Empire.

Coal, iron, steam and bank loans fuel the rise of the machines (source)

The Industrial Revolution is created out of London and the Bank of England, as it increasingly becomes a centrepoint for the British Banking system during the second half of the Eighteenth Century, accelerating with severing the Gold Standard in 1797, and explodes largely outside London and the South East, in the North and Midlands, the South of Scotland, and South Wales.

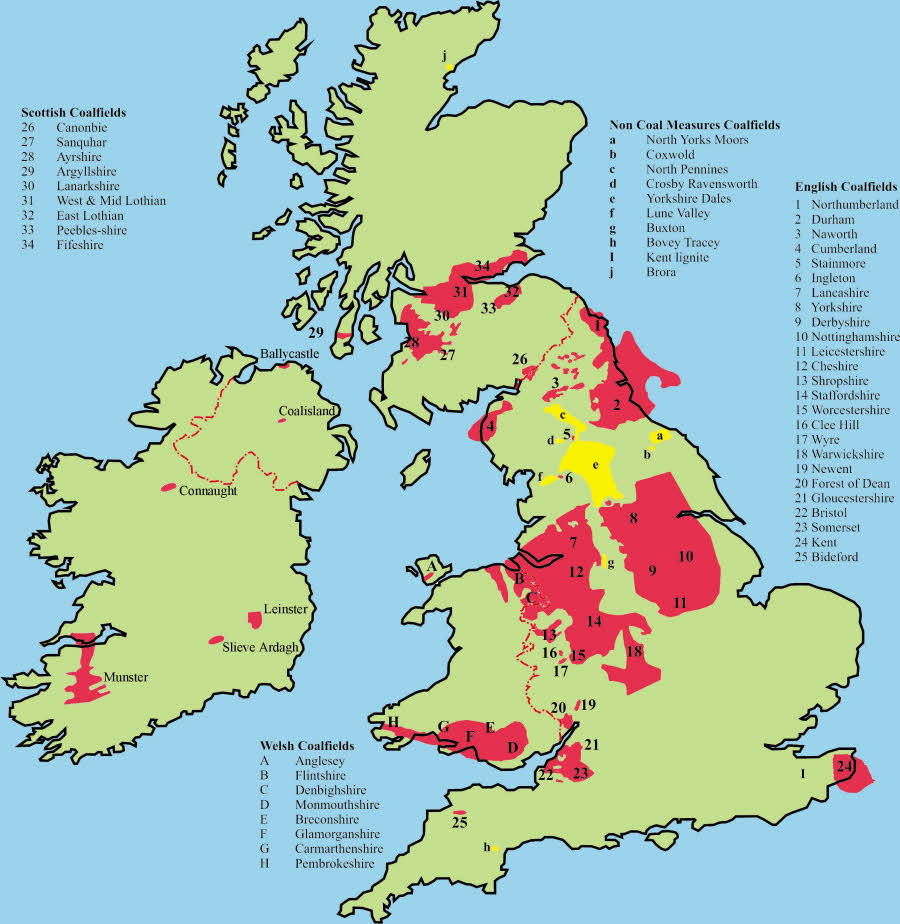

The Energy Revolution – geology and coalfields of the British Isles (source)

The energy revolution was based on geology, with discoveries and establishment of coal mines and pits to power industrial iron works over England, Scotland and South Wales. There is also an agricultural revolution, beginning to interfere with the traditional labour based rural economy, as the machines drove unemployment and migration from the countryside to create new industrial cities. In short, machines and machination explode throughout the British economy, co-inciding with England’s population explosion and the Child Labour revolution from 1800.

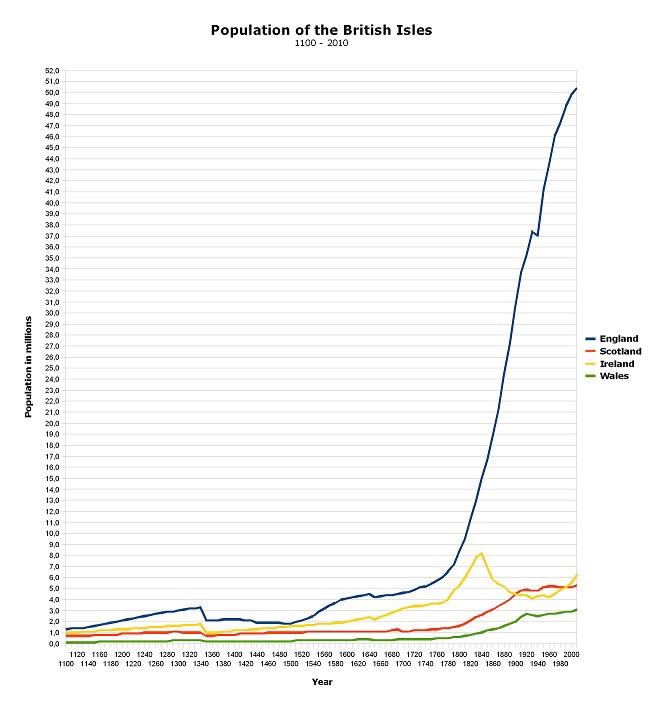

After rising on average by one million people every Century from 1100 to 1800, England’s population explodes from 8.3 million in the 1801 Census to 30 million by the 1901 Census (source)

The population explosion and rise of the machines eliminates labour, creating huge unemployment in the English countryside particularly, therefore forcing the rise of English industrial towns and a workforce for the factory system to increase the Country’s productivity, alongside the revolution in child labour to maintain families living standards due to the grinding poverty fueled by the debasement of the Pound’s purchasing power. The Industrial Revolution exhibits all the symptoms of inflation, first in the money supply and loss in purchasing power, inflating family size, the population, and demands upon energy, industry and machinery.

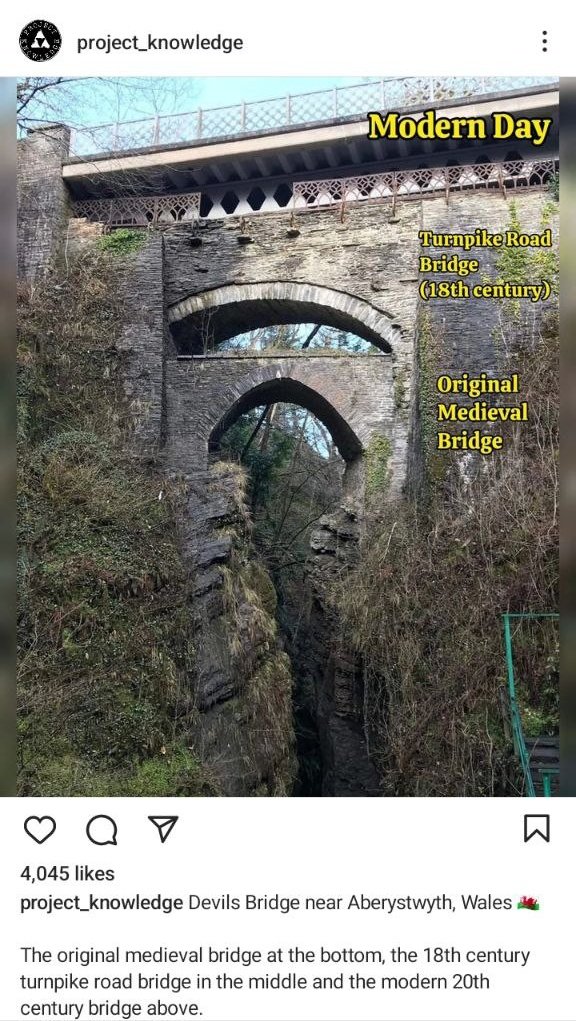

South Wales plays a prominent part in the Industrial Revolution, in the coal and iron industries. Following the invention of Watt’s condensing steam engine, Cornish mining engineer Richard Trevithick would develop the earliest train and railways for coal fields and iron works, two decades before public trains and railways. The first recorded steam hauled railway journey is February 1804, from the Penydarren ironworks near Merthyr Tudfil, down to Abercynon.

The Penydarren Loco – the world’s oldest locomotive in the Welsh National Museum (source)

The Industrial Revolution has enormous effects upon the power structures within Wales, away from the North and the historical supremacy of Gwynedd, down to the South Wales valleys and the industrial cities of Cardiff, Swansea and Newport. The population of South Wales explodes compared to the North, as English and other outward migration swamps the native Welsh population. By statistics, the population of South Wales doubles from half a million to over million between 1801 and 1851, and doubles again to 2.4 million by 1911.

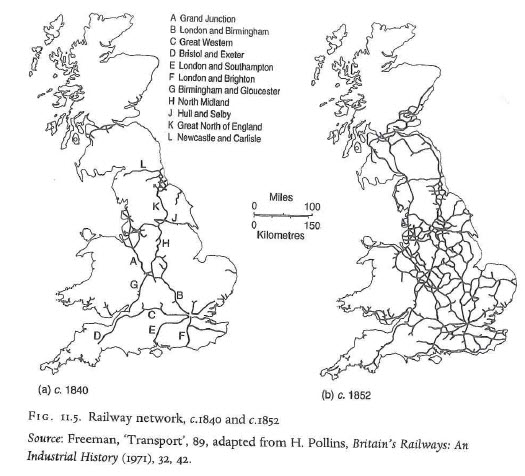

The Public Railways explode in the mid 1840’s, mostly due to the Bank of England lowering interest rates and hundreds of Parliamentary Acts passed by greedy politicians profiting from the Railway Mania (source)

The first half of the Nineteenth Century co-incides with the last half century of the Industrial Revolution in Britain, with the spread of public railways and trains, enabling tourism and immigration and the opening up of Britain, undermining localism and cultural diversity as London and Westminster politics takes more control over the infrastructure of the island. Industry and transportation also transforms Cardiff and Swansea into rich and powerful port cities of the Empire. Industrialism in its nature also centralises power and control, mostly in English hands, leading to Welsh counter-rebellion on occasion. The Merthyr Rising is one but example, in 1831 during a recession amid unemployment and low wages, the natives riot against the ironmaster William Crawshay, calling in the British Army to maintain order, and the hanging of Dic Penderyn and exile of Lewis Lewis to Australia. The rise of Labour Unions and Socialism will play an important part in the future of Wales, with Keir Hardie elected as the first ever Member of Parliament for the Labour Party in Britain, in Merthyr Tudfil in 1900.

The Red Flag symbolic of Socialism and labour revolutions, flown for the first time in Merthyr Tudfil in 1831 (source)

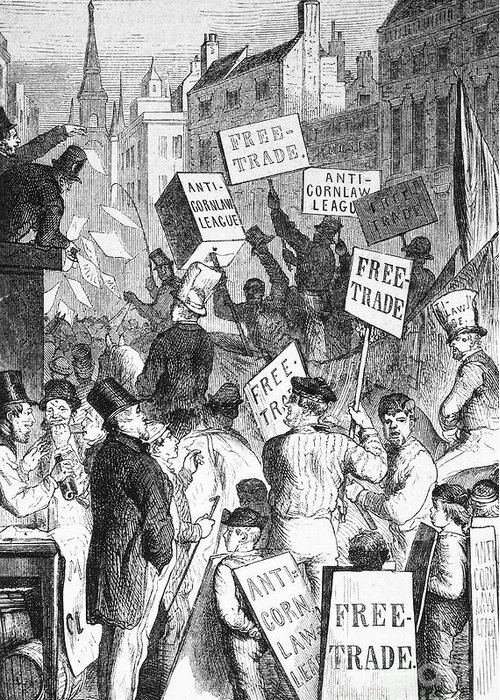

Under the Prime Ministership of Robert Peel, London’s vice grip over the rest of the Union via the British Pound would also strengthen. In 1844 the Bank Charter Act makes the Bank of England’s Banknotes legal tender, prohibiting any other bank from issuing their own banknotes. Even though the BoE is still an institution with private shareholders, its banknotes are nationalised throughout Britain by Parliament.

A Conservative Government turns its back on Mercantilism, and takes the Liberal path towards Free Trade (source)

Additionally, in 1846 a Conservative Government repeals the Corn Laws splitting the Party and forcing the resignation of Peel, the shift toward Free Trade and promotion of financial flows into Pound Sterling and London as the World Reserve Currency and Financial Centre of the Nineteenth Century, while undermining the long term by running trade deficits with its two main international competitors, Germany and the US.

Indeed, in 1850 the British economy is twice the size of the United States but by 1900 the British economy is half the size of the US, and the same size as Germany who under the Chanchellorship of Otto von Bismarck following the founding of the German Empire in 1871, had adopted Mercantilism and the American System of protective tariffs on imports. The by-product of a half century of Free Trade was to build up the economic forces of the two main countries that would end the hegemony of Britain as the world’s biggest Empire in the First World War.

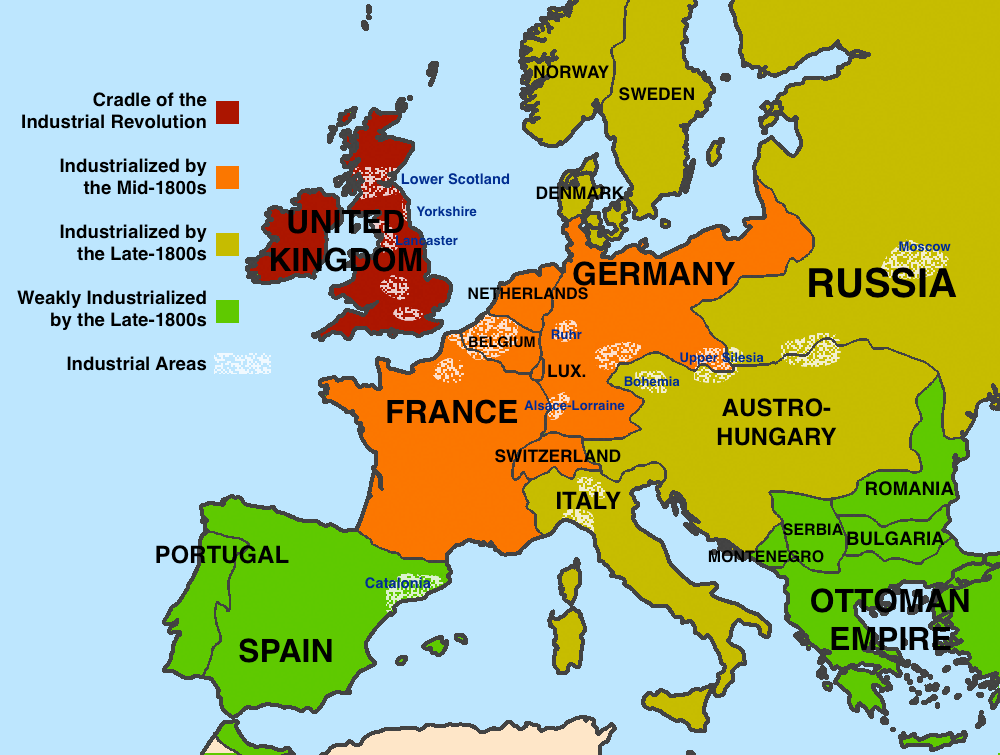

The Nineteenth Century witnesses the export of the Industrial Revolution, Empire and Central Banking to the rest of Europe and the United States (source)

The Twentieth Century

With the growth of the German Empire by the beginning of the Twentieth Century to the same size as Britain, they have become a threat. Germany would have likely defeated France and Russia in a continental war enlarging their empire a little to the West and East, but Britain as the world’s foremost Empire creates the First World War by joining the Allies to halt the further growth of Germany.

Britain and Europe abandon the Classical Gold Standard, extending the War from six months to a genocidal four years that destroys the Monarchical governing structures of Europe, destroys Britain’s future as the World’s biggest Empire, and establishes its dependence on the United States to win wars and the gradual transition of the world’s policeman over the Atlantic.

An estimated 35,000 Welshmen are killed in the First World War (source)

The evidence of the destruction of the First World War can still be seen today, in every cemetery in the villages, towns and cities of Britain and Europe, the genocide of a generation of Europe’s finest men, plunging a generation of families into grief and poverty, the first industrial war, and the destruction of an economy via inflation and shortages. Thanks to the warmongering Winston Churchill and David Lloyd George, dragging Britain into the war that cripples its future.

The inter-war years are hard times for Wales after losing so many men in the war and in every village, as poverty increases over the period. The Labour Party replaces the Liberal Party in the industrial valleys and population centres of South Wales, as Socialism and Labour Unions takes hold, and essential to the growth of the Labour Party and the Nationalisation of Welsh and British industry to come.

In addition to losing an estimated 15,000 Welshmen, the Second World War comes home through the bombing raids of the German Wehrmacht targeting British infrastructure, especially the port cities of Swansea and Cardiff (source)

The Second World War destroys the populations and countries of the UK, Europe and Russia for the second time in a quarter of a Century, leaving Britain essentially bankrupt as Pound Sterling and the Bank of England cedes World Reserve Currency status to the United States and the Federal Reserve. The US establishes the Gold Exchange Standard aka the Bretton Woods System, fixing the gold price at $35 an ounce, with the British Pound being exchanged for it. To rebuild Britain and Europe following the war, the US finances the Marshall Plan with Britain receiving a £5 billion loan, 26% of the total.

The Pound is devalued to 4 dollars following the Bretton Woods agreement, meaning an ounce of gold was £8.75 following the war. For comparison, to demonstrate the unending debasement of Sterling over the last eight decades, an ounce of gold today is over £2,000! (source)

Post War Britain – Shadow of the Sickle

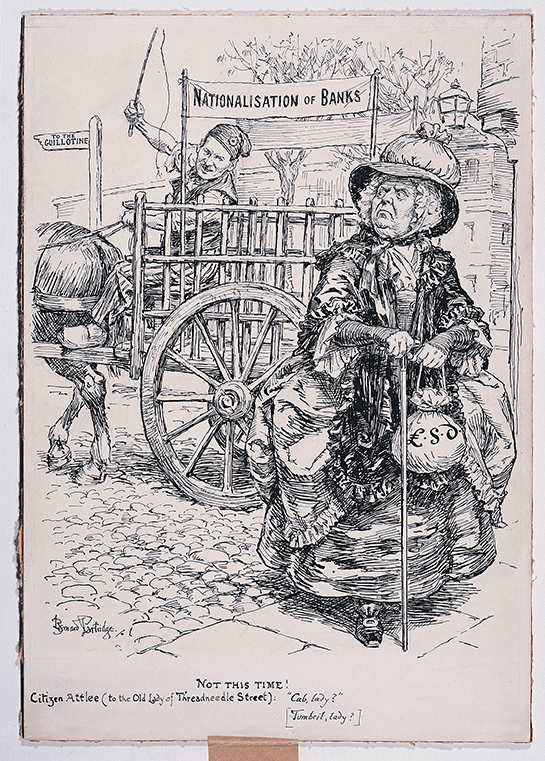

After leaving Eastern Europe in the hands of Stalin, in 1946 Communism comes home to Britain, under Clement Attlee’s Labour Party following the landslide defeat of Churchill and the Conservatives in the Election of 1945, Britain’s economy and infrastructure is nationalised.

Punch Magazine’s satirical cartoon from 1935 portraying Clement Attlee offering a lift to the Old Lady of Threadneedle Street, on her way to the guillotine. Eleven years later, it is realised (source)

The most important element of perpetuating Nationalisation and financing Communism, is the Bank of England itself in 1946. After existing as a bank with private shareholders for 252 years, two years after Bretton Woods and loss of World Reserve Currency, the Bank is now owned by the Parliament of Westminster.

To follow, the Nationalisation of the Country:

In 1946 the coal industry is nationalised with the Coal Industry Nationalisation Act.

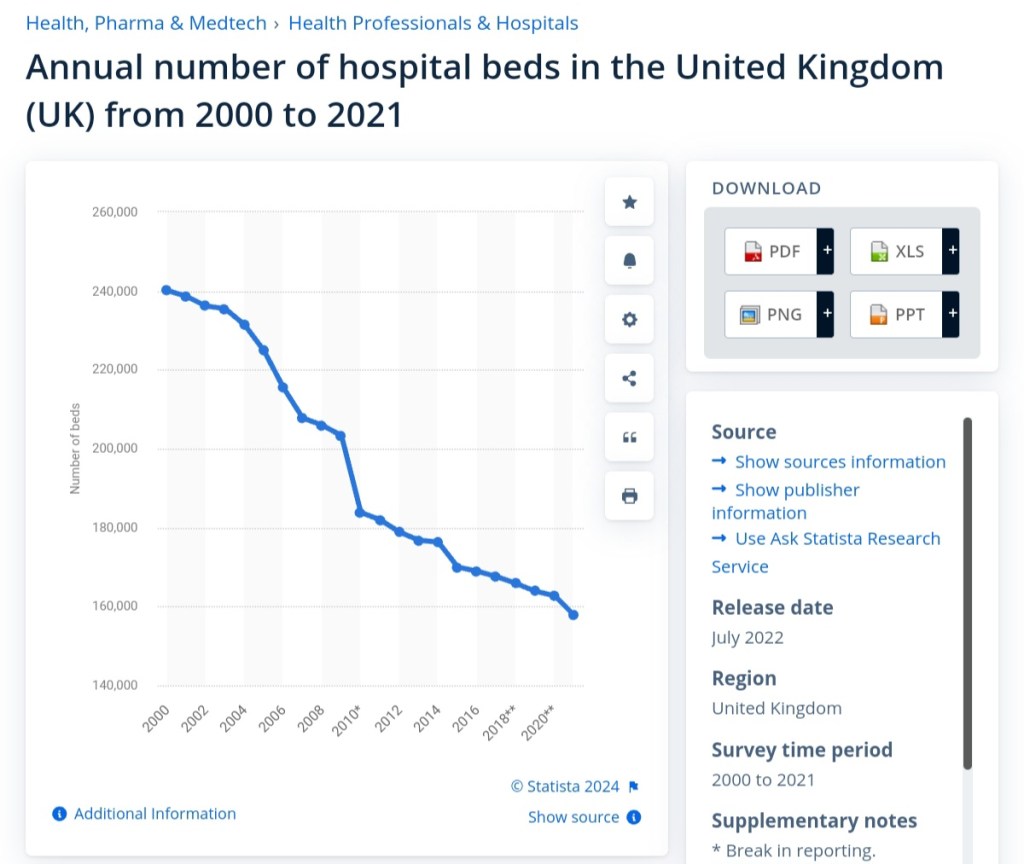

In 1946 healthcare, with the National Health Service Act and National Insurance Act, expanding the Welfare State under Health Minister Aneurin Bevan.

In 1947 under the New Towns Act and Town and Country Planning Act, the government gets into Social/Council Housing and the construction of new centrally planned towns to ease the overpopulation of cities such as London and Glasgow, creating a myriad of new social problems from unemployment and welfare, driving poverty and crime.

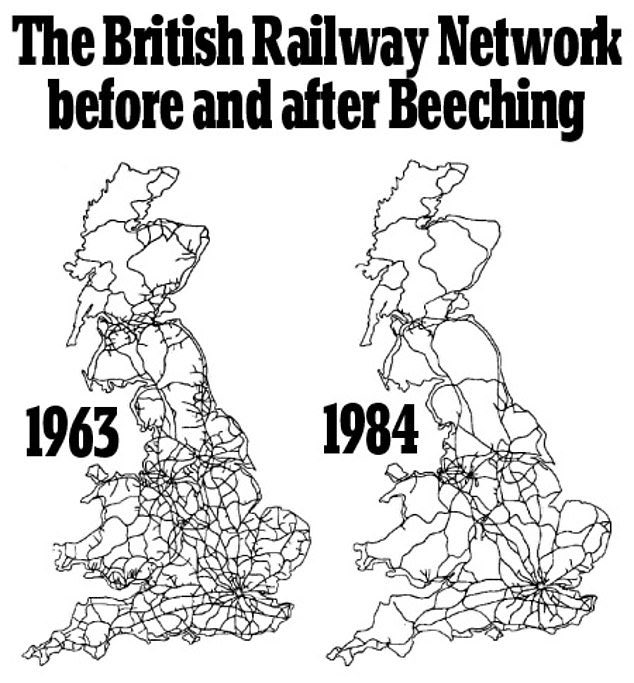

In 1947 the Transport Act nationalises the highways, the railways, the canals, ports, bus companies and even lorries!

In 1947 the Electricity Act fully nationalises the Electrical Grid, alongside Cable and Wireless (Telegraph and Telephone).

In 1948 the Gas Act nationalises the Gas Industry.

In 1949 mae’r Iron and Steel Act nationalises the Iron and Steel Industries.

Another satirical cartoon from Punch Magazine, depicting the predictable catastrophe of Government controlled infrastructure, via the mangle of Westminster (source)

In effect, the Labour Party and British Government become owners of South Wales industries, and so South Wales becomes a hostage to the whims and perfidy of London’s Parliament for their economic future and way of life.

Outside the urban and industrial centres, in the countryside by some mercy the Agricultural sector escapes full Nationalisation and repeating the famines of other Communist countries such as Soviet Russia and Maoist China, but even in the greenest depths of rural Wales the shadow of Socialism and Central Planning threaten the old Welsh way of life, strikingly depicted by Islwyn Ffowc Elis in the Welsh Language novel Cysgod y Cryman (Shadow of the Sickle) published in 1953, and awarded Welsh Book of the Century in 1999.

Book of the Century – the Sickle is of course Communism

Welsh Nationalism strengthens following the War, and even though Plaid Cymru had been established since 1925, it takes until 1966 to win its first seat in Westminster. In 1967 the Welsh Language Act gives rights to the use of Welsh in the legal system within Wales, that had been illegal for over four centuries.

The Stagflationary Seventies – End of the Gold Standard

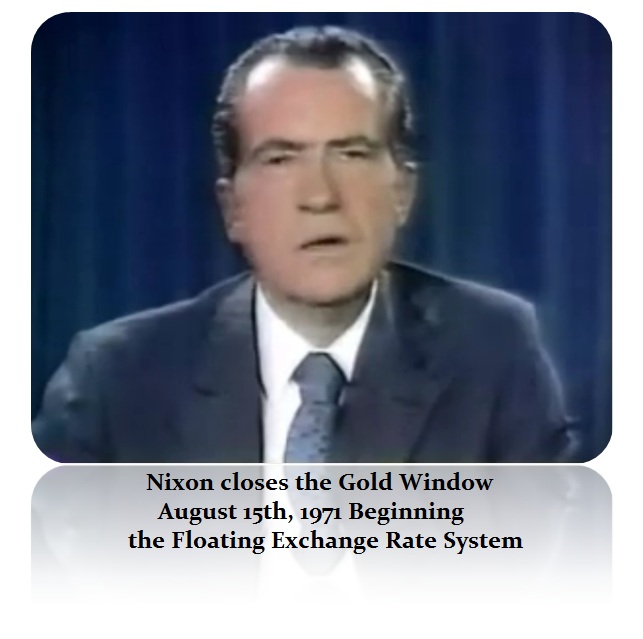

The United States defaults on settling its debts in gold – the leash upon inflation is severed

In 1971 Richard Nixon takes the US off the Gold Exchange Standard onto The US Treasury Exchange Standard and National Debt machine, severing the leash upon the purchasing power of money, sending inflation of living costs to the moon in the Seventies.

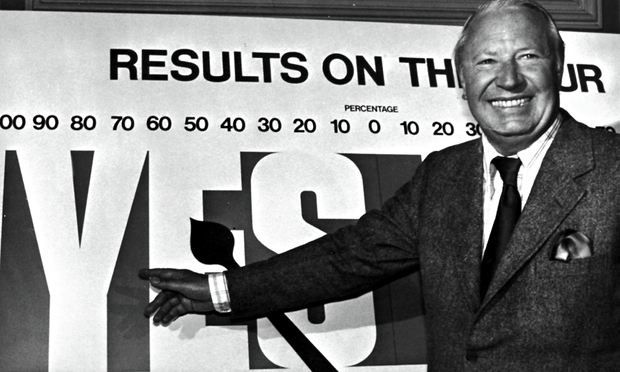

Primary Architect of dragging Britain into a bigger, centralised trade union – Edward Heath and the Conservative Party (source)

1973 is an important year, as the Tories swindle Britain into the EEC as the European Union was called back then, in an age when Conservatives were Europhiles and Labour were Eurosceptics, concerned over the future of domestic Labour Unions and British Industry in an enlarged customs union, and the foreign tide of cheap goods and labour undermining the Unions, domestic industries and the nationalised electorate of the Labour Party. The half century since have confirmed the concerns of Old Labour about the Union of Britain with the Continent, and our current Trade Deficit of a hundred BILLION per annum with Europe (especially Germany) has massively contributed to the undermining of the British industrial economy since the Seventies.

The Three Day Weeks that last three months in early 1974 ending Ted Heath’s political career, Labour retake power in the Elections of February and October 1974 (source)

The chronic inflation of the Pound in the early 70’s drives national industrial strikes over Britain to increase wages to protect workes and families enduring a cost of living crisis, especially the Miner and Railway strikes of 1974, forcing the Tories into Three Day Weeks on companies and industries to conserve electricity between January and March, that also ends Tory Rule in the second General Election of 1974 as Labour return to power.

The Sterling Crisis in 1976 forces Britain to default on its debts and beg the International Monetary Fund for a bailout (source)

In 1976 the Government of James Callaghan defaults on loans and is forced to seek an IMF bailout, a humiliating episode for the Country that had run the world only a few decades earlier. It is remembered as the Sterling Crisis and the loan of £4 Billion, the largest in IMF history up until then, to prop up the exchange rate of the Pound suffering 10% annual inflation rates, echoes the last few years the UK has suffered since the Covid Crisis debacle.

Union strikes meant that rubbish collection was suspended over the towns and cities of Britain in the Winter of 1978 (source)

The Winter of 1978 is remebered as the Winter of Discontent, with labour union strikes bringing the Country and the Labour Party to its knees, and paving the way for Thatcherism and the Conservative Eighties. The strikes of the bin men chokes the towns and cities of Britain in rubbish, and strikes amongst the grave digging unions stopped the dead from being buried. Three decades of nationalised infrastructure and unions in every major industry nearly brings Britain to a halt for wage bargaining, all because of the chronic mismanagement of the common currency, the Pound, comes close to destroying Britain.

Prime Minister Margaret Thatcher following the 1979 Election (source)

In the last year of the turbulent Seventies, Thatcher and the Conservative Party gain power, that will decimate the industries and economy of South Wales during the Eighties, the peak of Welsh Industry and labour union leverage over the British economy ends with the sweeping away of the Labour Party following the 1979 Election.

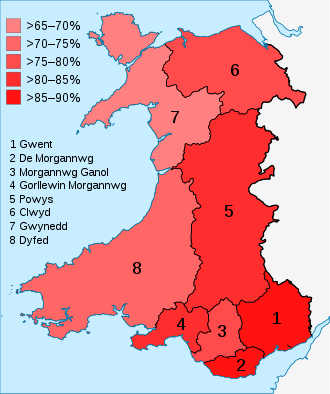

The percentage against Devolution for Wales – even in West Wales two thirds voted No! (source)

Additionally, on the First of May (St David’s Day) 1979 Wales receives a Referendum on Devolution and a Welsh Assembly, and a stregth test within Scotland and Wales for the Union, and any strength in Welsh Independence. 80% of the Welsh public vote against the referendum and only 20% in support, closing the debate around any devolution for the next twenty years.

The Eighties – Privatisation

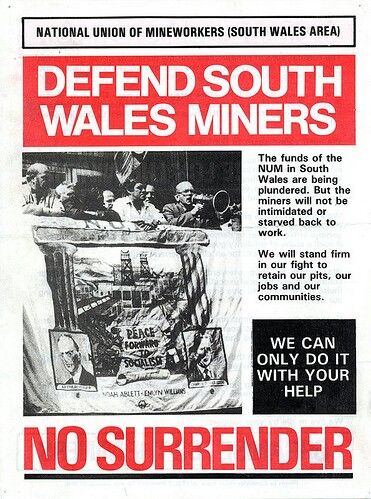

The Miner Strike of 1984-5 against closing South Wales collieries, and other coal areas in Britain. The Coal Industry was privatised and put out of business nearly overnight (source)

The Eighties are of one of Welsh history’s most destructive and saddest decades, removing much of its power and influence, especially Welsh labour workers over the rest of the Union, and most of this is down to one woman, in Maggie. But before she is dragged out of her grave for recrimination, she must be discussed in the context of the earlier mistake in Nationalising the energy and heavy industry sectors.

As already discussed, the beginning of the destruction of the Eighties is in the Fourties, and the Nationalisation of the coal, gas, electricity, transport, and steel industries. Central Planning and working outside of any profit motive in competitive industries, suffers from the “Socialist Calculation Problem“, in that because the government does not have to run on a profit to survive, it is impossible to ascertain what is profitable and what is not. It was becoming increasingly clear that the British Government was running Britain’s heavy industries at a massive loss, reflected in large part by the inflation and monetary problems of the Pound during the Seventies.

By the Eighties, British Industry had become increasingly uncompetitive with rest of the European Union and the World, lacking investment in new machines and engineering, and over dependent on labour and the unions that had become powerful, and could bring the British economy to a halt with strikes. This is a major reason in Thatcher’s decision to break the unions, via privatisation of Britain’s public companies, and the following list gives a flavour of the extent of public ownership: Royal Mail, Capita, British Aerospace, Cable & Wireless, British Gas, British Coal, British Telecom, British Steel, British Petroleum (BP), Rolls Royce, British Airways, Water Boards, Electricity Boards, National Power, Powergen, British Rail.

Instead of continuing to subsidise industrial areas creating domestic energy and commodities strengthening independence and national security, the Tories throw everyone on the dole prefering to subsidise unemployment and despair instead (source)

Where Thatcher and the Conservatives deserve judgement was in a chaotic and premature privatisation, throwing large swathes of Britain’s heavy industries out of work overnight, creating mass unemployment and poverty in British industrial heartlands and especially South Wales, feeding the Welfare State and Government subsidies for not working, and the second order effects of alcoholism, drug addiction, crime and suicide. Indeed, Welsh wounds have yet to heal since the Eighties. Privatisation has also, in many cases, put these state sponsored monopolies in the hands of people who have ravaged the institutions for a small gang of private shareholder profits, at the expense of inferior and more expensive utilities for the public that subsidise it through bills and/or taxes. Many of these companies have become worse and under-funded than in direct government hands, meaning that today we have another brewing infrastructure crisis in Britain, see the condition of the railways and the Thames Water scandal recently. Privatisation and mismanagement in many examples have degraded our infrastructure and made us more dependent on foreign imports from other countries for resources such as steel, coal and gas.

The Nineties – Decentralisation Emerges

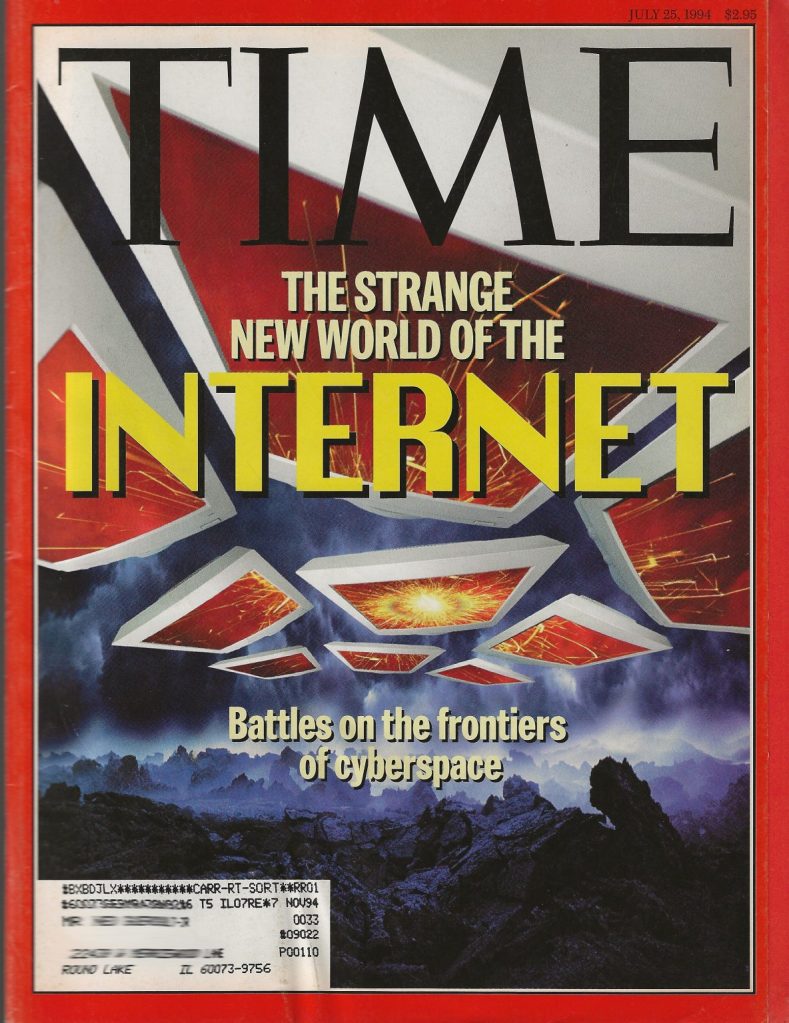

Time Magazine Cover, November 1994 – the year the Internet was privatised (source)

It could be argued that the trend of political centralisation that began with the Protestant Reformation five Centuries back, reaches its peak under the Labour Party at the end of the Fourties or under Labour in the late Seventies, the Eighties was the beginning of a new trend of devolution and decentralisation, but it is the Nineties that sees the decentralisation of communication, confirming a multi-decade trend of decentralisation. Critical to this trend is the internet, previously a communication technology reserved for National Militaries, Educational Institutions and within the Public Sector, privatised in 1994 for the public over the world to use. Despite little demand in the beginning, as few of the public had a computer or internet access, three decades later digital technology has changed all our lives and we are today undoubtedly completely dependent on our mobile phones for mobile banking, e-mails and social media for information and communication. Indeed the explosion of online peer to peer communication in the last thirty years is undermining the power and influence of the legacy media that once monopolised the flow of information, and is contributing to the increasing censorship of the internet and online, as Politicians and the State wake up to the perils of freedom of speech, and our judgements on the madness and incompetence of our political elites who believe they are above any judgements. Despite the increasing Parliamentary Acts to “Protect Safety” and taxpayer funds thrown at calming the “anti-democratic” waters via restrictions and banning the freedom to broadcast and communicate online, the ongoing trend of tension and struggle between the forces of centralisation and decentralisation will increase for the next decade.

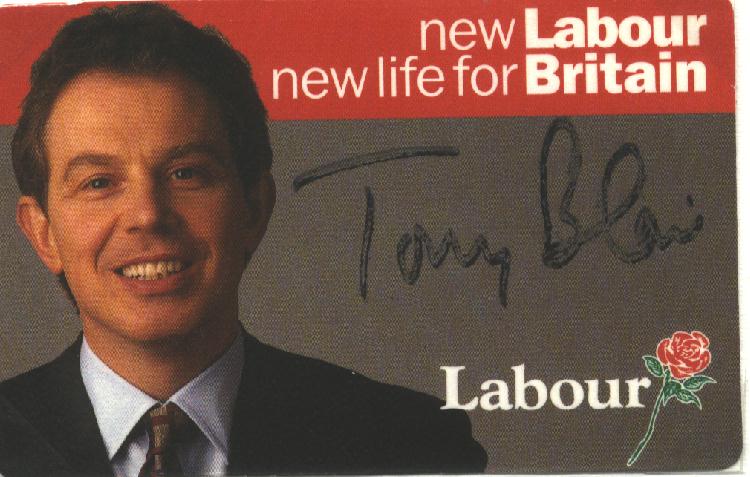

New Labour (minus the Union), and the Conservatives in Red (source)

By the late Nineties eighteen years of the Tories has become too much, and with New Labour’s landslide in the 1997 Election and the coming of Tony Blair and Gordon Brown, there is the promise of hope for a demoralised Wales within the Union. In keeping with the origins of the Labour Party and Kier Hardie in the South Wales valleys, three of Labour’s original four pledges are realised by New Labour, in Devolution, the Minimum Wage, and the abolition of heredity in The House of Lords. The only pledge to fail is the prohibition of alcohol.

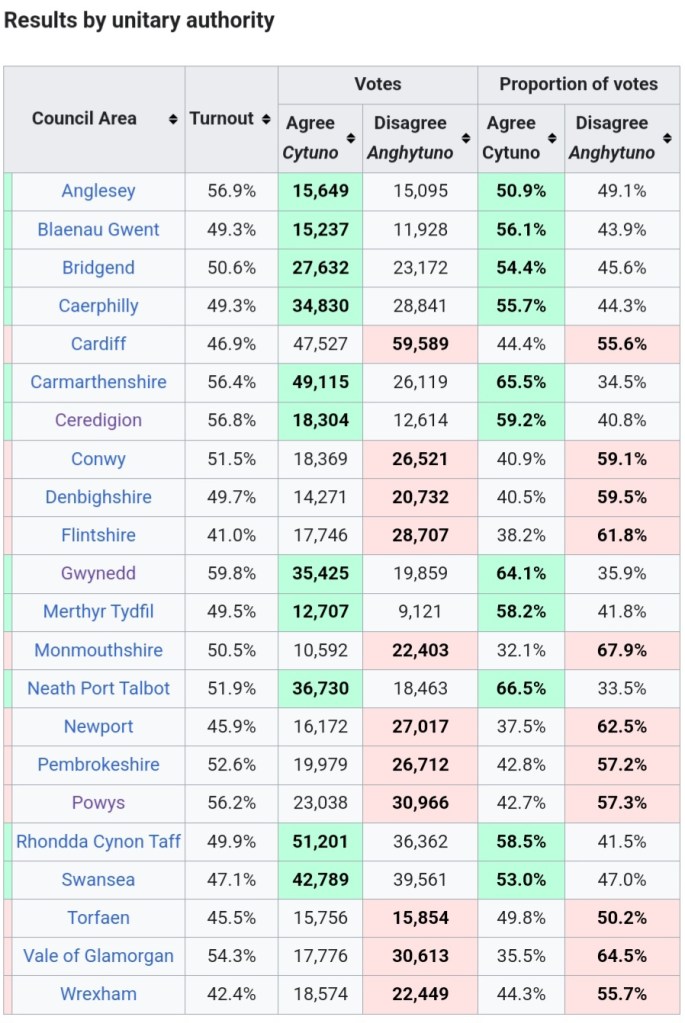

Wales, thanks to the South Wales valleys, votes marginally for Welsh Devolution (source)

Devolution of the Union is realised after Labour victory with the 1997 Referendum, and in 1999 the National Assembly for Wales is established after Wales narrowly votes in favour. The Assembly becomes the Senedd in May 2020. It can be argued that Devolution has been a success with new Welsh Government powers, it could also be argued that Welsh Devolution has been a failure due to the monopoly of the Labour Party in Wales socialising and slowly killing off Wales productive sectors, with the public sector and its destructive policies addicting Wales further to London’s Treasury.

Brexit 2016 – Further Devolution

The main drivers of Brexit were England (outside London and the South), and Wales (source)

The Brexit Referendum is one of the most important political earthquakes of the Twenty First Century so far, and in the author’s opinion fatally weakens the European Union and the United Kingdom, as we are likely to see over the next decade.

Brexit was a source of mirth to the author as a devolutionist who is suspicious of Political Unions in general, in realising that the biggest supporters of the British Union were against the European Union, and the biggest supporters of the European Union were most hostile to the British Union!

In the end, Britain voted narrowly to exit the European Union after nearly half a Century, to take back powers and laws from the Brussels Commission back to the Parliament of Westminster, for Britain to run more of its economy, negotiate its own trade deals, and compete more flexibly and effectively outside the EU’s trade union monopoly and the mad bureaucrats of Brussels.

Alas, the fatal flaw of this independent outlook since 2016, was that neither David Cameron or the Conservative Party that allowed the referendum, nor Westminster politicians and Whitehall civil servants, nor London’s media and press (the BBC particularly), ever expected the majority of Britain to vote leave, therefore there was no desire or will in the British Establishment and no plan to grasp the independence nettle and take back control of their own Country, by severing the Acts and Laws of the Continent.

The result is that today, over eight years since Brexit, we have done nothing with the gift of British Independence, still subservient to most of the nonsensical laws and regulations on the Continent, still without control over our fisheries industry, and still running massive trade deficits of now over £100 Billion per annum, in other words Britain is purchasing over £100 Billion of European goods (mostly from Germany) more than the sell to us. We are exporting our industries and companies and jobs to German industrialists and French farmers, while Britain exports the Pound and our National Debt via our FIRE (Finance, Insurance and Real Estate) sector to pay for this catastrophic subsidy, and only running a balance of trade with Europe would return over £100 billion a year worth of industries and jobs back to Britain!!!

According to House of Commons statistics on trade for 2023, Britain has run a trade surplus of £75 billion with the rest of the world while running a trade deficit of £109 Billion with the European Union. This is the reason that what is left of our industries is disappearing, making us increasingly dependent on imports from foreign countries (source)

Brexit is increasingly being recognised today as a catastrophic mistake by those who voted to remain and those who voted to leave, but this due to the political hash the Conservatives and the British Establishment have made of Leave, unsurprising upon the realisation that the British State is run by left wing liberals. The blowback for Brexit impotence for the Conservative Party was its landslide defeat in the 2024 General Election, likely leading to the collapse of the Party in the next five years as the centre and right fight over the carcass, while europhile Labour now have a simple majority in the House of Commons to slow up and sabotage Brexit further, with the same Permanent Bureaucracy scheming secretly in the shadows pulling the strings of Labour, as they did the Tories. We are headed into darker days for this Country in the next few years.

In terms of the long term decentralisation trend there is light, and we will likely look back at Brexit in the next decade or two as the beginning of the end for the European Union and the United Kingdom, and a very positive development in the author’s opinion. Europe has now lost one of its main financial contributors in Britain, increasing the burden on Germany and France as core foundation of the currency and debt union, forcing Germany to pull the plug on the European experiment sooner. It has to be remembered that the EU and Euro are extremely young and immature compared to the long established United Kingdom and Pound Sterling, therefore it is logically the EU and the Euro that will disintergrate first.

Results for the National Identity question in the 2011 Census, showing that only a few areas of London (and Northern Ireland) consider themselves British first. This important question has changed by the 2021 Census, more discussion here (source)

Within Britain, Brexit has exposed the differences between the mindset of London’s population (and media establishment) and the rest of England, and between England and the Celtic Countries, currently manifesting as strengthening movements in Scotland and Wales for further Devolution, and even independence. Not only has Brexit fatally wounded the European Union in the long run, the author is also of the opinion that Brexit will break apart the United Kingdom in the next generation.

The Present and the Reality of the British Union

This map is from 2014, two years before Brexit, reflecting our trade deficits with Northern Europe and the debt and poverty this creates outside London’s financial centre, that benefits most from our current economy through the common currency, the Pound (source)

An important step is to get to the root of the truth of how Unions operate, who benefits and who suffers, and the State and Media work together in this realm to misinform, confuse and gaslight the British Public.

Listening to London’s media establishment in the dragon’s lair, London is the financial powerhouse and subsidiser of the rest of Britain, through Government, the Treasury, the Bank of England and the City of London’s financial sector.

Further, the English believe they suffer because they subsidise the economies of Scotland, Wales and Northern Ireland via local government, as public sector spending in the Celtic Countries is higher per capita and in GDP, which is true.

The Celtic Countries likewise complain they suffer at the hands of the English because they own the Treasury in London, and calculations like the Barnett Formula that decide the subsidies doled out to Scotland, Wales and Northern Ireland in exchange for their taxes.

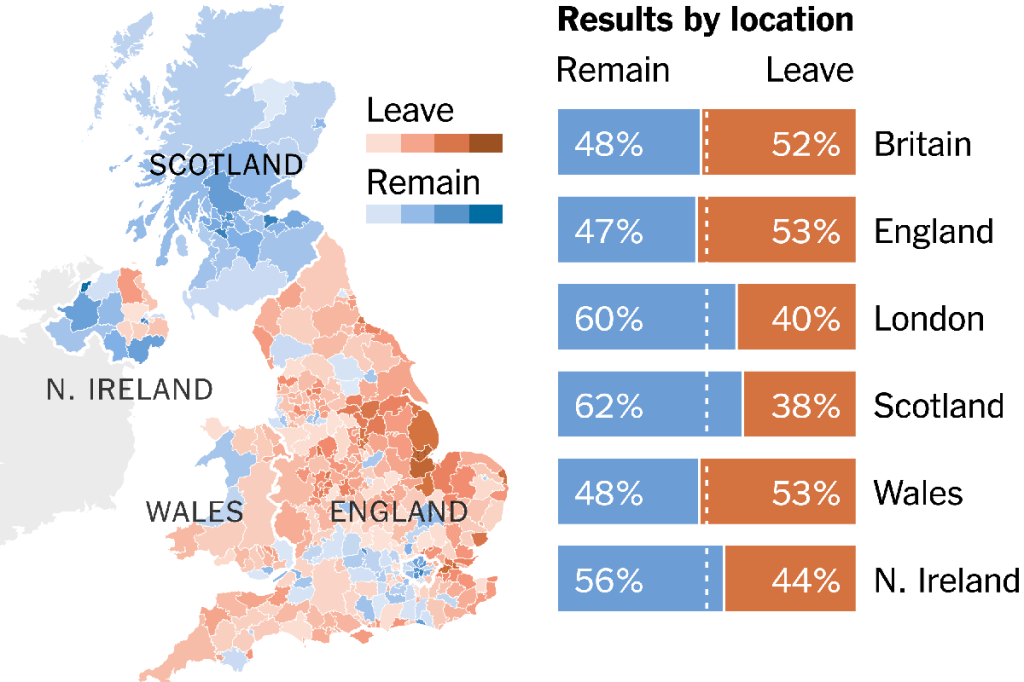

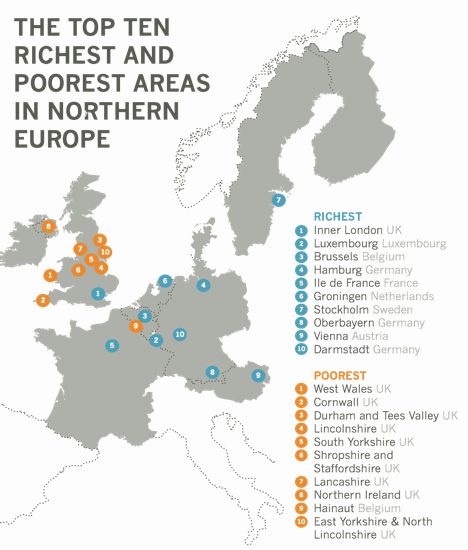

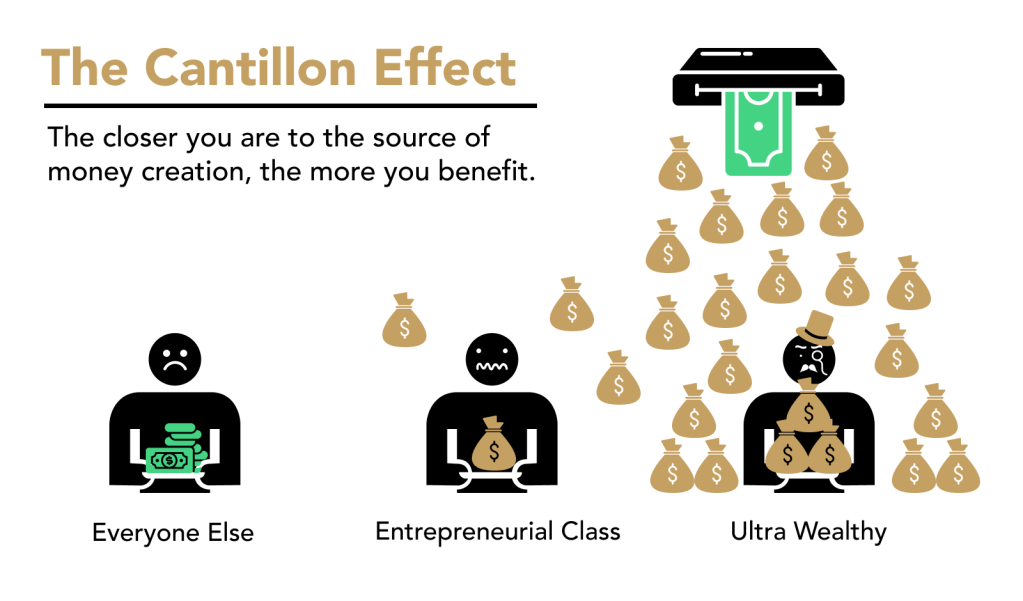

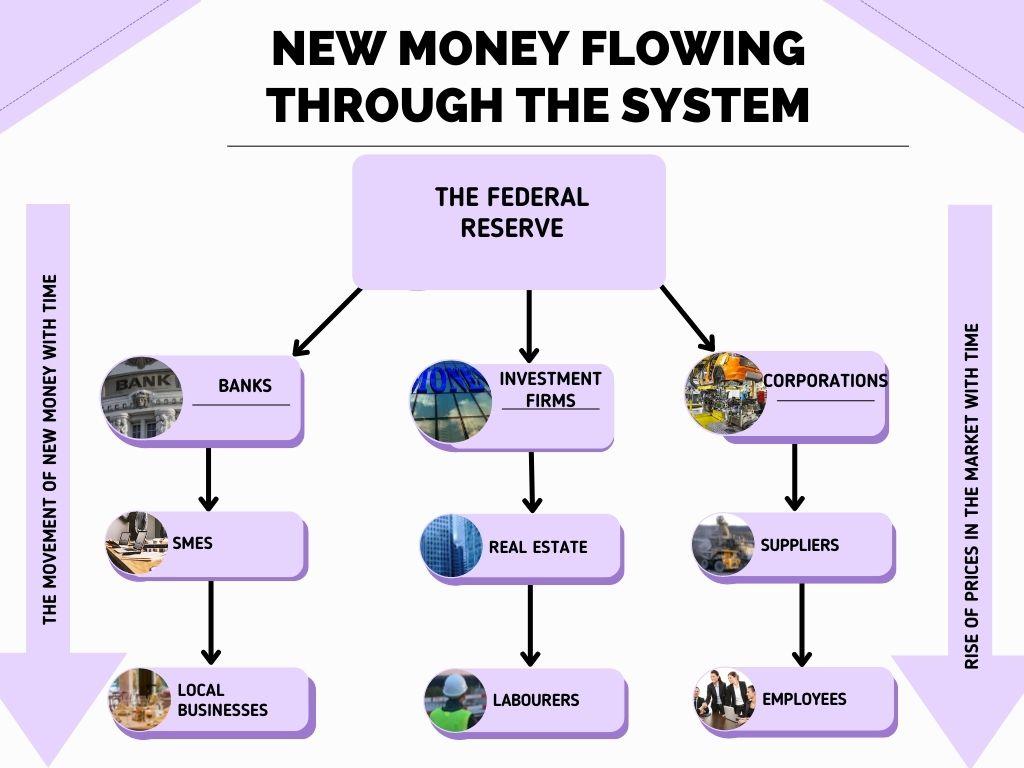

Everyone is squabbling amongst each other, while the nature and reality of our monetary and currency union centrally issued out of London, gets lost in the noise. The reality is that London receives the ultimate subsidy out of this system via the Cantillon Effect, with those closest to the inflationary credit creation apparatus receiving the money first, and at the original purchasing power. As this money circulates outwards from the centre to the rest of the country, to the later receivers and as its purchasing power is diminished. This reflects the relative over-abundance of money (and the mirage of wealth) in London and England’s South East, and relative shortages of money and poverty in the rest of England, Scotland and Wales, depicted in in the graphics below.

Two graphics that describe how money flows from the centre towards the peripheries, and losing its purchasing power on the journey. The Cantillon Effect also explains how London is the richest area in Northern Europe, while eight of the poorest areas are within the same Union (source, source)

Once the people of Wales, Scotland and the North and Midlands of England wake up to how the Pound and our present monetary union operates, it is possible to unify and turn their gaze towards the City of London banks, and the centre, the Bank of England. Unfortunately this is not likely to happen anytime soon, but the persistent inflation and debasement of the Pound will guarantee more debts out of London’s Treasury and more poverty in the rest of Britain, driving more inflation and taxation, and forcing more of the population to seek monetary solutions outside the Pound’s debt matrix, and into competing external currencies as the Digital Age proceeds.

End of Part One

PART TWO: PRESENT

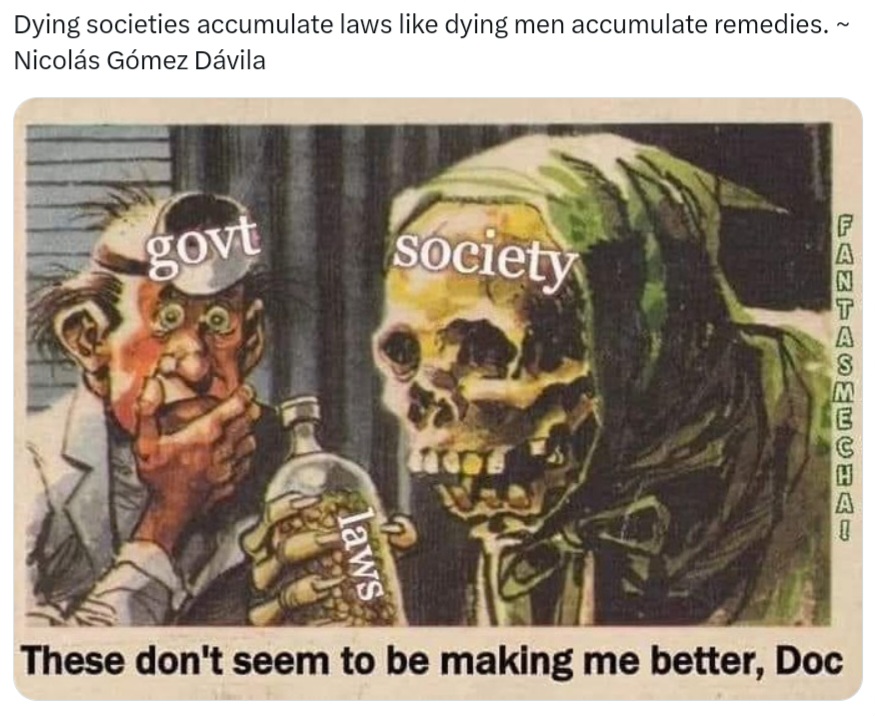

As explained by Niccolò Machiavelli, human nature is inherently conservative and suspicious of new foreign paradigms compared to established and familiar paradigms. This is truest of all for monetary systems, especially the three century old Bank of England British Pound.

Predicting the Future – Probabilities and the Game of Unions

Part Two of the essay will attempt to predict the future by discussing scenarios of the three options for Wales as an Independent Nation and the probabilities of each, that will be of aid in ruling out less probable scenarios as well as ruling in more probable scenarios.

Option 1: Leaving the United Kingdom and joining the European Union and the Euro

This is the least probable option, because Wales (within the British Union) voted to leave the EU in 2016, and to rejoin Wales would have to gain independence from the UK first, which looks improbable to impossible at present. Additionally the Brexit vote was roughly 50% remain and 50% leave, so even in a future referendum the probability of joining the EU would be half, and would drive a clear divide and civil war (literary rather than literally) down the middle of the Welsh population.

Keep the Pound Campaign – despite the best efforts of newly converted europhile New Labour riding the wave of goodwill following the ’97 landslide to swindle swoon Britain into the Euro and a Continental Currency Union at the start of the new Millennium, the idea received little traction on the ground (source)

Even less probable than re-adopting the European Union, would be to adopt for the first time the Euro. As discussed in Part One, the Pound is a historical institution of Wales for over a Millennium, and especially since the establishment of the Bank of England (1694) the Pound is the lifeblood of British and Welsh trade and taxation, for financing the debts of the British Government. Despite the best of will for the effective propaganda from New Labour for adopting the Euro, money is the most essential element within society, that we produce into and consume with, selling a good or service to buy goods and services, and store our personal net worth for a future that is by nature uncertain. Adopting a new monetary and accounting system therefore is always riskier and dangerous to destroy personal and national debt wealth, than remaining with the familiar and trusted. Indeed the Pound Sterling standard of the Bank of England is now over three centuries old, with historical certainty in the psychology of Welsh and British populations, for living today and more importantly for producing and saving in a relatively stable currency for the future. Only for this reason, any campaign by a newly independent Welsh Government to persuade Wales to adopt the Euro would unleash a civil war and wealth destruction on a national scale, bringing the government to its knees, not to mention that Wales has no domestic financial infrastructure or banking network today, we are completely dependent on an English banking system and financial network with its headquarters in the City of London.

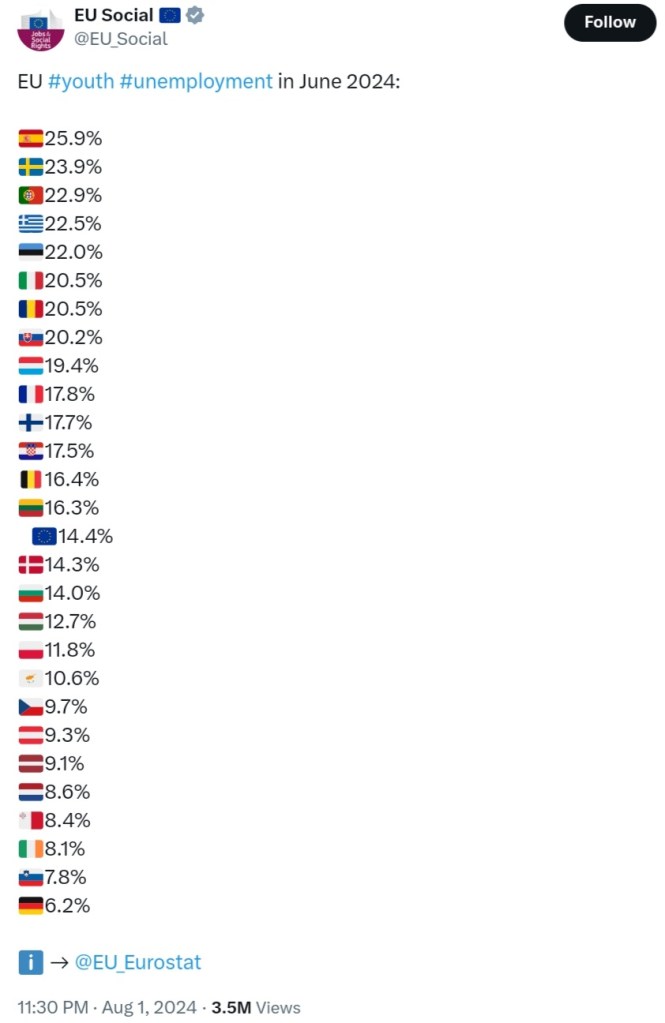

Unemployment and hopelessness among the youth is depressing the Southern countries, as their industries and jobs disappear towards the Northern countries in the monetary prison of the Euro. This would be Wales’ fate on the peripheries of Europe, which by comparison has a current youth unemployment rate of 13.1% according to Statista (source)

To expound upon the idea of Wales benefiting from membership of the Euro, the Cantillon Effect already discussed in Part One belongs to the Euro as well as the Pound. As bad as the inequalities the Pound produces between London as first receivers and the rest of the Union as last receivers, it is a far smaller Union compared to the European Continent and the twenty Nation States that are in the Euro today, with even more extreme inequalities between the North (including Frankfurt as the location of the European Central Bank and Brussels as the location of the Commission) and the EU producers, and the South on the whole being the consumer/debtor countries. The nature of the Euro as a Continental currency treats the economies of all twenty members as one, despite huge productivity disparities that in the old days could be remedied by twenty national currencies strengthening and weakening against each other, reflecting trade surpluses or deficits. In this system, having a weak currency depreciating against the strong currencies of the North, allowed Southern countries to maintain competitiveness by lowering the cost of exports (and domestic production) while increasing the cost of imports (and foreign products), but within the Euro this is impossible. It is inevitable therefore that unemployment in the Southern countries will increase as their industries disappear, largely to Germany and the Netherlands and the higher mechanised and productive economies of the North. By staying out of the Euro and keeping the Pound, the UK has been able to escape the worst of a destructive continental currency union.

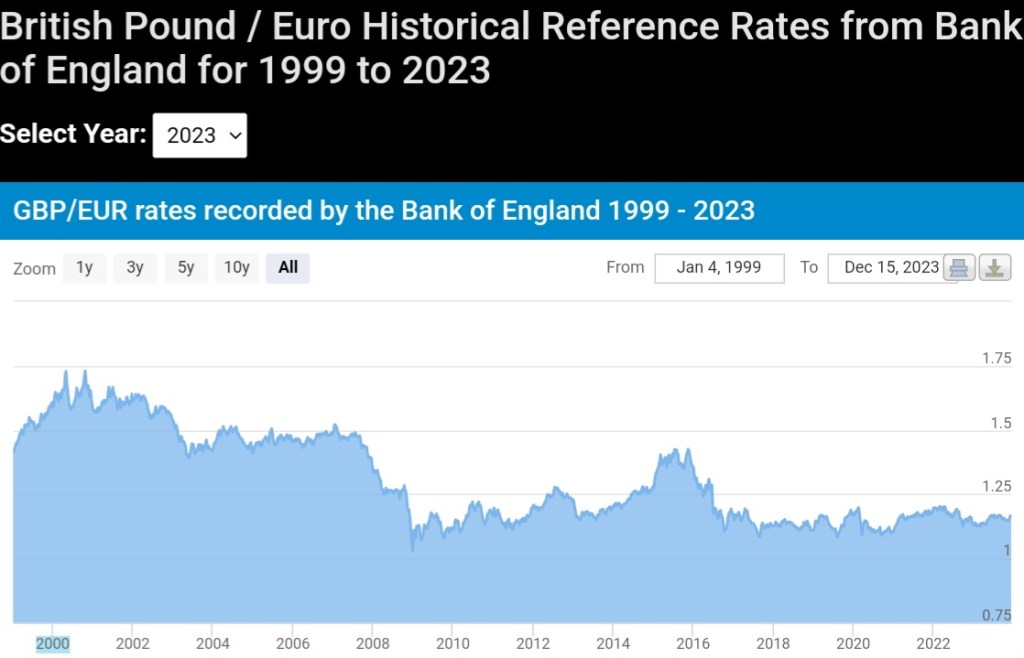

Despite the catastrophic trade deficits that Westminster Parliament chooses to run with the European Union, Britain has at least one mechanism to ease the pressure and compete more effectively, by devaluing the Pound against the Euro (source)

To tie off the discussion on the Game of Unions, the fact that the British Union and the Pound is 317 years old while the European Union has only been around since 1992 and the Maastricht Treaty, and the Euro has only existed since the 1st January 2002, makes Britain a far stronger Union than the Continent’s. Nowhere is this clearer than in the financial system, backed by Britain’s National debt market, the Treasuries and Gilts market, insofar as Britain’s fiscal union where debts are unified within a single Treasury. Europe on the other hand, has a Central Bank and Currency Union, but unlike Britain its debt markets are distributed between twenty disparate member state Treasuries, and for all the talk over the Age of the Euro about a Fiscal Union and the consolidation of debts via the issuance of EuroBonds, the European banking sector sits atop a collection of national bonds, mostly German Bunds, but also French OAT’s and Italian BTP’s. Because of the disparities between interest rates and credit ratings of these national bonds, in times of crisis the Euro Union wobbles because of the divided foundations and weakness of French and Italian economies, compared to the stregth of Germany. Indeed, the price Germany had to pay on French terms for Reunification following the collapse of the Soviet Union, was retiring the Deutsche Mark and adoption of the Euro and the Currency Union, however it is also Germany that has fought hardest against a Fiscal Union so that is doesn’t have to shoulder Continent wide European debts.

The European Central Bank keeps a Target 2 balance between its internal trading members, and the figures are eye watering. There is no possibility that Italy, Spain, Greece and France can repay their deficits to Germany, Luxembourg, the Netherlands and Ireland (source)

The Euro will end whenever Germany as the factory and most powerful country on the continent decides that enough is enough, there will be no Fiscal and Debt Union, and that it is time to bring the Euro experiment to an end. This will likely mean the Northern members breaking away to create a smaller Union with a stronger currency, leaving the Southern countries in an Union with a weaker currency, or Europe will once again revert to national currencies, correcting all the mistakes and imbalances created by a continental currency. The recent restrictions out of the German Constitutional Court on Government spending is an early example of the rebellion against increasing debt issue on deck the Titanic.

Probability of Option 1 for Welsh Independence: No Probability

Option 2: Leaving the United Kingdom and Creating a New Currency (Welsh Pound)

The Barnett Formula for redistribution of British taxes flowing into London’s Treasury, back out as public spending to the rest of the Union (source)

As the future of the EU depends upon Germany’s continuation as the most productive country running the largest trade surpluses, the United Kingdom is dependent upon England as the most productive running trade surpluses with the deficits of the rest of Britain, as the Barnett Formula suggests. Indeed as the author believes that it will be Germany that breaks up the EU, also believes that it will be England that breaks up the United Kingdom, for a few reasons.

The dissolution of the Union requires an Act of Parliament, so who is going to control the process with 543 constituencies out of 650?! (ffynhonell)

The most obvious reason is the power of England domination in Parliament compared to the rest of the Celtic nations, and to make this crystal clear Welsh incorporation into England in 1535 and 1542 were via Acts of Parliament, as was the Union of 1707 with Scotland and the 1800 Union of Ireland. Also in the case of the breakaway of the Irish Free State in 1922 in agreement with David Lloyd George, officially via the Act of Parliament. We also have a recent case to shed more light on the process of breaking up the Union, to study in some more detail.

The 2014 Scottish Independence Referendum gives an extremely interesting case study of an agreement if London Parliament would ever agree to separation, when David Cameron as Prime Minister agreed to the calls of the Scottish Parliament for a referendum. Via the Crown of Elizabeth II, it was decreed to transfer temporary powers to the Scottish Parliament to hold the referendum, with the question “Should Scotland be an Independent Country?”, with the British Government promising that a simple majority voting “Yes” would be enough for Scotland to become an independent country following a period of negotiation.

David Cameron, destroyer of Unions? – A far closer result than London’s Parliament had expected perhaps, but the Scots voted against Independence. Obviously Cameron and London Parliamentarians weren’t expecting Britain to vote in a Referendum to Leave the European Union either, less than two years later. Oops! (source)

Analysing the main reason over voting against Independence and for keeping the Union amongst the Scottish population, boiled down to keeping the Pound and the stability of Britain’s familiar monetary standard, over the uncertainty and chaos of splitting a three century old currency and customs union. This makes intuitive sense to anyone who owns a bank account and uses the Pound today, and opens up the discussion of what would happen if a future referendum were ever successful in Wales.

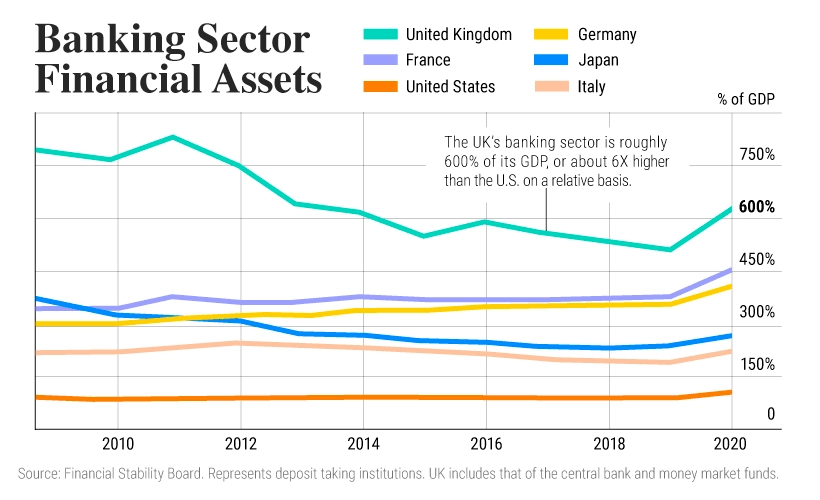

If the Currency Union came to an end under a hard money standard such as gold and silver as it was before the Bank of England standard from 1694, dissolution would be relatively straightforward, but in a Currency Union based upon a Central Bank and the value of money derives from paper or by today from electronic digits on a computer or mobile phone screen, this becomes a far more complex question. Today, Scotland has barely a domestic banking system and Wales has no domestic banking system, the UK’s monetary standard is completely dependent upon English banks, deriving their currency value from the Bank of England. Dissolving Britain’s monetary union would force the decentralisation of money, and for the modern world that runs on perpetually increasing debt and inflation to afford our socialist economy with public spending nearly half the size of the economy, then true independence would mean a Welsh Pound. In the modern world, an Independent Wales requires a Central Bank, the Bank of Wales and a Welsh Pound, which brings us to the monetary and banking infrastructure that enables our current reality.

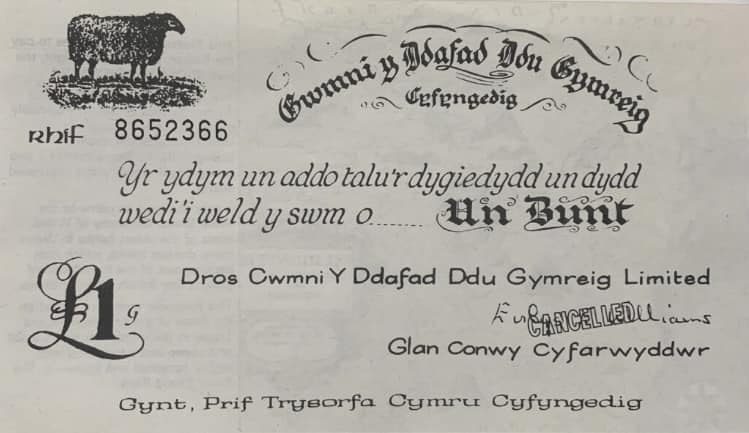

As part of the 1707 Union Scotland kept its own Legal system and to a extent kept its banking system too, but Wales has been in the Union nearly two centuries earlier, and therefore completely dependent on the English Legal system and London banking network. Indeed, despite a colourful history to Welsh Banking such as Bank y Llong (1762 to 1806), the Black Ox (Llandovery) Bank (1799 to 1909), The Black Sheep (Aberystwyth and Tregaron) Bank (1810 to 1815), and the most successful in the North and South Wales Bank (1836 to 1908), the Bank Charter Act of 1844 handed the monopoly on creating banknotes to the Bank of England as already discussed in Part One, impinging upon credit creation in rural Wales and since the early Twentieth Century Wales has been completely dependent on English banking infrastructure (North and South Wales Bank is swallowed by Lloyds Bank in 1908, and the Black Ox Bank swallowed by Midland Bank in 1909). Wales today therefore lacks its own financial infrastructure, and creating one overnight ex nihilo is practically impossible. There will be further treatment on the monetary policy of an Independent Wales in Part Three of the essay.

The foundation of the Monetary Union is the Fiscal Union, and the foundation of the Fiscal Union is Treasuries, national bonds (debt) created by Treasuries. The market for British debt is over £3 TRILLION up to year end 2022 (source)

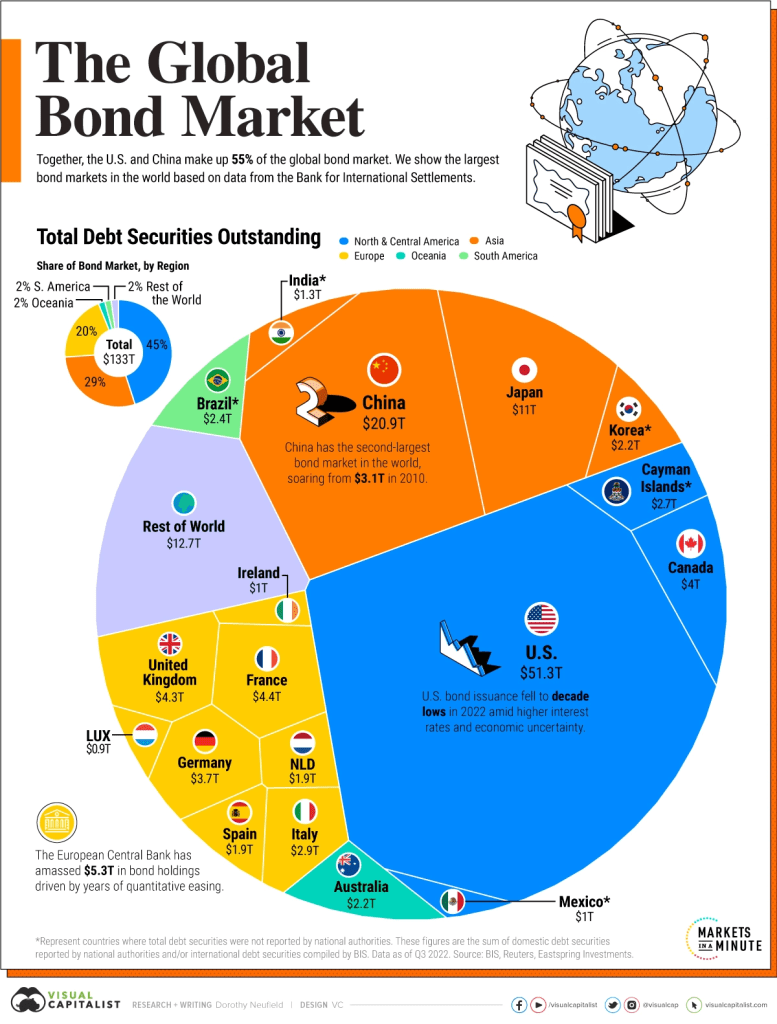

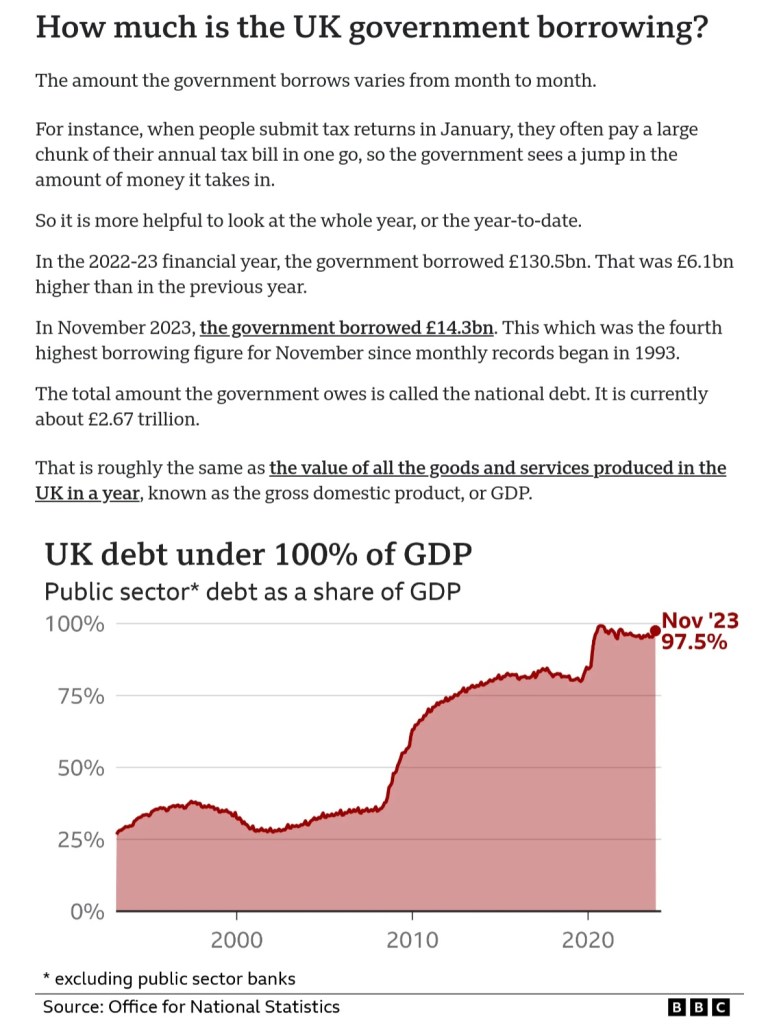

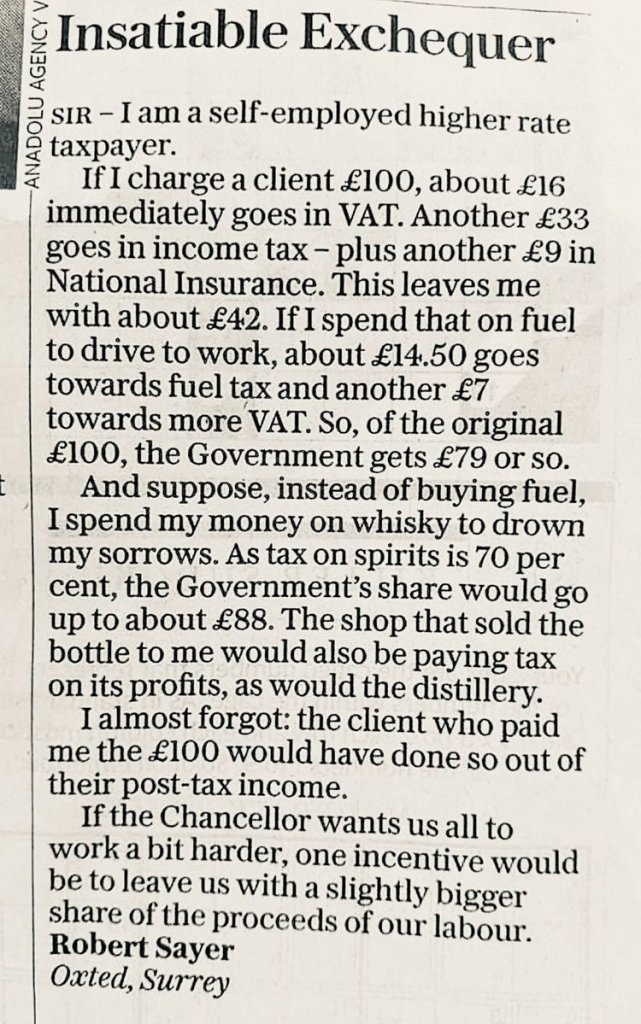

Even though the UK is a monetary union that enforces by Legal Tender the use of Pound Sterling for trade in order to pay the taxes (and the invisible inflation tax) to London’s Treasury, there is an even more important element to discuss which is the Fiscal Union and the chronic debts that underpin the monetary union. Despite all the taxes the Treasury collects by threatening UK taxpayers with imprisonment, which was a record of £787 Billion in the 2022/23 Financial Year, it is nowhere near enough to cover Westminster Parliament’s out of control public spending with the UK currently nearly £3 TRILLION in the red, with deficits increasing over time. There has been no treasure in the Treasury for a very long time, and the future of the Union is more debt, more taxes and more inflation to pay the interest costs to the lenders still stupid enough to invest in the national debt of the British Government.

Britain’s national debt is £2.67 Trillion or 97.5% of Gross Domestic Product according to ONS statistics (source)

Who then is still stupid enough to lend money to increase the spending and public liabilities of Britain? The answer is complex but to simplify they are investors of Britain’s financial (FIRE) sector, from banks to pension funds, investment funds, and insurance funds, effectively compelled by accounting laws and regulations to invest in Britain’s national debt. Additionally, the Bank of England can purchase UK Treasuries and take them out of circulation by a scam process called “Quantitative Easing“, guaranteeing a continuous demand for UK Treasury debt in the near term future, enabling Parliament to escalate the National Debt enslaving the population and the unborn to service the debts of our political elites.

To answer the question of how Britain can run trade deficits of £100 BILLION a year with the European Union, is through our banking and FIRE sector and the household, corporate and national debt that perpetuates this financial serfdom. This also means that any financial and debt crises will hit the British Banks and economy far harder in the coming recession of 2025 and 2026 (source)

To close the discussion on the probability of Welsh Independence through the front door, via the breakup of the Pound and Britain’n monetary and fiscal union, people must understand that this would mean the end of Britain as a socialist country, where public spending is nearly half of GDP and public sector employment is a quarter to a third of the population. The only reason we are still able to operate like this is the long and trusted history of the British Debt Union, and an Union that can maintain its debt service costs at low enough interest rates to maintain our socialist experiment, especially in the Celtic countries, as the Barnett Formula attests. Dissolving the British fiscal union would mean starting from scratch, dividing the debts of the Union between four new independent Treasuries, severely effecting upon the ability to borrow and at far higher interest rates, to reflect the far higher risk and uncertainty of investing in newly independent nations, than the historic stability of London’s Treasury and three centuries of tradition in increasing paying its debts.

The breakup of the British debt union would bring to an end public sector spending that is nearly half of GDP today, the Welsh public sector would have to be gutted for us to afford leaving the Union (source)

The above should explain to Welsh readers, even the most passionate independence believers, the cratering in purchasing power of a new currency and the collapse of the NHS, the education sector, state pensions and everything else that would become unaffordable outside Britain’s indebted Union, it should become clearer that the voluntary dissolution of the Union to its home nations in reality will never happen, because of the damage and destruction it would wreak on our present social order and the lives of everyone who works and lives in the Pound Sterling matrix, including Wales.

Probability of Option 2 for Welsh Independence: Very Low Probability

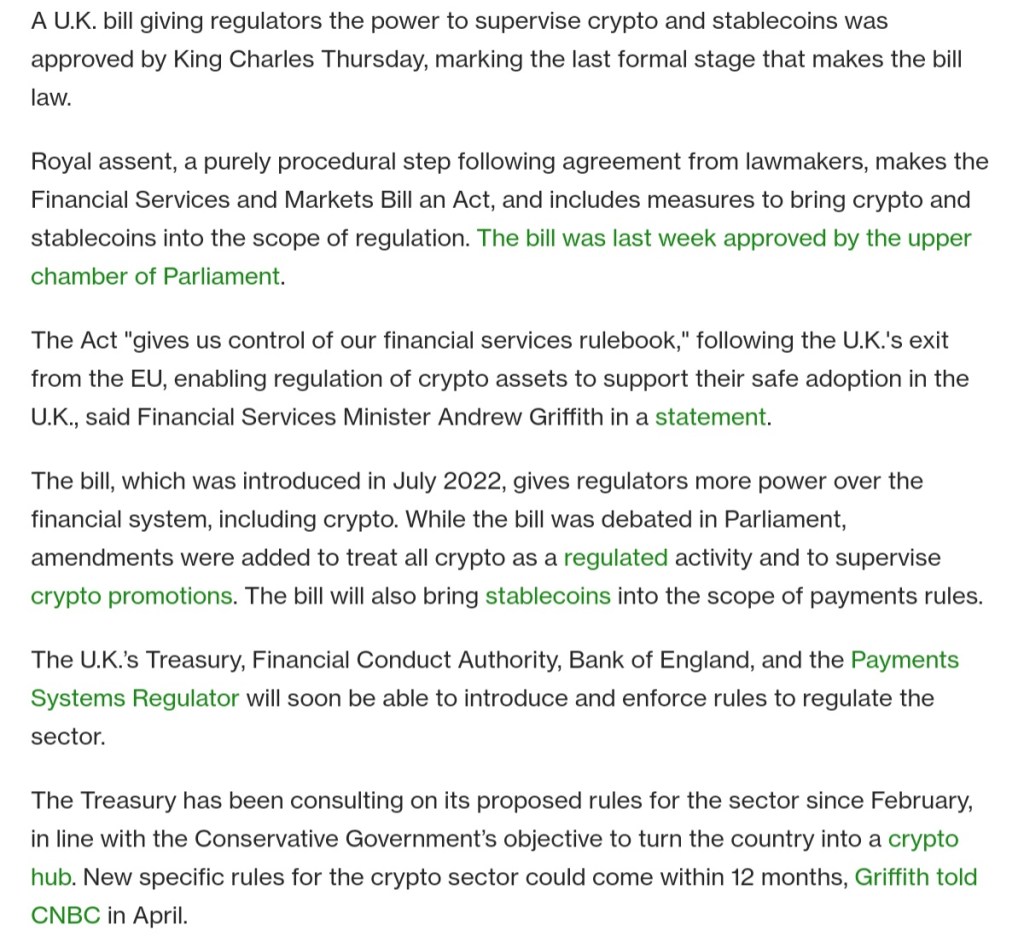

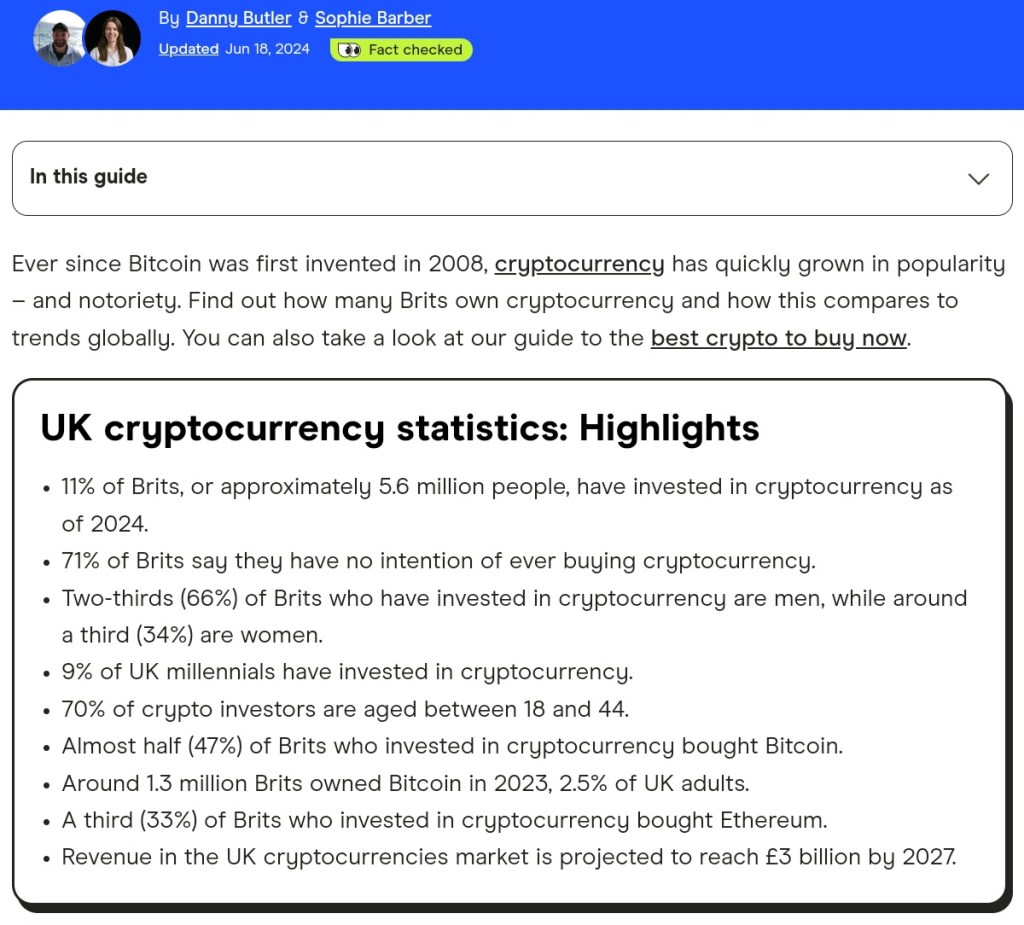

Option 3: Technological Change and Breaking the Pound and United Kingdom Via Adoption of External Money

It is worth listening to Hayek’s words in this short two minute video from 1984, on the denationalisation of money, via an alternative and superior accounting system. Hayek predicts the birth and rise of Bitcoin 25 years earlier (source)

This Option is already superior to the other two options, because it exists outside of any national law and is therefore already independent of the present order. This makes the monetary and accounting standard voluntary, allowing the population to adopt gradually and over an extended period of time, and avoids a disorderly dissolution of monetary and fiscal unions, which is critically important for the stability of the present order that would create economic destruction in an un-controlled demolition, as would be the case in the prior two options.

Another advantage of Bitcoin is that it is a worldwide standard that cuts out many of the regulations and barriers that are an intrinsic part of national fiat currencies, it works over borders enabling peer to peer trade, business to business, and even country to country, in the same way gold used to be a worldwide monetary standard for national and international trade settlement.

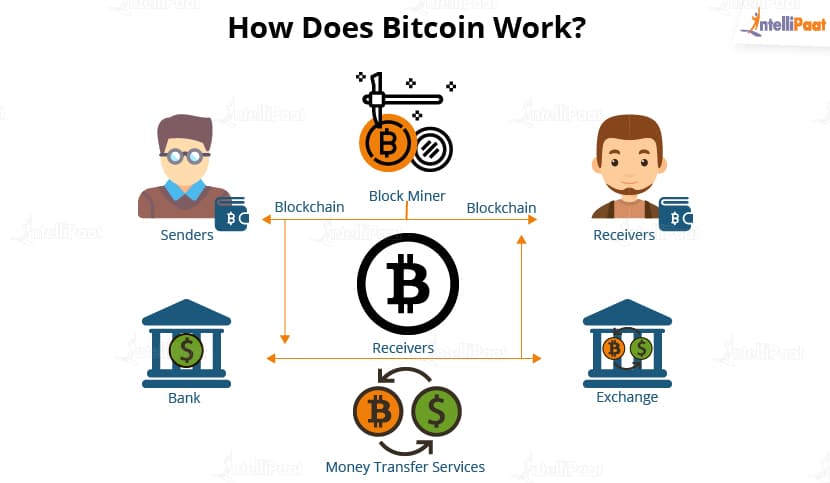

Bitcoin is an accounting standard native to the internet, and therefore dependent upon electricity and opeartes very similarly to online banking, but rather than trusting a bank you are trusting in the network that has had a permanent uptime for the last sixteen years, without limitations of banking hours or weekends, it can be sent or received 24 hours a day, 365 days a year.

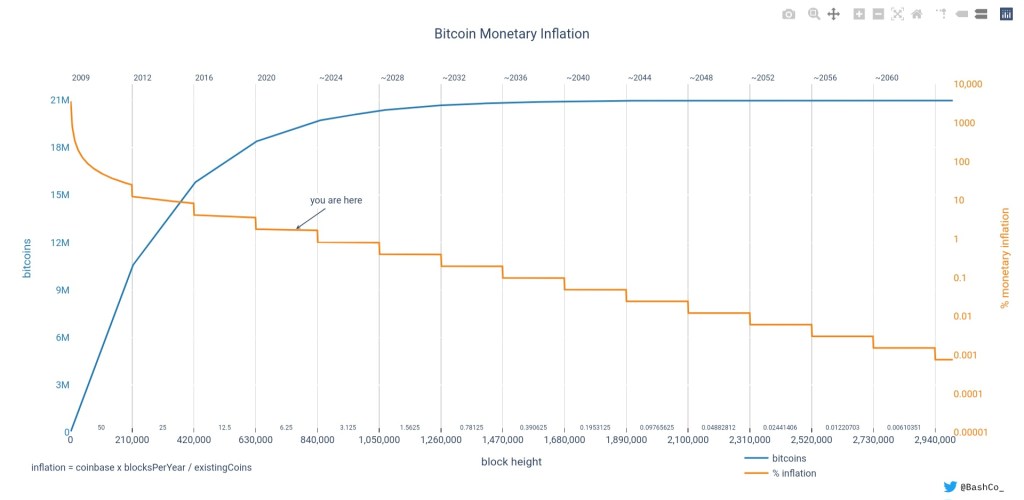

The most important element of Bitcoin’s monetary policy is its currency issue schedule, based upon Proof of Work and the dense use of electricity reinforcing the network, and receiving new bitcoins as a reward, currently issued at 3.125 every ten minutes plus any transaction fees included in the same block. This makes Bitcoin mining possible in any part of the world, that has led to the distribution of the mining network and electricity supply over the world. The nature of bitcoin creation also allows individuals, businesses or governments to mine currency in their own countries, as will be discussed in more detail further on.

For these reasons, if independence comes to Wales this is the most likely Option, therefore it is worth exploring further.

Probability of Option 3 for Welsh Independence: Most Probable

Defining Money and Currency

Monetary shortages early in the Industrial Revolution forces a copper mining company on Anglesey to create tokens for local trade settlement, in an interesting article (source)

Before delving deeper into Bitcoin, it is important to spend a section on the vagaries of money and currency, and the way to think about them in the modern world. Even though the Welsh words “arian” and “prês” derive from silver and brass (copper) because these were the foundation of the Pound, Shilling and Pence (£sd) standard for over eight centuries, gold and silver coins are only half the story, indeed there are long tracts of the Middle Ages where local shortages of precious metal coins necessitates local economies and trade to adapt to monetary substitutes, via accounting ledgers or paper currencies produced from wood, leather or paper.

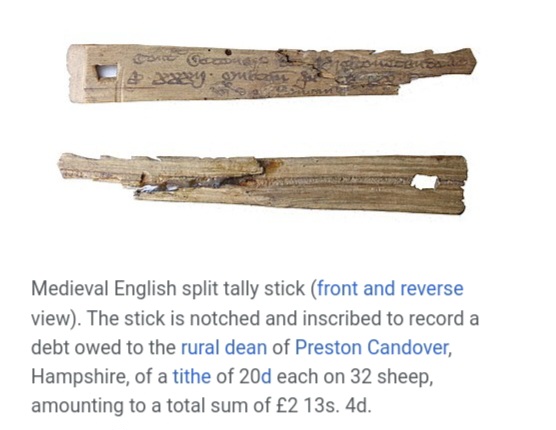

Rather than transacting in money, debits and credits can be settled via book-keeping and accounting, and the tally stick is an example. Once agreement is reached, the stick is split in half for each party to keep a contract copy, as an anti fraud measure (source)

Another example of a monetary substitute is paper currency (banknote), that explodes over the West at the end of the Medieval Period, and in the wake of the Protestant Reformation that establishes modern banking and double-entry book-keeping, giving control of credit creation to local banks that keep the precious metals in their vaults. This method also centralises credit creation, increasing fraud and fractional reserve banking.

Two pound banknote of the Black Sheep Bank – While small value transactions would be settled on the ground in shillings and pence, paper currencies were a convenient method of settling medium to large value transactions (for example two tower pounds (700 grams) of silver (two pounds) at today’s value of 75 pence per gram is worth £525! The custom of local paper banknotes came to an end with the Bank of England’s banknote issue monopoly in 1844 (source)

By the beginning of the Twentieth Century medium to large transactions were being settled in paper rather than metal, either via Bank of England banknotes for standard sums and increasingly through cheques for more specific and higher sums, the trend should be clear, trade settlement moves from physical money to promissory and abstract credit. The speed of trade settlement also increases with the invention of the Telegraph enabling Wire tranfers, that has only accelerated since the Second World War, with communication inventions such as Telex using the Telephone.

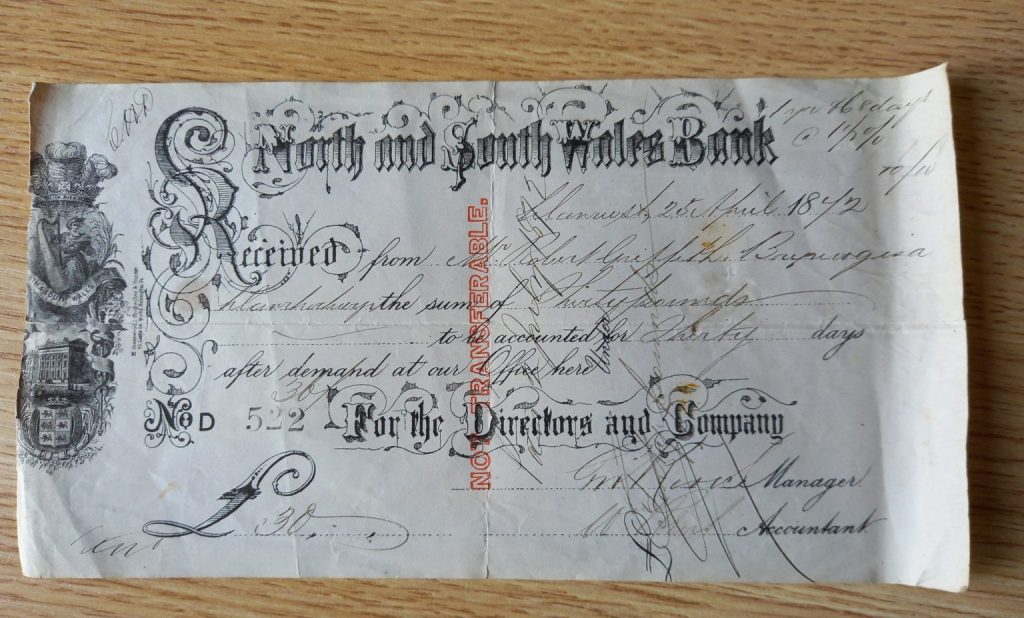

An example of a North and South Wales Bank cheque from 1872 for Thirty Pounds (nearly £8,000 priced in today’s silver) (source)

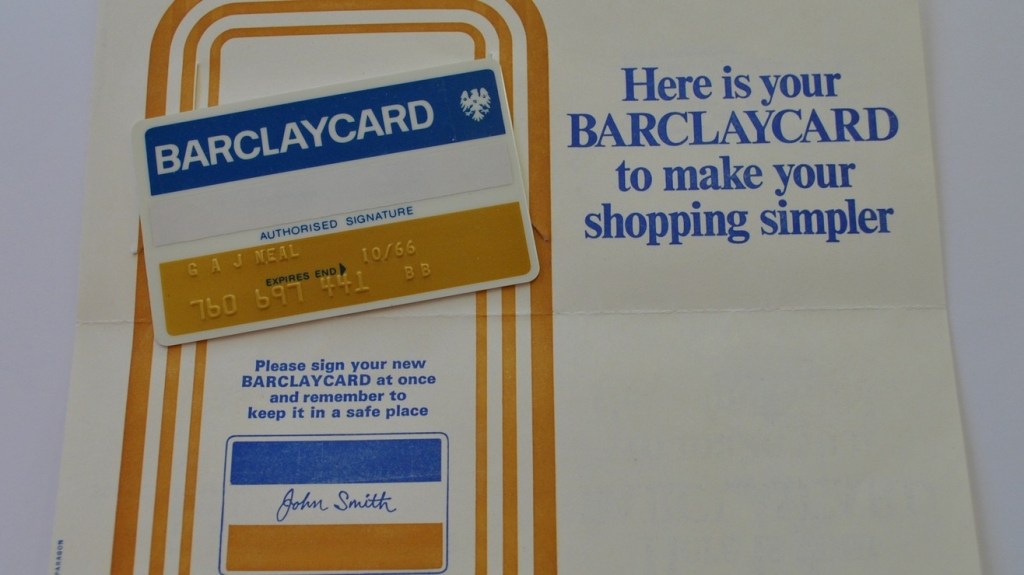

In the Sixties the payments revolution and credit cards start to hit Britain and 1966 sees the introduction of the Barclaycard, credit cards became far more popular in the UK and US than in Continental Europe for example.

Credit cards start competing with banknotes at the end of the Sixties, while Debit Cards are not introduced until 1987 with Barclays Connect (source)

The largest technological communications leap in the history of humanity and money/currency, begins with internet privatisation in 1994, beginning the Age of experimentation of computer money and digital currency. Indeed, within the internet’s first year and years ahead of the banks, David Chaum released DigiCash, a digital cash that communicated with correspondent banks to settle trade peer to peer, anonymously through blind cryptographic signatures, with the first payment completed in 1994. Unfotunately for Chaum, a lack of interest by the banks in his digital and anonymous e-cash, meant that DigiCash would go bankrupt in 1998.

The first e-cash of the internet – David Chaum’s DigiCash. Satoshi Nakamoto cites DigiCash in the 2008 Bitcoin Whitepaper (source)

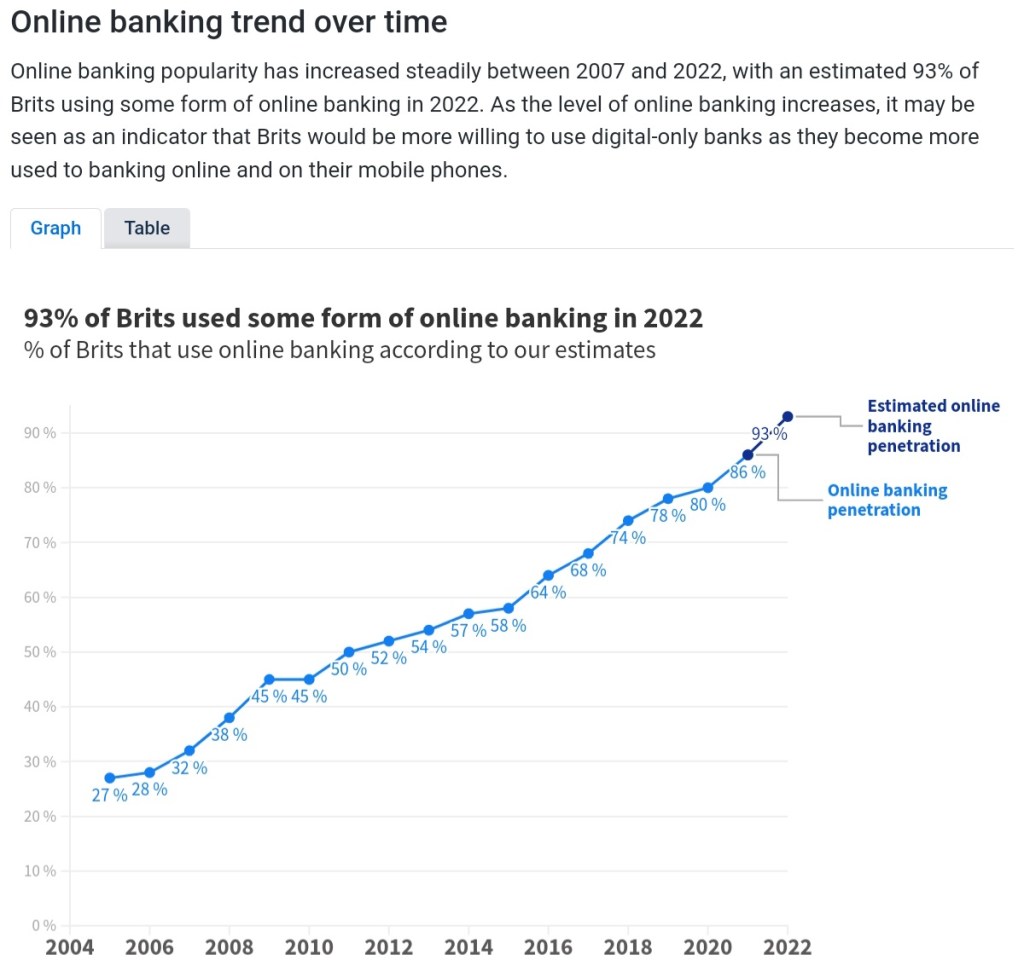

Since the turn of the Millennium banks over the world have continued building on the internet, and every modern and popular bank has developed their own version of online banking. It began on personal computers, and since the advent of the iPhone and the smartphone revolution since 2007, mobile banking has exploded the growth of digital money and is actively swallowing up the old cash economy and the demand for local bank branches, as the banking system has pledged their future to the internet and turning their backs on the old methods of credit creation and transfer.

An interesting read on modern banking trends. As the old generations die out, the new generations forget the monetary age before the internet (source)

The future should therefore be clear, the Banks operating under the licences and regulations of the British Government have turned their backs on the analogue monetary world of metal and paper, and bet the entire future on the internet and mobile phones, the British population and the rest of the world will adopt digital currency via the front door, which also makes it intuitive and familiarises the public with adopting Bitcoin, via the back door.

An example of a Bitcoin wallet on a mobile phone, bluewallet (source)

Tracing the Roots of Bitcoin

We begin discussing Bitcoin at its roots, and for what purpose was it created?

The Bitcoin Whitepaper, posted on bitcoin.org (source)

On the last day of October 2008 as the global financial system collapsed into the largest crisis of the new century, a link was e-mailed to a paper authored by Satoshi Nakamoto with the title, Bitcoin: A Peer-to-Peer Electronic Cash System, describing methods of a peer to peer financial network without a central counter-party. The Paper also lists other digital currency projects in the first fifteen years of the internet that inspired and contributed to the invention of Bitcoin, from David Chaum’s DigiCash 1994, Hashcash by Adam Back yn 1997, to Wei Dai’s B-money in 1998, Nick Szabo’s bitgold in 1998 and Hal Finney’s rpow in 2004. By combining elements of these earlier projects, the decentralised protocol design is presented to the world.

Bitcoin’s Genesis block on the 3rd of January 2009 refering to the financial crisis in Britain, and the banking bailout by Chancellor of the Exchequer Alistair Darling via the British taxpayer

The Bitcoin protocol is released quietly on the 3rd of January 2009, with Satoshi nurturing the project and mining to protect the network in its earliest days, while trying to spread awareness to other cryptographers. The following quote is also from the first weeks of the protocol:

“The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve. We have to trust them with our privacy, trust them not to let identity thieves drain our accounts. Their massive overhead costs make micropayments impossible.

Bitcoin’s solution is to use a peer-to-peer network to check for double-spending. In a nutshell, the network works like a distributed timestamp server, stamping the first transaction to spend a coin. It takes advantage of the nature of information being easy to spread but hard to stifle. For details on how it works, see the design paper at http://www.bitcoin.org/bitcoin.pdf” ~ Bitcoin open source implementation of P2P currency, 11th of February 2009 (source)

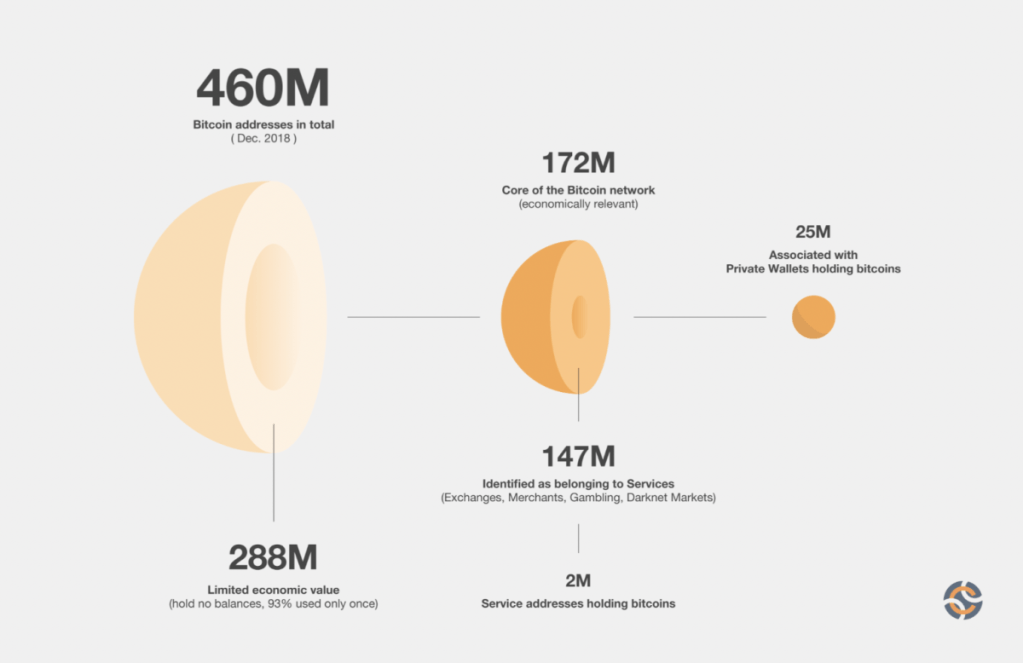

The purpose of Bitcoin therefore was to decentralise money and accounting over the world, by-passing the need for central trust in intermediaries, whether a banker, an accountant, a lawyer or regulator, and rather trust in Bitcoin’s distributed network increasing adoption and the value of the network. It is incredible that this project is not only still alive, but as it crosses sixteen years old on the 3rd January 2025 with its market capitalisation over One Trillion Dollars and an unit of its currency at £50,000 each, threatening and terrifying the inflation and taxation apparatus of the Legacy Regimes all over the world, Bitcoin is stronger than ever looking towards the future and monetary independence.

Who Was Satoshi?

There has been so much discussion and misinformation surrounding this question, it is worth commenting briefly. Firstly, the fact that this person is still anonymous, considering the open and permanent nature of the internet as his invention slowly takes over and changes the world, is quite incredible. There are many investigators and journalists who have tried to discover the identity of Satoshi, using his pseudonym, his online hours posting pattern, his references, and of course his language, writing style, grammar and spelling. Satoshi’s online correspondence lasts approximately two and a half years from August 2008 to his last recorded e-mail in April 2011, providing insights into the writing patterns of the author (Satoshi’s complete collected writings can be read here).

“Sorry to be a wet blanket, but, writing a description of Bitcoin for general audiences is bloody hard. There’s nothing to relate it to.” – Satoshi, 5th of July 2010. This sentence suggests a Briton, or native of the Commonwealth (source)

Despite not knowing with any certainty leaving us guessing in the dark, when taking the Front Page Headline of the Times of London newspaper in the genesis block, alongside his English writing style in words and spelling, does suggest that Satoshi is derived from the British Isles with the strongest probability of being an Englishman. Even so, it leaves the possibility that he was a Scot or a Welshman! In any case, his long term will was bent on disrupting and loosening the noose of London’s Parliament, the Bank of England and the Pound over the rest of Britain, and undermining the Union that enslaves us in this destructive monetary system.

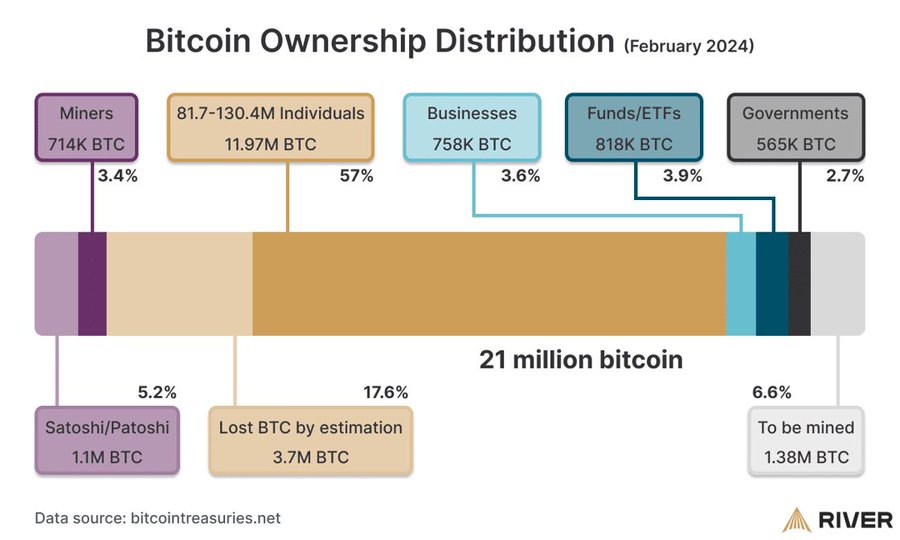

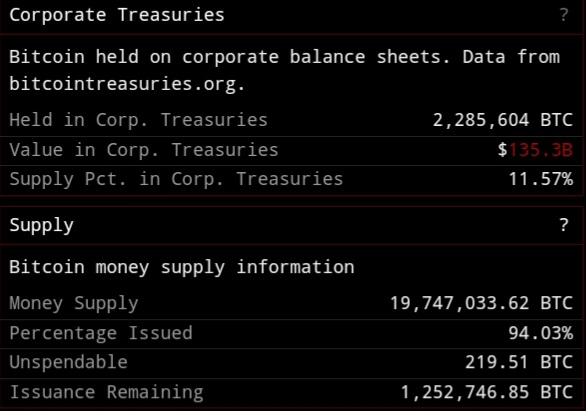

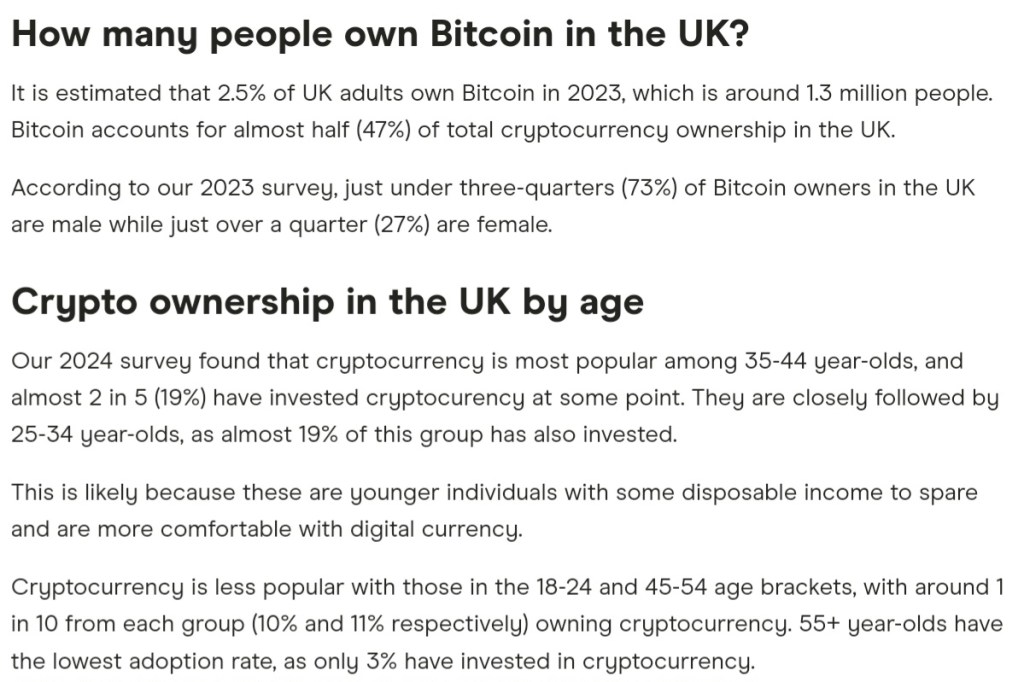

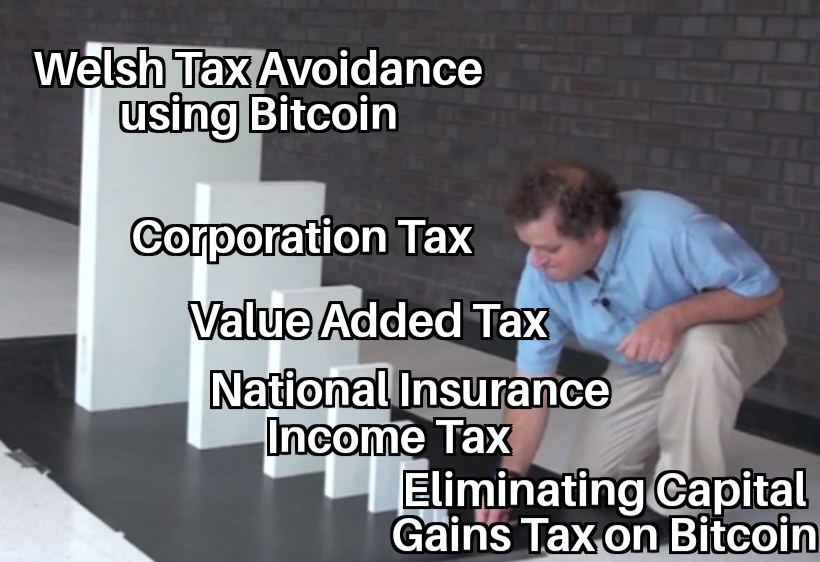

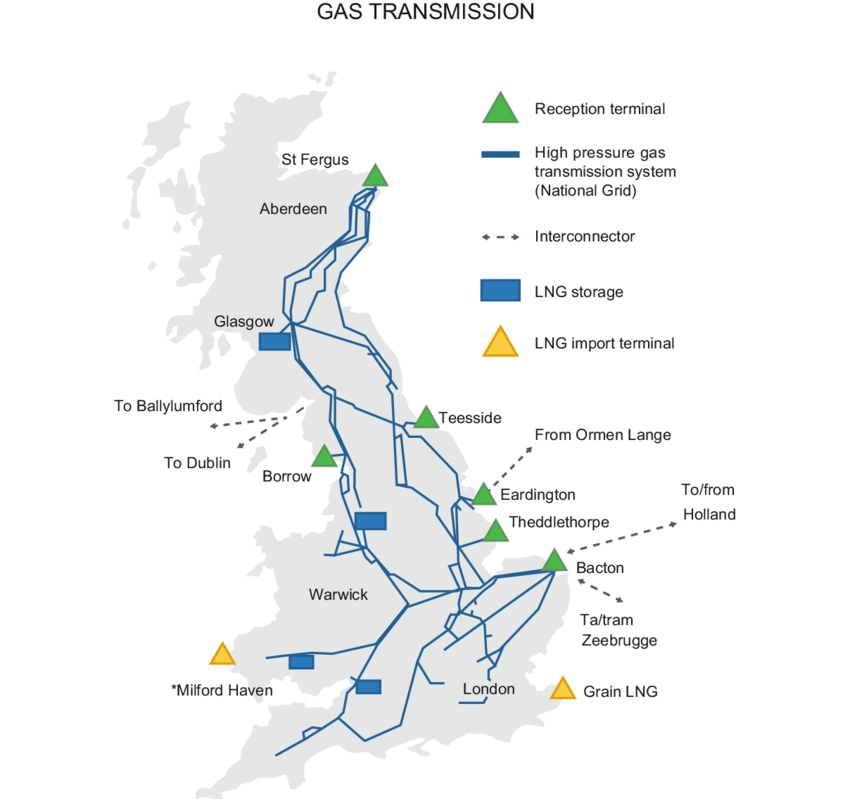

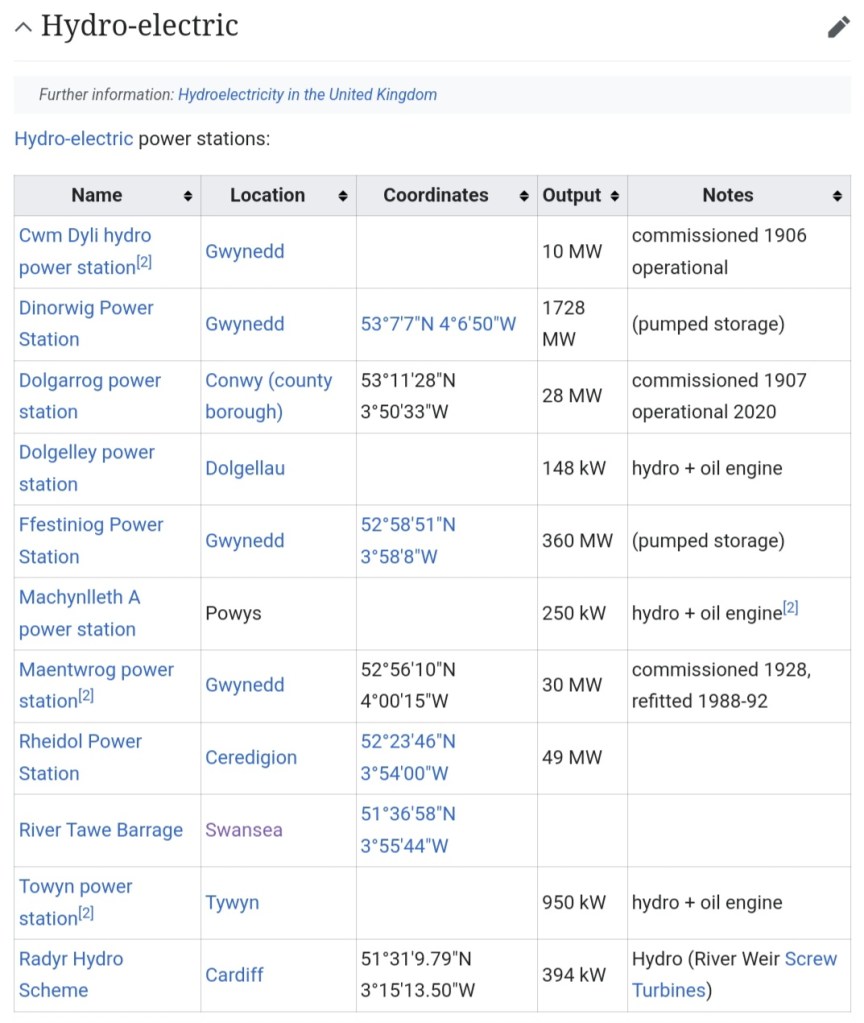

Bitcoin’s Elemental Trinity – Users, Developers, Miners